Euro appears depressed near 1.0530, Dollar remains strong

|

- The Euro maintains the bearish tone against the US Dollar.

- Stocks in Europe keep the mixed bias on Wednesday.

- EUR/USD slips back to new lows near 1.0530.

- The USD Index (DXY) extends its rally to new 2023 peaks.

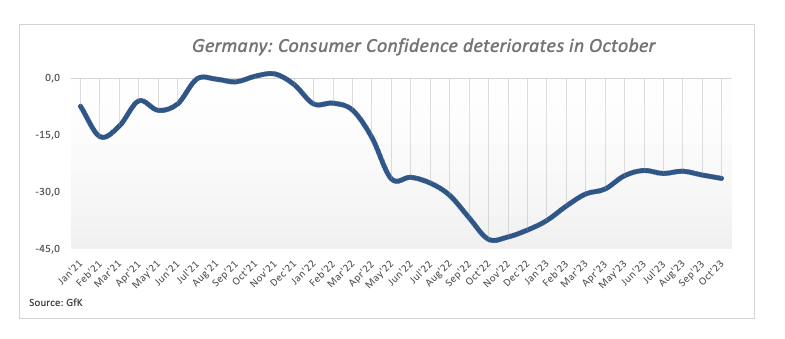

- Consumer Confidence in Germany expected to worsen in October.

- US Durable Goods Orders surprised to the upside in August.

Bearish sentiment toward the Euro (EUR) against the US Dollar (USD) has been on the rise, causing EUR/USD to slide and hit new six-month lows near 1.0530 earlier on Wednesday.

In contrast, the Greenback has been gaining strength for the fourth consecutive session, reaching 2023's highest levels at approximately 106.50 according to the USD Index (DXY). This level hasn't been observed since late November 2022.

The further decline in the pair is accompanied by a corrective move in US and German yields, which abandon the area of recent multi-year highs despite broadly unchanged expectations in the monetary policy scenario.

Regarding the latter, investors persist in factoring in an additional 25 basis points rate increase by the Federal Reserve (Fed) by year-end. Meanwhile, discussions in the market continue to lean towards an impasse at the European Central Bank (ECB), even in light of persistent inflation levels that significantly surpass the bank's target.

In the European calendar, Consumer Confidence in Germany is expected to weaken slightly to -26.5 in October, according to GfK.

In the US, Mortgage Applications tracked by MBA contracted 1.3% in the week to September 22, while Durable Goods Orders expanded 0.2% in August vs. the previous month.

Daily digest market movers: Euro looks poised to extend the decline below 1.0530

- The EUR keeps the offered stance unchanged against the USD.

- US and German yields correct lower across different maturities.

- Investors continue to see the Fed raising rates by 25 bps before end of 2023.

- Markets speculate on probable interest rate cuts by the Fed in Q3 2024.

- Market chatter over a pause by the ECB remains on the rise.

- ECB member of the Executive Board Frank Elderson says rates haven’t necessarily peaked.

- Intervention concerns remain well and sound around USD/JPY.

- BoJ Minutes favoured the continuation of the current monetary stance.

Technical Analysis: Euro could attempt a technical bounce

The EUR/USD continues to demonstrate signs of weakness, trading in close proximity to the March low around 1.0515. However, the pair's ongoing oversold condition carries the potential to spark a technical rebound in the near term.

On the downside, immediate support for the EUR/USD can be found at the March 15 low of 1.0516, followed by the 2023 low of 1.0481 seen on January 6.

Regarding potential resistance levels, there is a minor obstacle at the September 12 high of 1.0767, and a more significant barrier at the 200-day Simple Moving Average (SMA) at 1.0828. If the pair manages to break above this level, it could pave the way for further recovery, targeting the temporary 55-day SMA at 1.0879, with the possibility of reaching the August 30 high of 1.0945. Surpassing this level could shift the focus towards the psychological level of 1.1000, followed by the August 10 peak of 1.1064. Beyond that, the pair may retest the July 27 top at 1.1149 and potentially reach the 2023 high at 1.1275 from July 18.

However, as long as the EUR/USD remains below the 200-day SMA, there is a possibility that downward pressure will persist.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.