BABA Stock Forecast: Alibaba Group tumbles as China reinstates COVID lockdowns in Beijing

Premium|

You have reached your limit of 5 free articles for this month.

Get all exclusive analysis, access our analysis and get Gold and signals alerts

Elevate your trading Journey.

UPGRADE- NYSE:BABA fell by 10.31% during Monday’s trading session.

- China reinstates COVID lockdowns after an outbreak in Beijing.

- JPMorgan remains bullish on AliBaba despite recent weakness in the stock.

NYSE:BABA tumbled alongside other Chinese ADR stocks on Monday as investors received another round of bad news out of the nation’s capital. Shares of BABA plummeted by 10.31% and closed the trading day at $98.52. The fallout from the May CPI report extended into this week as global equities markets tanked to start the week. All three major US indices closed well lower, with all 504 constituents of the S&P 500 trading in the red at one point this morning. The Dow Jones dropped by a further 876 basis points, the S&P 500 re-entered bear market territory with a 3.88% loss, and the NASDAQ led the way lower posting a 4.68% loss during the session.

Stay up to speed with hot stocks' news!

Just weeks after Shanghai reopened from its disruptive COVID-lockdowns, China has announced that Beijing is now closed due to an outbreak of the virus. The news comes as Chinese ADR stocks looked to be turning a corner following months of lockdowns directly affecting businesses. Some of the companies that were impacted include Tesla (NASDAQ:TSLA) and Nio (NYSE:NIO) as production facilities in the Shanghai region were shut down.

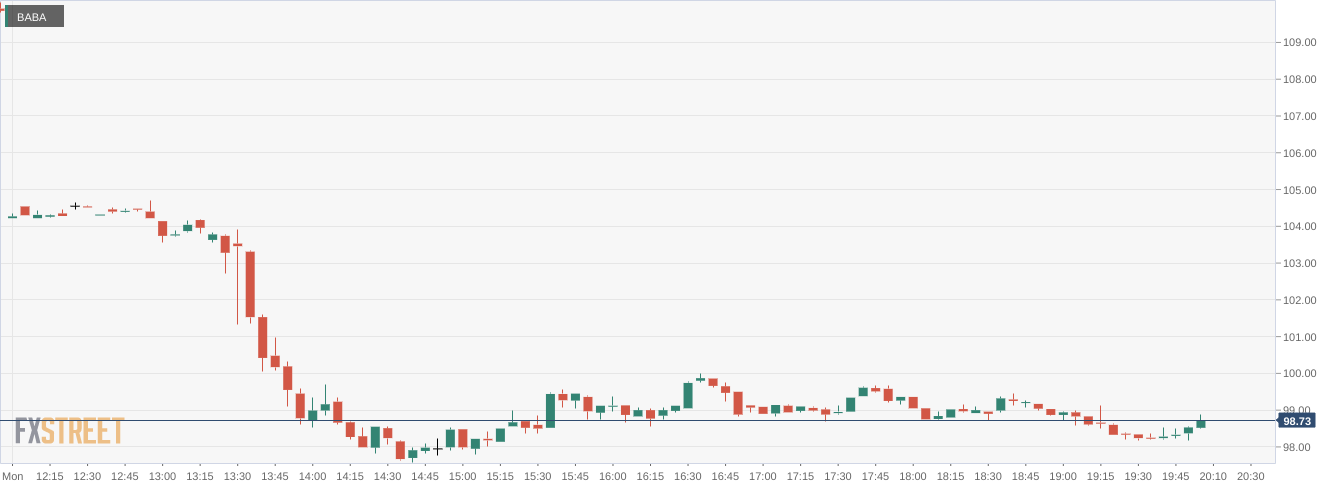

BABA stock price

Despite the recent weakness in AliBaba’s stock, analysts at JPMorgan remain bullish on the company moving forward. Analysts mainly pointed to China’s Zero-COVID policy as unsustainable. Each time the country goes into lockdown, the stocks get punished further, which according to JPMorgan is still a short-term overreaction. The firm is cautious ahead of ongoing US rate hikes to battle inflation, but is confident that AliBaba can outperform its current price levels over the long-term.

Like this article? Help us with some feedback by answering this survey:

- NYSE:BABA fell by 10.31% during Monday’s trading session.

- China reinstates COVID lockdowns after an outbreak in Beijing.

- JPMorgan remains bullish on AliBaba despite recent weakness in the stock.

NYSE:BABA tumbled alongside other Chinese ADR stocks on Monday as investors received another round of bad news out of the nation’s capital. Shares of BABA plummeted by 10.31% and closed the trading day at $98.52. The fallout from the May CPI report extended into this week as global equities markets tanked to start the week. All three major US indices closed well lower, with all 504 constituents of the S&P 500 trading in the red at one point this morning. The Dow Jones dropped by a further 876 basis points, the S&P 500 re-entered bear market territory with a 3.88% loss, and the NASDAQ led the way lower posting a 4.68% loss during the session.

Stay up to speed with hot stocks' news!

Just weeks after Shanghai reopened from its disruptive COVID-lockdowns, China has announced that Beijing is now closed due to an outbreak of the virus. The news comes as Chinese ADR stocks looked to be turning a corner following months of lockdowns directly affecting businesses. Some of the companies that were impacted include Tesla (NASDAQ:TSLA) and Nio (NYSE:NIO) as production facilities in the Shanghai region were shut down.

BABA stock price

Despite the recent weakness in AliBaba’s stock, analysts at JPMorgan remain bullish on the company moving forward. Analysts mainly pointed to China’s Zero-COVID policy as unsustainable. Each time the country goes into lockdown, the stocks get punished further, which according to JPMorgan is still a short-term overreaction. The firm is cautious ahead of ongoing US rate hikes to battle inflation, but is confident that AliBaba can outperform its current price levels over the long-term.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.