XRP to drop by 15% if Ripple bears push prices below $1

|

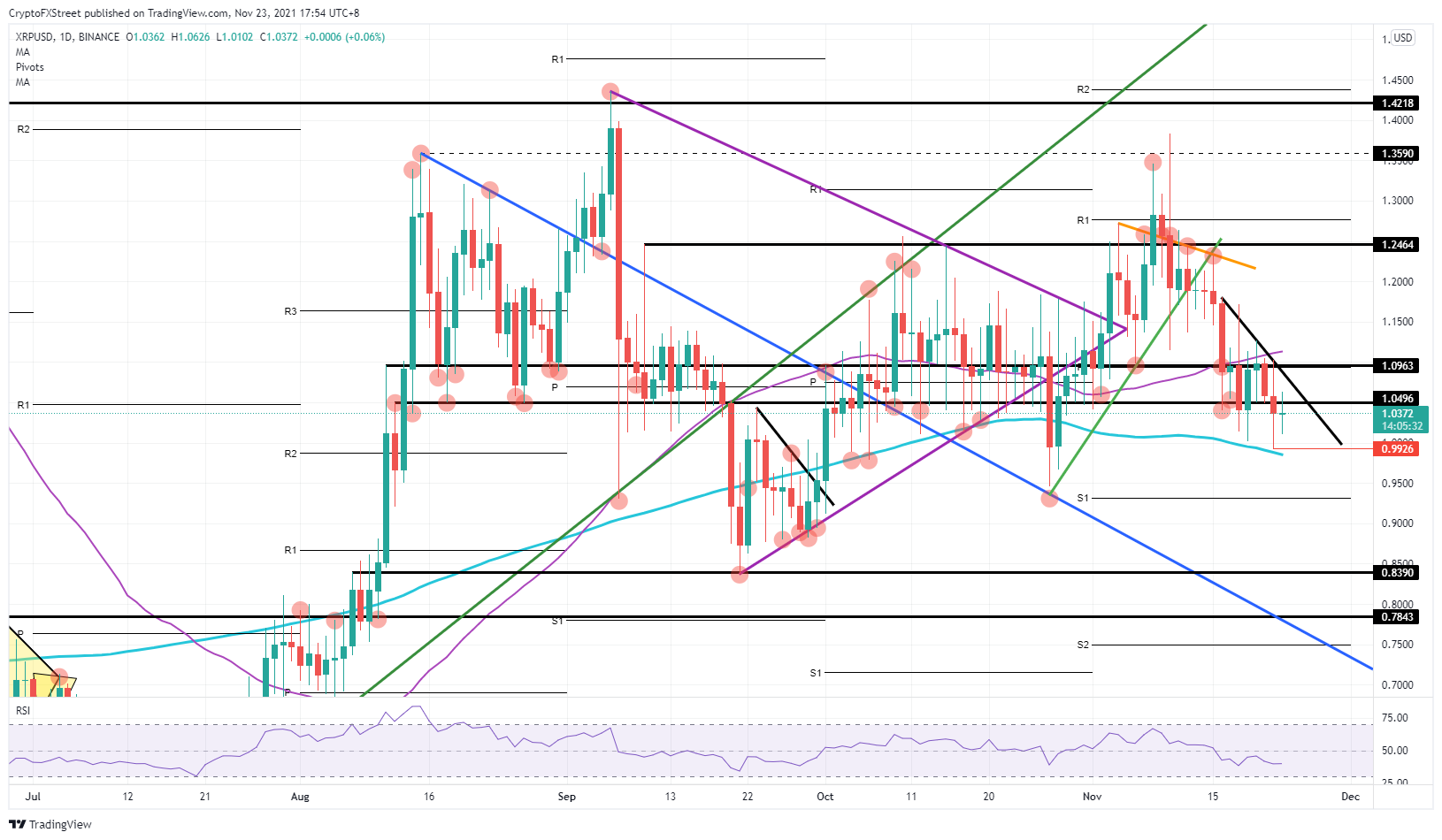

- XRP price is under pressure from bears with a new monthly low on Monday.

- Ripple price briefly slipped below $1.00, but a squeeze and break look inevitable with lower highs.

- The double barrier support area offers solid bullish support around $0.80.

Ripple (XRP) price is in a downtrend, already correcting 28% since the peak from November. In that correction, XRP price is putting pressure on the $1.00 level. As a break looks inevitable, bulls will only want to jump in and start buying XRP price action around $0.78-$0.85, which would translate into another 15% devaluation in Ripple price.

An XRP price break below $1 would ignite a sell-off

Ripple price saw bulls trying to break out of the downtrend that has been present since most of November. Bulls got rejected against a historical level at $1.10 and its intersection point with a short-term descending trend line that looks to be holding some respect for most of November. The feint higher was really a bull trap and bears then took the opportunity to push price briefly below $1.00

XRP price will see further pressure on that $1.00 as bears have seen the possibility of a breakthrough. Expect bears to build momentum further, as the 55-day Simple Moving Average (SMA) forms a cap on the top side at around $1.10. Expect each bullish uptick to be matched and reversed to the downside.

XRP/USD daily chart

A break below $1.00 will give XRP bears the persistence to exert further bearish pressure. This, in turn, will attract more short-term bears and see an acceleration on the sell-side as bulls panic and close out their positions. Expect a break below the 200-day SMA and see a nosedive towards $0.84. Bulls will see the falling knife hit a floor and twang between$0.84 and $0.78 and start to buy, which will then see a handover in sentiment and begin the start of a new uptrend.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.