AUD/USD bulls are looking for the doji close followed by a bullish engulfing

|

- AUD has been sold off despite the hot CPI data.

- The bulls are moving in following a significant spell of supply.

- The US dollar is picking up the flows in the forex space.

At 0.7142, AUD/USD is higher on the day by some 0.27% after recovering from a low of 0.7101 but still below the post inflation data highs posted in Tokyo at 0.7190. The Consumer Price Index outcome means that a rate hike from the Reserve Bank of Australia is coming sooner and faster than what markets had thought, yet a challenging external environment has continued to weigh on the Aussie nonetheless.

The RBA has been gradually making room for itself to tighten for the months ahead, but the CPI beat overnight for the first quarter of 2022 means has left the possibility of a rate hike as soon as May on the table. Additionally, there is a strong case for some front-loading for the rest of the meetings this year.

Trimmed mean inflation surged to 1.4% QoQ in Q1 (3.7% YoY), while headline inflation reached 5.1% YoY, the highest result since the mid-90s (excluding the introduction of GST in 2001). The momentum on wages, and not just disruptions in the global economy, means that high levels of inflation are likely to be persistent for the foreseeable future.

''We now expect the RBA to hike by 15bp next week. Inflation pressures have momentum and have broadened. A cash rate target of 0.1% is inappropriate against this backdrop,'' analysts at ANZ Bank argued.

Initially, the Aussie rallied to an important hourly resistance level as follows:

AUD/USD price analysis around CPI

''On the hourly chart, AUD/USD had been forming a bullish reverse head & shoulders ahead of the data as follows:

''This is a reversal pattern and the neckline of the prior M-formation near 0.7180 could be targetted for the day ahead. The outcome has triggered a bid, so this validates the chart pattern, as follows:

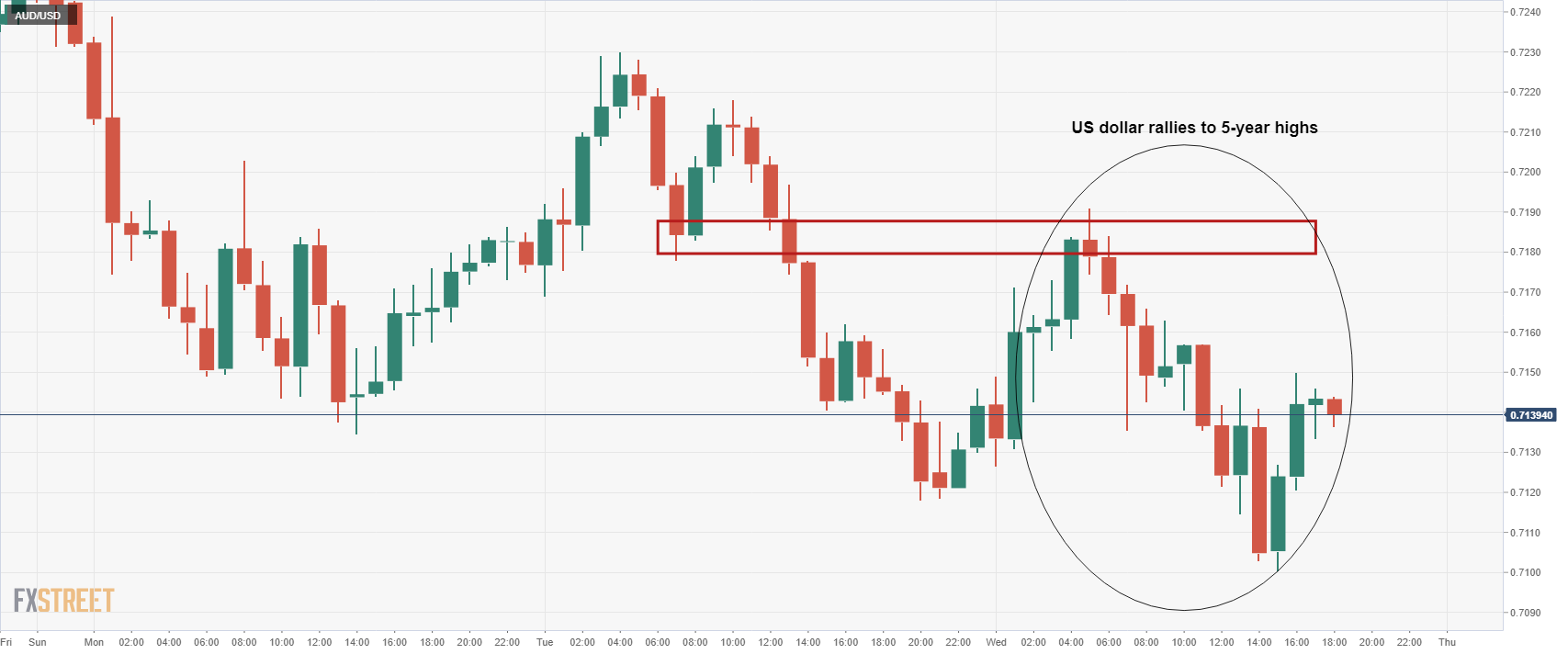

However, as illustrated here, the price has been rejected from this resistance as the US dollar hits a five-year high:

US dollar rallies to five-year highs

On Wednesday, the greenback rallied to a five-year high ahead of the Federal Reserve next week. The Fed is expected to increase rates by 50 basis points at its May 3-4 meeting, as well as in June and July. Some analysts, such as those from Nomura, are calling for a 75bp hike. The dollar index against a basket of currencies (DXY) reached 103.282, the highest since Jan. 2017.

Propelling the greenback further are the economic growth concerns in Europe after Russia cut off gas supplies to parts of the region. Russia's Gazprom (GAZP) halted gas supplies to Poland and Bulgaria on Wednesday over their failure to pay in roubles, cranking up an economic war with Europe in response to Western sanctions imposed for Moscow's invasion of Ukraine.

The greenback has also benefited from global growth concerns as China enacts lockdowns in a bid to stem the spread of COVID-19. Beijing has ramped up mass testing for COVID-19 while the financial hub of Shanghai has been under strict lockdown for around a month.

''The step-up in risks to Chinese growth is set against the widespread acceptance that the war in Ukraine could continue for many months and an anticipated aggressive tightening in monetary policy by the Federal Reserve this year. This increased safe-haven demand stemming from growth fears could result in a stronger-for-longer USD,'' analysts at Rabobank explained.

''More restrictions in China imply a fresh test for global supply chains. At the start of this week, the unleashing of fresh growth concerns spooked stock markets and triggered another round of demand for safe-haven assets,'' the analysts added. '

''In previous periods of heightened growth fears, the Fed has been in a position to loosen monetary policy as global growth stresses mount. At the start of the pandemic in 2020, the Fed swiftly batted away safe-haven demand by drastically increasing liquidity provision. The result was a surge in risky assets and persistent downward pressure on the then low yielding USD for the rest of that year.''

However, the analysts explain, that ''in contrast, against the backdrop of accelerated US inflationary pressures, the Fed is currently signalling that it will be tightening policy aggressively in the coming months. This should undermine the outlook for riskier EM currencies and keep the USD underpinned. '' AUD is a high beta currency and much like EM-FX, this environment should be to its detriment.

Eyes on US growth

Meanwhile, for tomorrow, US Real Gross Domestic Product likely slowed sharply in Q1 following a significant increase to 6.9% AR in Q4 from 2.3% in Q3, analysts at TD Securities said.

''As was the case last quarter, inventories will play a large role though they will be a drag instead. That said, domestic final sales likely continued to strengthen on the back of firming consumer spending. The inflation parts of the report will likely show acceleration.''

AUD/USD technical analysis

We are seeing a gradual deceleration of the bearish impulse on the daily chart and a correction from the weekly support structure could be in order:

A bullish engulfing candle preceding what could turn out to be a bullish Doji close on Wednesday would signal prospects of a correction to test prior daily support structures and confluences along the Fibonacci retracement scale.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.