EUR/USD eyes 1.0890 as the next downside target – Confluence Detector

|

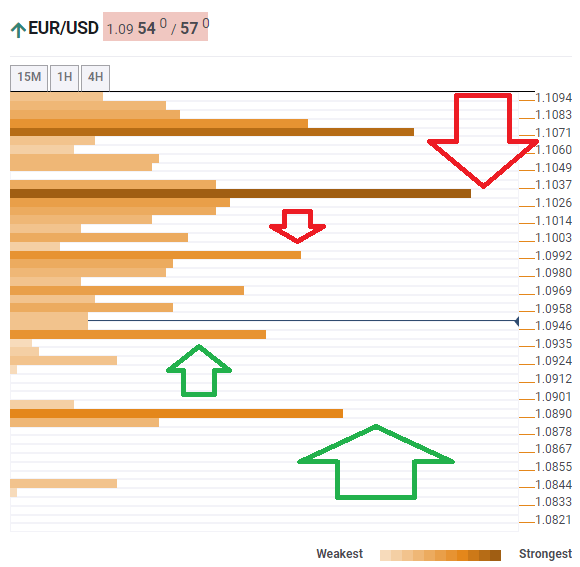

EUR/USD has been on the back foot as the US dollar stormed the board. As it nears the 2019 low of 1.0926, it is time to look at the next downside targets.

The Technical Confluences Indicator is showing that EUR/USD has some support at 1.0941, which is the meeting point of the Pivot Point one-week Support 2 and the previous daily low.

If the world's most popular currency pair slips to lower ground, the next support line is 1.0890, which is the convergence of the PP 1m-S1, the PP 1d-S2, and the PP 1w-S3.

Noteworthy resistance awaits at 1.0992, which is the confluence of the Fibonacci 61.8% one-day, the Bollinger Band 1h-Upper, the BB 4h-Middle, and the previous weekly low.

A considerable cap awaits at 1.1032, where we see several substantial liens converge – the Fibonacci 38.2% one-week, the Simple Moving Average 100-4h, and the Fibonacci 23.6% one-month.

Here is how it looks on the tool:

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

This tool assigns a certain amount of “weight” to each indicator, and this “weight” can influence adjacents price levels. These weightings mean that one price level without any indicator or moving average but under the influence of two “strongly weighted” levels accumulate more resistance than their neighbors. In these cases, the tool signals resistance in apparently empty areas.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.