XRP Price Prediction: Ripple recovery in full force as key indicator flashes buy signals

|

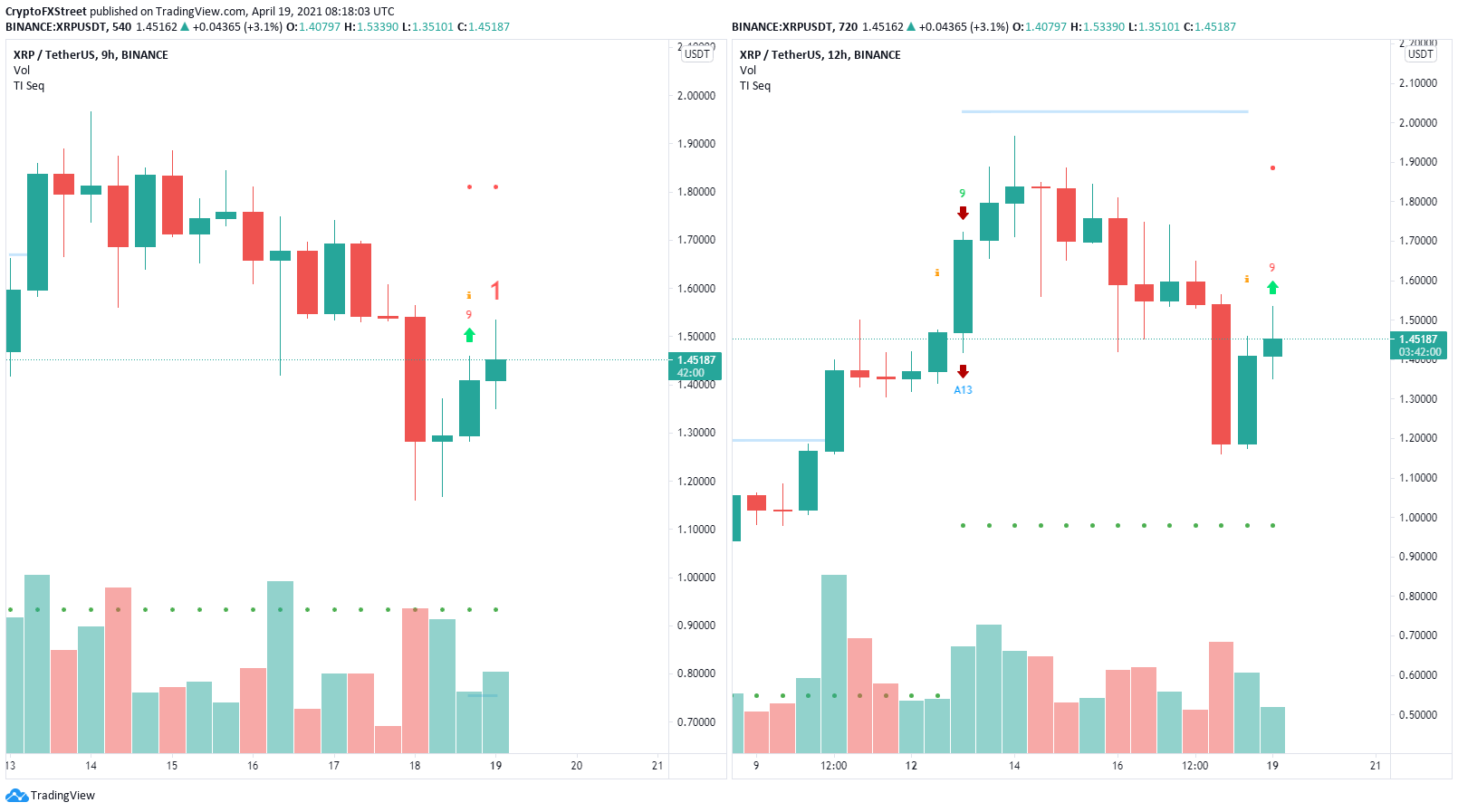

- XRP price is poised for a significant rebound after the TD Sequential indicator presented two buy signals.

- The digital asset faces only one crucial resistance level on its way up.

- The number of large holders continues to steadily increase.

XRP price had a massive sell-off in the past four days, losing 41% of its value. However, the digital asset has experienced a significant rebound from a key support level and aims to regain its previous uptrend.

XRP price ready for a massive bounce

Ripple had a significant sell-off in the past four days but managed to recover in the last 24 hours. The digital asset seems ready to resume its previous uptrend with several indicators in its favor.

The TD Sequential indicator has just presented a buy signal on the 12-hour chart and another one on the 9-hour chart in the form of a red ‘9’ candlestick.

XRP/USD Buy Signals

On the 4-hour chart, XRP bulls defended the 100 SMA support level and need to push the digital asset above the 50 SMA resistance at $1.56, which coincides with the 50% Fibonacci level. A breakout above this point can quickly drive XRP price toward $1.66 and $1.77.

XRP 4-hour chart

There is significant buying pressure in favor of XRP as the number of large holders with 100,000 to 1,000,000 coins has increased by 150 this month.

XRP Supply Distribution

However, if bears can keep XRP below the key resistance level at $1.56, the digital asset could easily fall toward the 100 four-hour SMA again at $1.23 and as low as $1.16.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.