Elliott Wave view: Nasdaq 100 ETF (QQQ) extending higher [Video]

|![Elliott Wave view: Nasdaq 100 ETF (QQQ) extending higher [Video]](https://editorial.fxsstatic.com/images/i/Equity-Index_Nasdaq-2_Small.jpg)

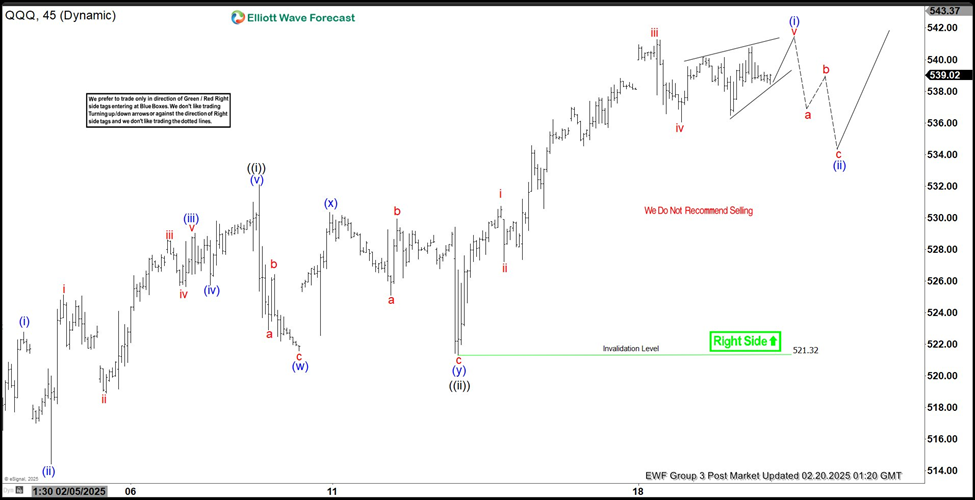

Nasdaq 100 ETF (QQQ) has broken to new all-time high suggesting the right side remains firmly bullish. The rally from 1.27.2025 low is in progress as a 5 waves with extension (nest). Up from 1.27.2025 low, wave 1 ended at 531.52 and pullback in wave 2 ended at 507.5. The ETF has extended higher in wave 3. Up from wave 2, wave ((i)) ended at 532.10. Pullback in wave ((ii)) unfolded as a double three Elliott Wave structure. Down from wave ((i)), wave (w) ended at 521.56, and wave (x) ended at 530.36. Wave (y) lower ended at 521.32 which also completed wave ((ii)) in higher degree.

Nasdaq 100 ETF (QQQ) 60 minutes Elliott Wave chart

The ETF has resumed higher in wave ((iii)). Up from wave ((ii)), wave i ended at 530.72 and pullback in wave ii ended at 527.22. Wave iii higher ended at 541.28 and pullback in wave iv ended at 536.04. Expect wave v to complete soon which should end wave (i) in higher degree. The ETF should then pullback in wave (ii) to correct cycle from 2.12.2025 low before it resumes higher. Near term, as far as pivot at 521.32 low stays intact, expect pullback to find support in 3, 7, or 11 swing for further upside.

QQQ [Video]

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.