Berkshire Hathaway Inc. (BRK.B) Elliott Wave technical analysis

|

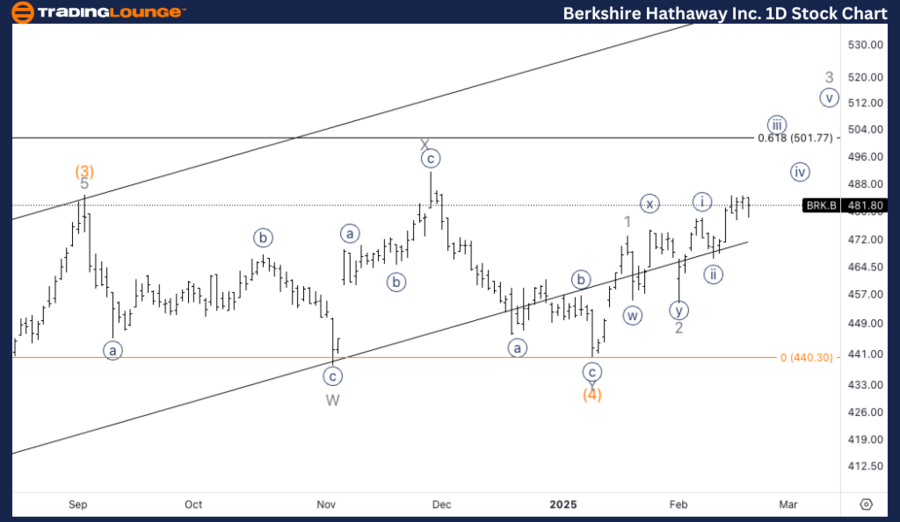

Berkshire Hathaway Inc. (BRK.B) – Elliott Wave analysis (daily chart)

-

Function: Trend.

-

Mode: Impulsive.

-

Structure: Motive.

-

Position: Wave 3 of (5).

-

Direction: Upside into Wave 3.

Details:

-

Expecting upside movement into Minor Wave 3 as we approach TradingLevel5 at $500.

-

Looking for a clear subdivision within Wave 3.

Berkshire Hathaway Inc. (BRK.B) – Elliott Wave analysis (one-hour chart)

-

Function: Trend.

-

Mode: Impulsive.

-

Structure: Motive.

-

Position: Wave {iii} of 3.

-

Direction: Upside in Wave {iii}.

Details:

-

Wave {iii} is developing, and we might be missing one leg higher into Wave (v) of {iii}.

-

Looking for a potential subdivision in Wave {iii} to confirm the next movement.

Summary of BRK.B Elliott Wave analysis

Daily chart

Berkshire Hathaway (BRK.B) remains in an impulsive phase within Wave 3 of (5), following a motive structure. The price is pushing higher within Minor Wave 3, with a target around $500. Expect further upside as Wave 3 unfolds, with clear subdivisions forming within the internal wave structure.

One-hour chart

On the 1-hour chart, BRK.B continues to progress through Wave {iii} of 3. The structure in Wave {iii} suggests additional upside potential, with one final leg expected to complete Wave (v) of {iii}. This would indicate more upward momentum ahead.

Berkshire Hathaway Inc. (BRK.B) Elliott Wave technical analysis

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.