Elliott Wave intraday view on Russell 2000 (RTY) calling for index to resume higher

|

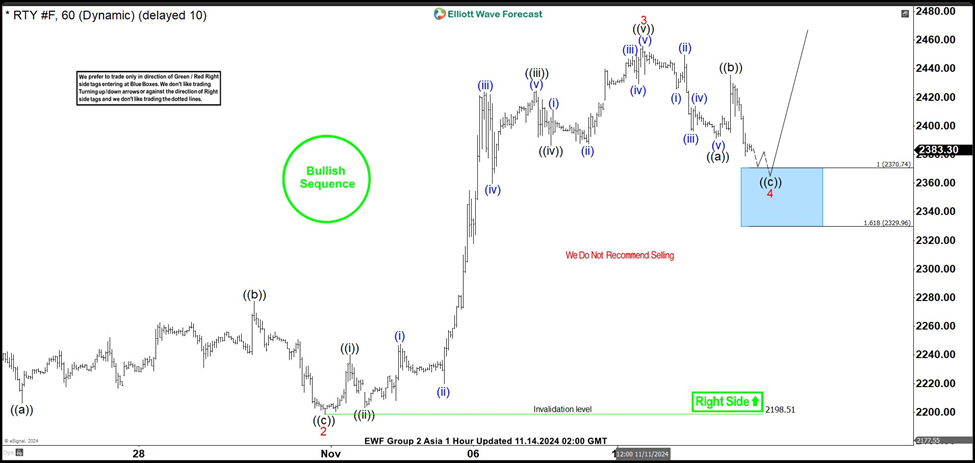

Short Term Elliott Wave view on Russell 2000 (RTY) suggests rally from 8.5.2024 low is in progress as a 5 waves impulse. Up from 8.5.2024 low, wave 1 ended at 2311.4 and pullback in wave 2 ended at 2198.51 like the 1 hour chart below shows. The Index then extends higher in wave 3 with internal subdivision as an impulse. Up from wave 2, wave ((i)) ended at 2240 and dips in wave ((ii)) ended at 2203.3. Rally in wave ((iii)) higher ended at 2424.5 and pullback in wave ((iv)) ended at 2386.5. Final leg wave ((v)) ended at 2455.6 which completed wave 3 in higher degree.

Wave 4 pullback is in progress with internal subdivision as a zigzag Elliott Wave structure. Down from wave 3, wave (i) ended at 2425.9 and wave (ii) rally ended at 2449.7. Wave (iii) lower ended at 2396.3 and wave (iv) rally ended at 2413.8. Final leg wave (v) ended at 2391.4 which completed wave ((a)) in higher degree. Rally in wave ((b)) ended at 2435.6. Expect wave ((c)) lower to end at 2330 – 2370 area to complete wave 4 in higher degree. From there, the Index can then see further upside or rally in 3 waves at least.

Russell 2000 (RTY) 60 minutes Elliott Wave chart

RTY_F Elliott Wave [Video]

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.