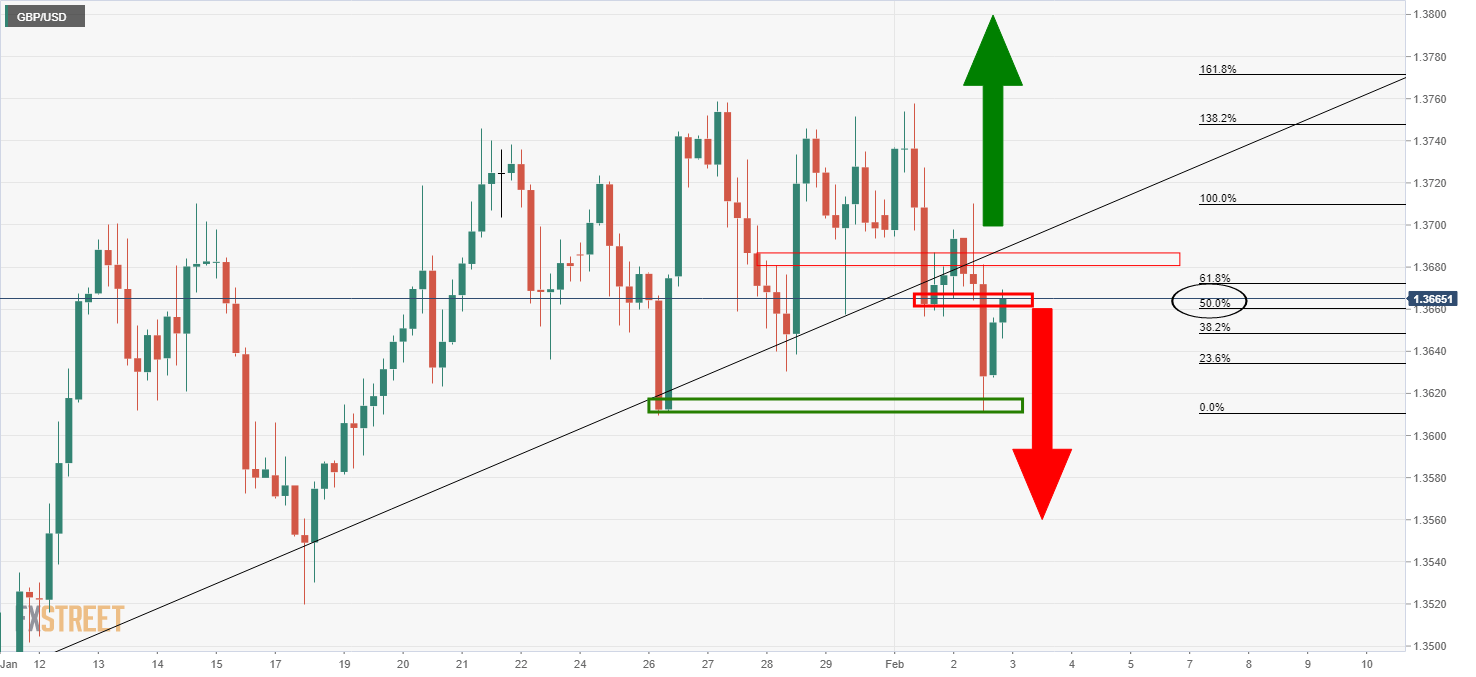

GBP/USD Price Analysis: 1.3650 support remains in focus ahead of a 61.8% Fib retracement

|

- GBP/USD bears seeking a restest of the structure.

- A confluence of the 38.2% Fibo, 21-moving average and structure is compelling support.

As per the prior analysis, GBP/USD Price Analysis: Bears seeking the next corrective leg to the downside, the price did indeed melt to the downside, however, only to spike bac to test the highest resistance within the latest downtrend.

Prior analysis, 4-hour

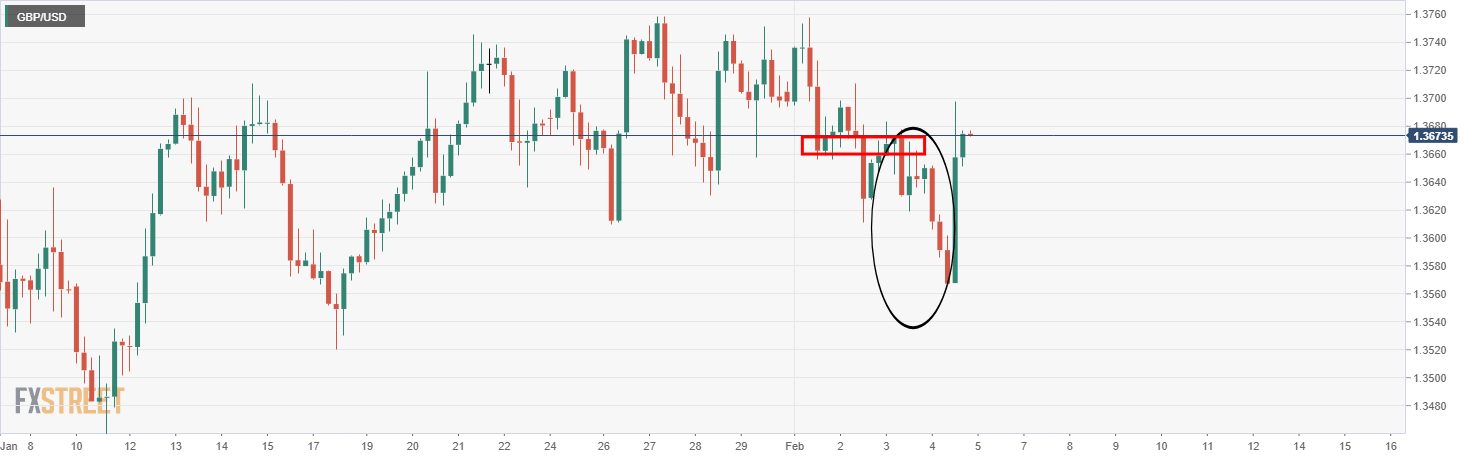

Live market, 4-hour

As seen, the price dropped to create new resistance structure for which the market simply burst through on the day before testing a more defined dynamic counter-trendline resistance as follows:

The price has a high probability of moving in firmly on the 38.2% Fibonacci retracement and a confluence of the 21-moving average that meets structure around the psychological and round 1.3650 level.

1-hour chart

The price has already reached a 38.2% Fibo of the move, so there is every chance that the price can continue higher and taken the bear's commitments at trendline resistance on a break beyond the recent highs.

Nevertheless, a re-run of the level and break thereof could open the way for a deeper correction all the way to the trendline support and a 61.8% Fibonacci support level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.