GBP/JPY skids along the bottom, bears looking for 181.00

|

- The GBP/JPY consolidated in the back half of Tuesday trading, pinned to the low side just above 181.00.

- The Guppy is down from Tuesday's opening bids near 181.80.

- Broader market risk appetite burst into flames on Tuesday, but Yen traders are leery ahead of Japan inflation figures.

The GBP/JPY is down nearly 80 pips heading into the Wednesday market session, with the Pound Sterling (GBP) continuing to flag against the Japanese Yen (JPY). The pair is down almost 1.3% from last week's peak, and in the red over 3.0% from August's peak of 186.77.

The mid-week is thin on the economic calendar for the Guppy, and traders will be looking ahead to Thursday's Tokyo Consumer Price Index (CPI) reading on Thursday, which will be followed by Friday's Gross Domestic Product (GDP) figures for the UK.

The Bank of Japan (BoJ) is determined to see Japanese inflation remain above 2% in a meaningful way before stepping away from its hyper-easy monetary policy regime. Japanese interest rates are currently at -0.1%, and despite inflation being over the BoJ's 2% target, fears of an inflation collapse are plaguing the BoJ.

Investors will be keeping a close eye on Thursday's Tokyo CPI reading for September, which last printed at 2.9% for the annualized period into August.

Japan's Tokyo CPI data drops late Thursday at 23:30 GMT.

Friday will bring an end-of-week juggle for the GBP, with UK GDP figures in the pipe; laboring economic growth remains a key sticking point for the Bank of England (BoE), and UK GDP is forecast to hold steady at 0.2% for the second quarter.

GBP/JPY technical outlook

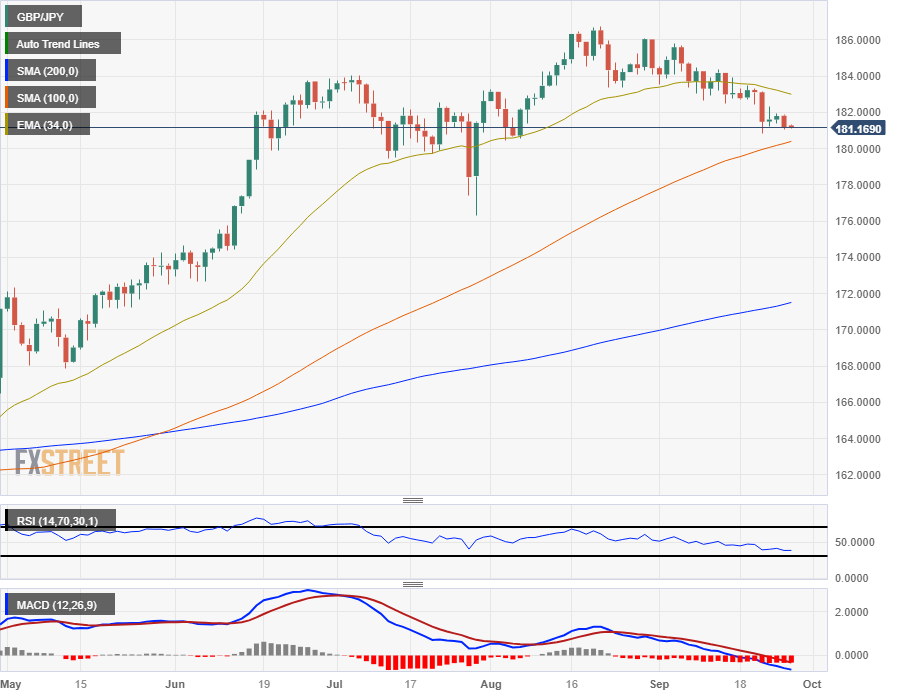

Intraday action for the GPB/JPY is decidedly bearish, with prices slumping away from the 34-hour Exponential Moving Average (EMA) near 181.40 and the 200-hour Simple Moving Average (SMA) well above current price action at 182.40.

Daily candlesticks see the Guppy on the downside as well, with the pair drifting into the 100-day SMA just above the 180.00 major handle. Despite recent bearish momentum, the GBP/JPY has soared in the medium-term and still remains almost 17% higher for the year.

Technical indicators are drifting into oversold territory thanks to the last six weeks' gradual decline, and the Relative Strength Index (RSI) is set to ping the lower boundary indicating overextended selling pressure.

GBP/JPY daily chart

GBP/JPY technical levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.