XRP on-chain metrics predict explosive price rally in the altcoin

|

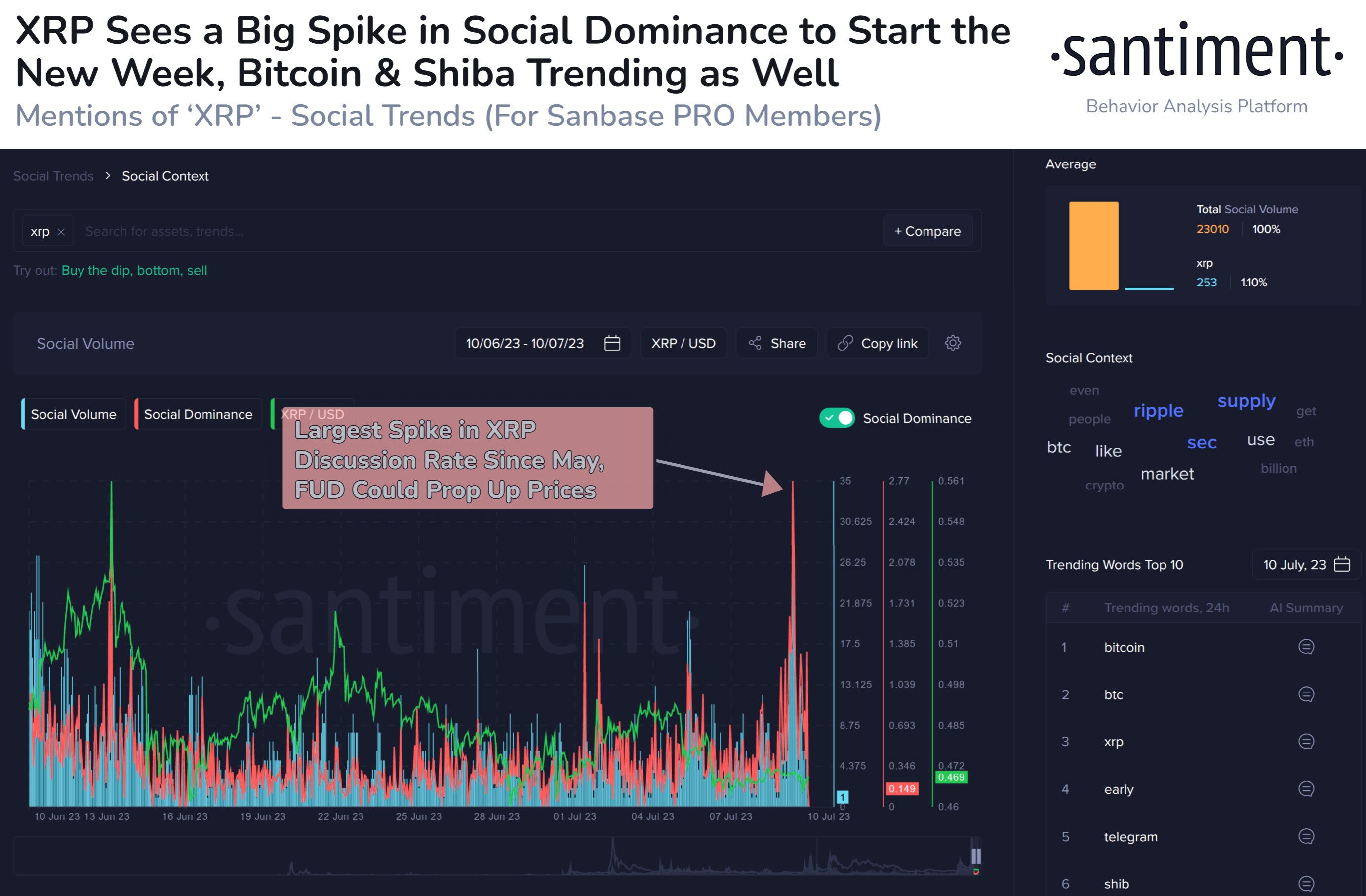

- XRP Network noted an uptick in mentions on social media platforms in the early hours of Monday.

- Typically, an increase in discussions of an asset when its price is in a downtrend signals a bullish trend reversal.

- XRP price is poised for recovery, eyeing the 50% Fibonacci level at $0.4971.

XRP is in the spotlight once again as the community awaits a verdict in the SEC vs. Ripple case. The token noted a spike in its social dominance, an on-chain metric used to measure the mentions of an asset across social media platforms like Twitter.

Typically, this is considered a sign of a recovery, which would mean thatand XRP price is likely to wipe out its losses from June 2023.

XRP network gears up for recovery with bullish on-chain metrics

Based on data from crypto intelligence tracker Santiment, the altcoin XRP observed an increase in its social dominance. Social dominance shows the share of discussions in crypto media, associated with XRP. Santiment builds this metric on top of social data, gathered from different social media platforms.

XRP social dominance

In the early hours of Monday, there was a significant uptick, despite the XRP price decline. Experts at Santiment believe that the probability of recovery in XRP price increases with the rise in social dominance.

As seen in the chart above, the spike in social dominance is the largest increase since May, and XRP prices are likely to rally in the short term.

There is a higher probability of XRP price recovering from the decline in June 2023. XRP price declined nearly 20% in mid-June, plummeting from $0.5647 to $0.4567 within a week.

XRP/USDT one-day price chart on Binance

A recovery in XRP price is likely to push the altcoin to its July 2 high of $0.4971, which coincides with the 50% Fibonacci retracement of the decline from the March 29 peak of $0.5840 to the May 8 low of $0.4102.

It remains to be seen whether XRP price will recover from the recent losses. XRP holders are awaiting an outcome in the SEC vs. Ripple lawsuit.

XRP price prediction

The technical analyst behind the Twitter handle @egragcrypto evaluated the weekly XRP price chart on Binance and identified potential for a rally in the altcoin. The analyst suggests longer the consolidation, higher the potential for a bullish breakout.

#XRP Lines Within Lines (Breakout Is Imminent)

— EGRAG CRYPTO (@egragcrypto) July 10, 2023

White Lines - Ranging:

⚙️ The micro ranging area between 0.38c - 0.54c serves as a foundation, allowing for stability and growth. The longer the consolidation, the greater the potential for an explosive upward movement.… pic.twitter.com/4MyHl2wWjF

#XRP Lines Within Lines (Breakout Is Imminent)

— EGRAG CRYPTO (@egragcrypto) July 10, 2023

White Lines - Ranging:

⚙️ The micro ranging area between 0.38c - 0.54c serves as a foundation, allowing for stability and growth. The longer the consolidation, the greater the potential for an explosive upward movement.… pic.twitter.com/4MyHl2wWjF

SEC vs Ripple lawsuit FAQs

Why are the US Securities and Exchange Commission and Ripple litigating?

The United States Securities and Exchange Commission (SEC) brought charges against Ripple and its executives alleging that the cross-border payment settlement firm raised more than $1.3 billion through an unregistered asset offering of the XRP token. Ripple argues that XRP should not be treated as a security or an investment contract, just like the SEC looks at Bitcoin or Ethereum, citing views from former SEC Director of Corporation Finance William Hinman.

When did the SEC vs. Ripple court case start?

The SEC charges were made public in December 2020. The long-running litigation, presided by Judge Analisa Torres, seems to be close to its end as both parties fail to reach an agreement.

What are the effects on XRP price?

Ripple is the largest holder of the altcoin XRP. The SEC’s charges against Ripple resulted in a mass delisting of XRP across crypto exchange platforms and a sharp decline in the token’s value, which used to be the third crypto asset by market capitalization after Bitcoin and Ethereum. A positive outcome for Ripple in its case against the SEC would benefit XRP’s price, while a SEC win is likely to weigh further on the asset, experts say.

Which implications could the ruling have on the overall crypto industry?

The final verdict in the SEC vs. Ripple lawsuit is the most highly anticipated in the crypto ecosystem. The lawsuit is expected to set precedent for other open cases that affect dozens of digital assets. A ruling in favor of the SEC would most likely bring further regulation to the sector as it would classify most tokens as securities. On the contrary, Ripple’s win would be interpreted as a validation of the crypto markets and could boost investors' confidence if current legal uncertainties surrounding digital assets in the US are solved.

What about secondary sales of XRP among traders?

The ruling may also include views over XRP secondary sales, which directly affects investors who trade XRP on cryptocurrency exchange platforms. Pro-Ripple attorney John Deaton, who filed an amicus brief in the SEC vs. Ripple case, suggests this matter is likely to be addressed. A ruling stating that secondary sales don't qualify as securities, contrary to what the SEC claims, is likely to be beneficial for XRP.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.