AMC Stock News: AMC Entertainment snaps as Nasdaq tanks

Premium|

You have reached your limit of 5 free articles for this month.

Get all exclusive analysis, access our analysis and get Gold and signals alerts

Elevate your trading Journey.

UPGRADE- NYSE:AMC fell by 3.74% during Monday’s trading session.

- GameStop announced the launch of a non-custodial crypto and NFT wallet.

- Doctor Strange 2 stays on top at the box office for the third straight week.

UPDATE: AMC stock lost 8.3% on Tuesday early in the session to trade at $10.63. The Nasdaq is down 3.3% at the same time as fallout from Snap's reduced outlook has hurt a broad swath of the market. This is especially true of growth and risky stocks. The growth-heavy Nasdaq Composite is down 3.3% on Tuesday morning even as the S&P 500 and Dow are down a reduced 2% and 1.2%, respectively. Over 6,000 call contracts expiring this Friday at a $12 strike price have exchange hands this morning. The last price they traded at was $0.27 per share.

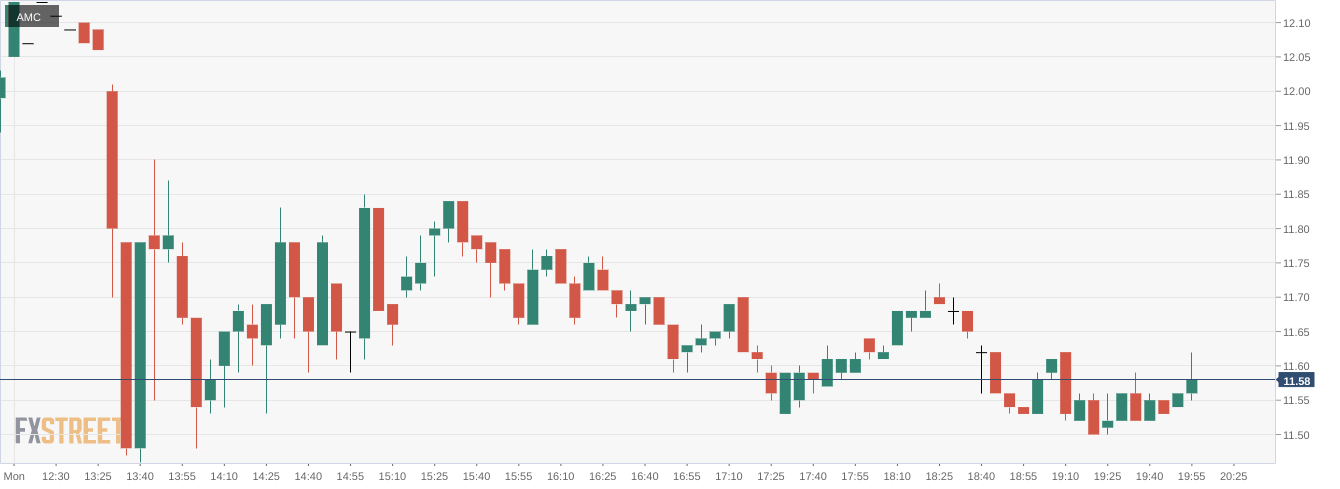

NYSE:AMC started the week off with its third straight decline as the movie theater stock has now erased most of its gains from the previous week. On Monday, shares of AMC dropped by a further 3.74% and closed the trading session at $11.58. The broader markets snapped back on Monday after another week of sharp sell offs that saw all three major indices fall for the seventh consecutive week. The Dow Jones jumped by 618 basis points, while the S&P 500 and the NASDAQ rose by 1.86% and 1.58% respectively during the session.

Stay up to speed with hot stocks' news!

AMC’s running mate, GameStop (NYSE:GME) made a major announcement on Monday as the company continues its digital transformation. The original meme stock company announced that it would be releasing a non-custodial NFT and crypto wallet to be used on the Ethereum layer-2 network called Loopring. The news comes following recent rumors that GameStop is nearing a launch of its NFT marketplace that it is creating with another blockchain company called Immutable X. The Loopring crypto token saw a nice surge following the news but shares of GameStop only had a marginal gain of 0.48% during the session.

AMC stock forecast

It was another relatively slow week at the box offices and to no surprise, Doctor Strange in the Multiverse of Madness remained atop the standings for a third straight week. The Disney (NYSE:DIS) and Marvel film has now made over $800 million worldwide. The next big threat to Doctor Strange’s reign? Top Gun: Maverick which launches in the US on May 27th. Needless to say, AMC will need the blockbuster releases to continue if it wants to keep moviegoers in the seats.

Like this article? Help us with some feedback by answering this survey:

- NYSE:AMC fell by 3.74% during Monday’s trading session.

- GameStop announced the launch of a non-custodial crypto and NFT wallet.

- Doctor Strange 2 stays on top at the box office for the third straight week.

UPDATE: AMC stock lost 8.3% on Tuesday early in the session to trade at $10.63. The Nasdaq is down 3.3% at the same time as fallout from Snap's reduced outlook has hurt a broad swath of the market. This is especially true of growth and risky stocks. The growth-heavy Nasdaq Composite is down 3.3% on Tuesday morning even as the S&P 500 and Dow are down a reduced 2% and 1.2%, respectively. Over 6,000 call contracts expiring this Friday at a $12 strike price have exchange hands this morning. The last price they traded at was $0.27 per share.

NYSE:AMC started the week off with its third straight decline as the movie theater stock has now erased most of its gains from the previous week. On Monday, shares of AMC dropped by a further 3.74% and closed the trading session at $11.58. The broader markets snapped back on Monday after another week of sharp sell offs that saw all three major indices fall for the seventh consecutive week. The Dow Jones jumped by 618 basis points, while the S&P 500 and the NASDAQ rose by 1.86% and 1.58% respectively during the session.

Stay up to speed with hot stocks' news!

AMC’s running mate, GameStop (NYSE:GME) made a major announcement on Monday as the company continues its digital transformation. The original meme stock company announced that it would be releasing a non-custodial NFT and crypto wallet to be used on the Ethereum layer-2 network called Loopring. The news comes following recent rumors that GameStop is nearing a launch of its NFT marketplace that it is creating with another blockchain company called Immutable X. The Loopring crypto token saw a nice surge following the news but shares of GameStop only had a marginal gain of 0.48% during the session.

AMC stock forecast

It was another relatively slow week at the box offices and to no surprise, Doctor Strange in the Multiverse of Madness remained atop the standings for a third straight week. The Disney (NYSE:DIS) and Marvel film has now made over $800 million worldwide. The next big threat to Doctor Strange’s reign? Top Gun: Maverick which launches in the US on May 27th. Needless to say, AMC will need the blockbuster releases to continue if it wants to keep moviegoers in the seats.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.