Canadian Dollar sees further gains as market extends Fed-fueled rally

|

- The Canadian Dollar is seeing a rebound alongside market sentiment.

- Canada Unemployment, Wages figures due on Friday alongside US NFP.

- Crude Oil prices are moderating on the low end, capping CAD gains.

The Canadian Dollar (CAD) is seeing a rebound as the broader market sentiment recovers on Thursday, pushing down the US Dollar (USD) and giving riskier currencies some much-needed breathing room.

Canada Unemployment and Average Hourly Wages data is slated for release on Friday, with the data points likely to be overshadowed by another US Nonfarm Payrolls (NFP) in the books.

Daily Digest Market Movers: Canadian Dollar finds foothold as markets send US Dollar lower

- Broad market risk appetite recovery sends equities and risk assets back up, US Dollar and Treasury yields back down.

- Fed’s rate hold and statement on Wednesday signals the end of the rate hike cycle to possibly overeager markets.

- Thursday’s rally gives way to US NFP Friday with Canada Unemployment and Wages data buried in the calendar.

- Canadian wage growth expected to ease, Net Change in Employment forecast to decline from 63.8K to 22.5K for October.

- Canada Unemployment Rate seen ticking upward from 5.5% to 5.6%.

- Canadian home sales broadly decline, key hotspots see sales activity fall to levels only seen in last two recessions.

- US NFP to dominate market data reactions, October jobs additions seen declining from 336K to 180K.

- WTI Crude Oil subdued below $82.00 per barrel, limiting topside gains for Oil-dependent Loonie.

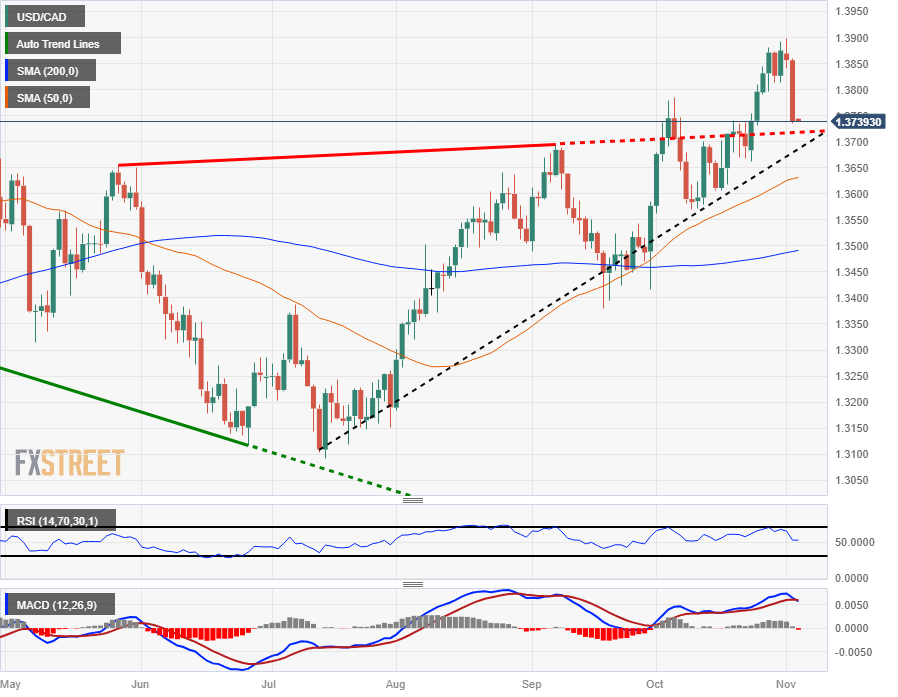

Technical Analysis: Canadian Dollar follows rest of market higher against US Dollar, USD/CAD slips back below 1.3750

The USD/CAD pair fell back below the 1.3800 handle as the Canadian Dollar (CAD) follows market sentiment higher against the US Dollar (USD).

The CAD fell to a twelve-month low against the USD yesterday, sending the USD/CAD to 1.3899, and a relief pullback has sent the USD/CAD into a fresh Thursday low around 1.3735.

Near-term technical support sits at the 50-day Simple Moving Average (SMA) at 1.3625, while a longer-term move toward the downside sees a floor at the 200-day SMA currently rising into 1.3500.

A topside break of yesterday’s peak will see fresh year-long highs for the USD/CAD, with the way clear for a run at 2022’s high bids near 1.3980 set in October of last year.

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.