Yearn Finance faces a bull trap that will push YFI to $25,000

|

- Yearn Finance price faces an $8,500 drop to return to $25,000.

- Resistance within the Ichimoku system corroborates weakness on the Point and Figure chart.

- Upside potential does remain but is likely limited.

Yearn Finance price action is developing a particularly bearish chart pattern in the form of a head-and-shoulders pattern on its $250/3-box reversal Point and Figure chart, warning of a nearly 25% drop coming up.

Yearn Finance price to top out against crucial resistance levels and eyes a significant drop soon

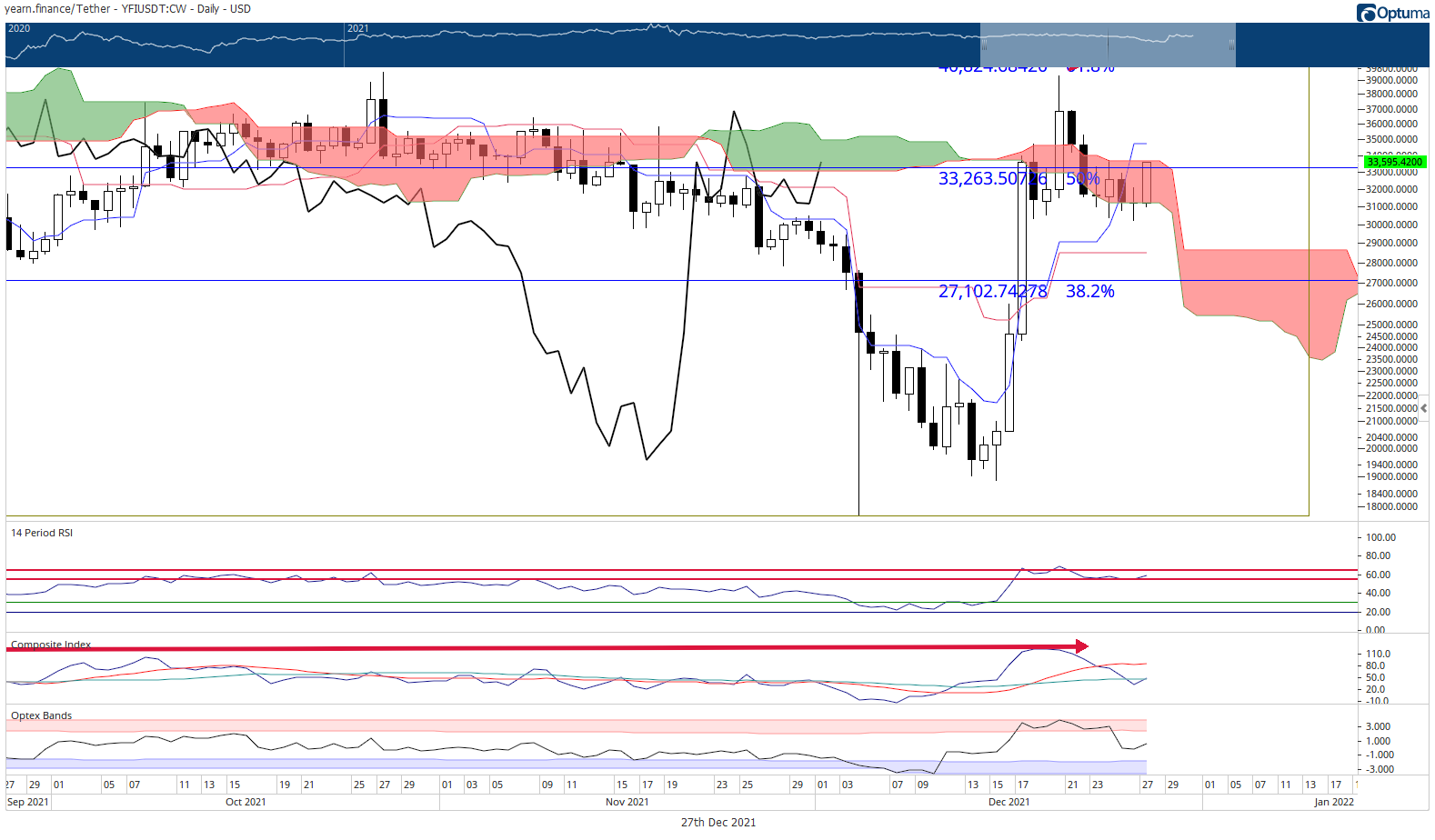

Yearn Finance price has been stuck inside the Ichimoku Cloud on the daily chart since December 22. The range and bodies of those daily candlesticks have mostly been confined to the bounds of the top and bottom of the Cloud. Today, YFI is testing the top of the Cloud (Senkou Span B) at $33,750.

Bulls will likely face some difficulty pushing Yearn Finance price higher. The 50% Fibonacci retracement, Senkou Span B, and daily Tenkan-Sen reside within the $33,500 to $34,750 value area. Combining those three price levels form considerable resistance to any further movement higher.

The oscillators also hint at continued difficulty moving higher for Yearn Finance price. The Optex Bands have developed a relatively extreme slope, warning of extreme overbought conditions getting hit soon. The Relative Strength Index remains in bear market conditions and oscillates between the two overbought levels in a bear market (65 and 55). The RSI is barely staying above the first overbought level at 55.

It is expected that Yearn Finance price action will be constrained to the top and bottom of the Cloud. If YFI continues to follow the Cloud, traders should expect a fast drop between December 28 and December 29 below the neckline of the head-and-shoulders pattern on the Point and Figure chart to the bottom of the daily Cloud at the $25,000 value area.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.