DXY on the verge of a breakout ahead of Fed meeting next week

|

- The FOMC meets next Wednesday at 18.00 GMT.

- DXY potential bull breakout but need to close above 91.00.

The US dollar index is trading at around 90.21 up 0.07% after the bulls made a nice recovery as prices plunged sub-90 in the EU session.

The Fed will decide on monetary policy next Wednesday. Most investors believe a rate hike is a done deal as they will seek for clues of the FOMC increasing its 2018 and 2019 end-of-year targets for fed funds rate. At least four of the twelve members who projected the fed funds rate to be 2.125% or less at the end of the year would then need to revise their projection upward.

Earlier in the week on Tuesday, we saw the US CPI dataset which came mainly in line with expectations. PPI on Wednesday also came in line. On Thursday, initial jobless claims, NY empire state manufacturing and import price index came above expectation while the Philly Fed manufacturing survey disappointed. As the week ended on Friday, Industrial production JOLTS and the Michigan consumer sentiment index also came above expectation.

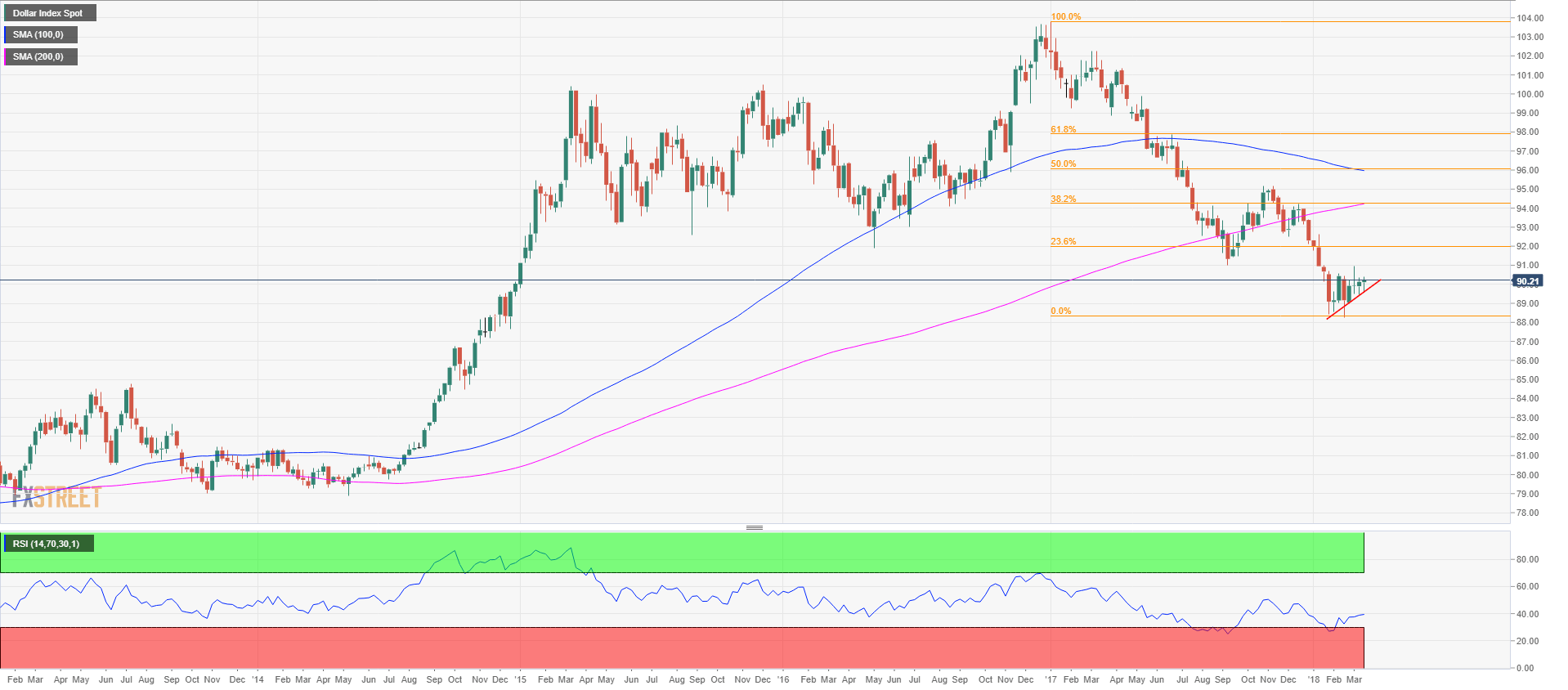

DXY weekly chart

The technical picture on the DXY looks quite similar to the USD/JPY price action since the start of the year 2018. Essentially, a bear leg followed by a consolidation. Those last two weeks the dollar bulls managed to close the bar in the upper third part and have managed to form a small triangle compression pattern in the process. Resistance is seen at the 91.00 figure followed by the 92.00 figure and Fibonacci retracement 23.6% from the December 2017-February 2018 downtrend. To the downside 89 and 88 figure are support.

DXY daily chart

On Thursday the dollar broke above the 50-period SMA and the bullish pressure continued on Thursday as it was anticipated. The bulls are building momentum but the bull breakout will be confirmed when they can break above 91.00 (last significant swing) and start putting in higher highs. Stay tuned as next week will most likely provide an answer as to which direction the dollar will be headed in the near future.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.