XRP price prepares for a strong rebound, as weekly inflows stay unchanged

|

- XRP price commences recovery journey after tapping the massive demand area around $0.3200.

- Weekly digital asset inflows in XRP-related products stay at zero despite price drop.

- An incoming buy signal from the MACD could cement the bulls’ presence in the market against a potential retracement to $0.3000.

XRP price is printing the second bullish candlestick from support at $0.3200. The largest international money transfer token traded at $0.3559 on Monday after bulls rushed to prevent overarching losses below $0.3000. A daily close above $0.3500 (XRP’s immediate support) will point the token to highs around $0.5577.

XRP price in green as weekly digital asset funds soar

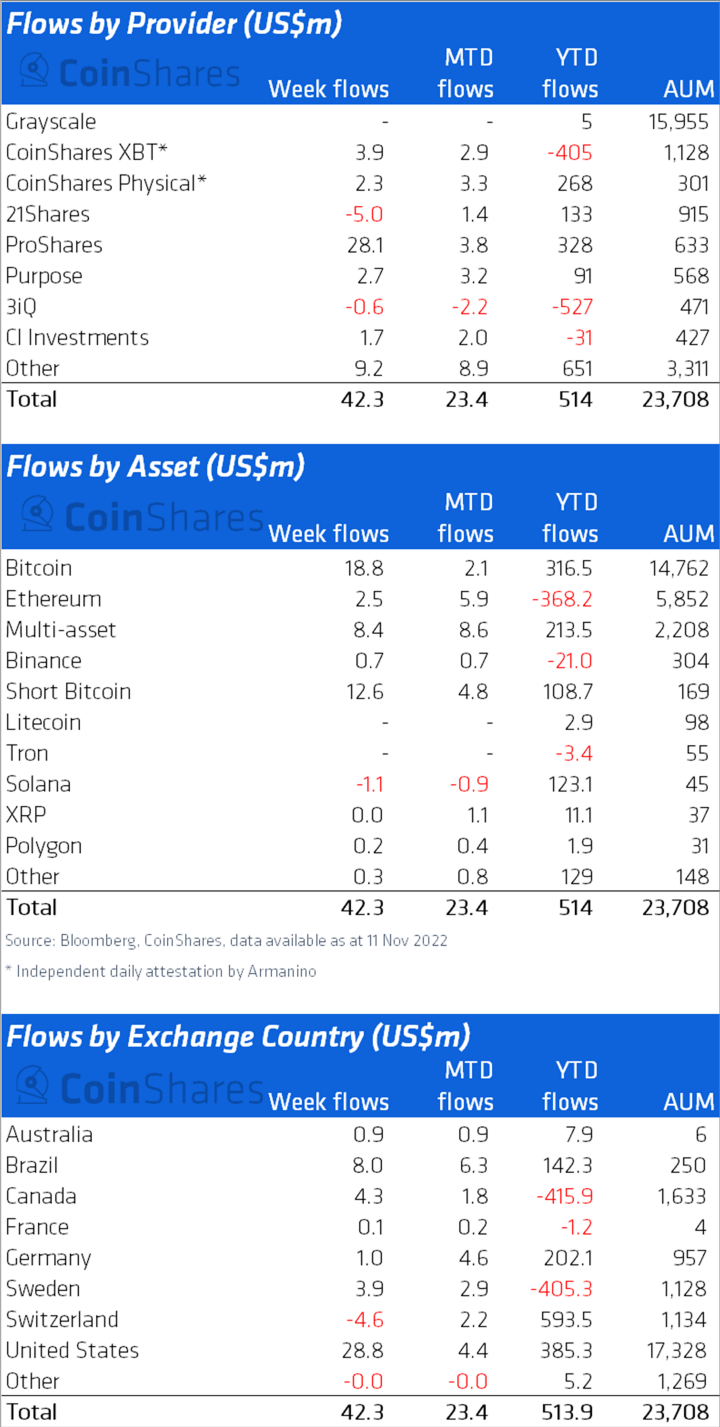

Investors appear to be watching the FTX collapse with a microscope – possibly to gauge its impact on the crypto market. According to a report by CoinShares, crypto-related products recorded over $42 million in inflows – the highest in 14 weeks. However, no funds were sent to XRP-related investment products.

According to the report published on CoinShares blog site, most funds started to trickle in toward the end of last week as the crypto market reacted to the crash of FTX and Alameda.

Bitcoin accounted for most of the inflows at $18.8 million, while $2.5 million entered Ethereum-focused investment products.

CoinShares weekly inflow report

XRP price bullish again, but is it time to buy the dip?

XRP price could quickly validate an anticipated move to $0.5577 if the Moving Average Convergence Divergence (MACD) indicator flashes a buy signal. Traders should wait for the 12-day Exponential Moving Average (EMA) (in blue) to cross above the 26-day EMA (in brown) before triggering their long positions.

XRPUSD 12-hour chart

XRP will likely uphold its uptrend now that the Stochastic oscillator is almost climbing out of the oversold region (above 30.00). Assets tend to recover after such oversold conditions and return to their fair market value in the process. The optimistic outlook in XRP will keep solidifying as the Stochastic moves into the neutral zone and possibly enters the overbought region (above 70.00).

Traders can consider $0.4100 as the first take-profit position (TP-1), but those who are stubbornly bullish will hold on until XRP tags $0.5577 (TP-2). Nevertheless, XRP is not out of the woods yet, and short-term retracements - testing support at $0.3100 are possible, especially with the fresh FTX scandal.

On the bright side, investors could use the retracements to fill their bags (buying lower-priced XRP tokens), as cited by CoinShares. Therefore, pullbacks are okay for XRP as long as they are quickly exhausted, thus paving the way for more gains.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.