Crude Oil Futures: Recovery has further legs to go

|

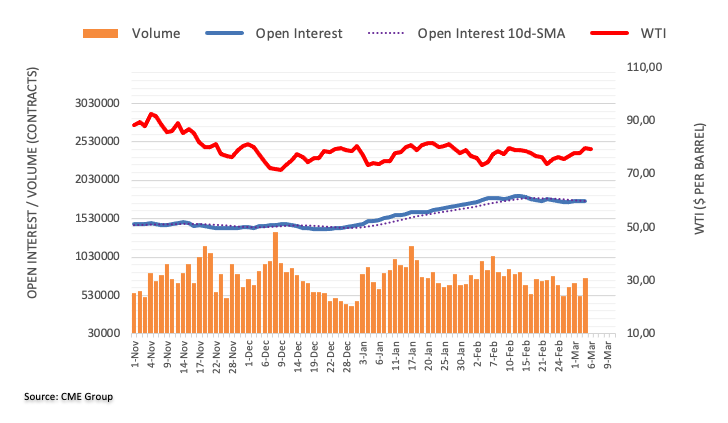

CME Group’s flash data for crude oil futures markets noted traders added nearly 5K contracts to their open interest positions at the end of last week, keeping the erratic performance unchanged for the time being. Volume, in the same direction, resumed the uptrend and rose by around 241.7K contracts.

WTI keeps targeting $80.00 and above

Prices of the WTI extended the weekly rebound on Friday. The move was in tandem with rising open interest and volume and suggests that further gains look likely in the very near term. The surpass of the key $80.00 mark per barrel should pave the way for a test of the February high at $80.57 (February 13) ahead of the so far 2023 peak at $82.60 (January 23).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.