AUD/USD Price Analysis: Bulls eye 0.6850 while bears look to 0.6650

|

- AUD/USD bulls eye a move towards 0.6850.

- A break of the micro trendline opens risk to 0.6650.

AUDUSD increased to an 11-week high of 0.6813 after the US dollar fell across the board after Federal Reserve Chairman Jerome Powell said that the US central bank could scale back the pace of its interest rate hikes. This sent the US Dollar index on track for its worst month since 2010.

The following illustrates the technical outlook for AUD/USD on the daily and 4-hour charts:

AUD/USD daily chart

AUD/USD is heading into an area of liquidity and prior resistance between 0.6420/50. Should the US Dollar find buyers in its decent, AUD/USD could find itself on the way to test the rising trendline on the daily chart near 0.6750.

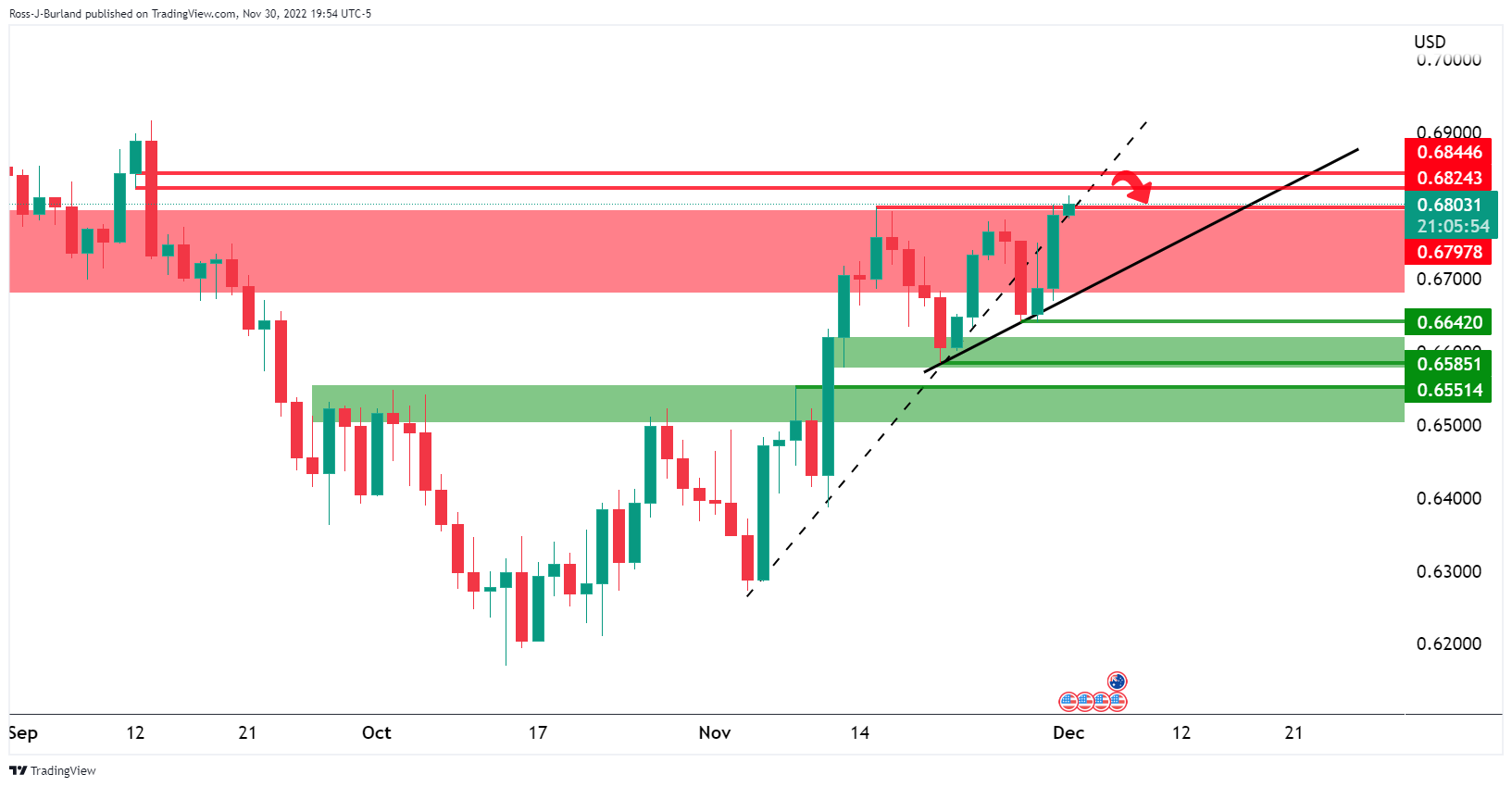

AUD/USD H4 chart

Moving down to the lower time frames we can see the possible areas of interest above and below the price. A break of the micro trendline opens risk to 0.6650. The Caixin China Manufacturing PMI data could be a meanwhile catalyst for the day ahead for lower time frame traders.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.