XRP Price Prediction: Ripple bulls plan comeback with 30% rally

|

- XRP price could surge 30% after a bounce from an ascending parallel channel’s lower trend line.

- Resetting social sentiment and funding rates provide a tailwind to the bullish thesis.

- A bearish scenario could come into play if sellers slice through the channel’s lower boundary at $1.70.

XRP price could restart its parabolic upswing as technicals and on-chain metrics point to a massive bullish breakout.

XRP price eyes higher high

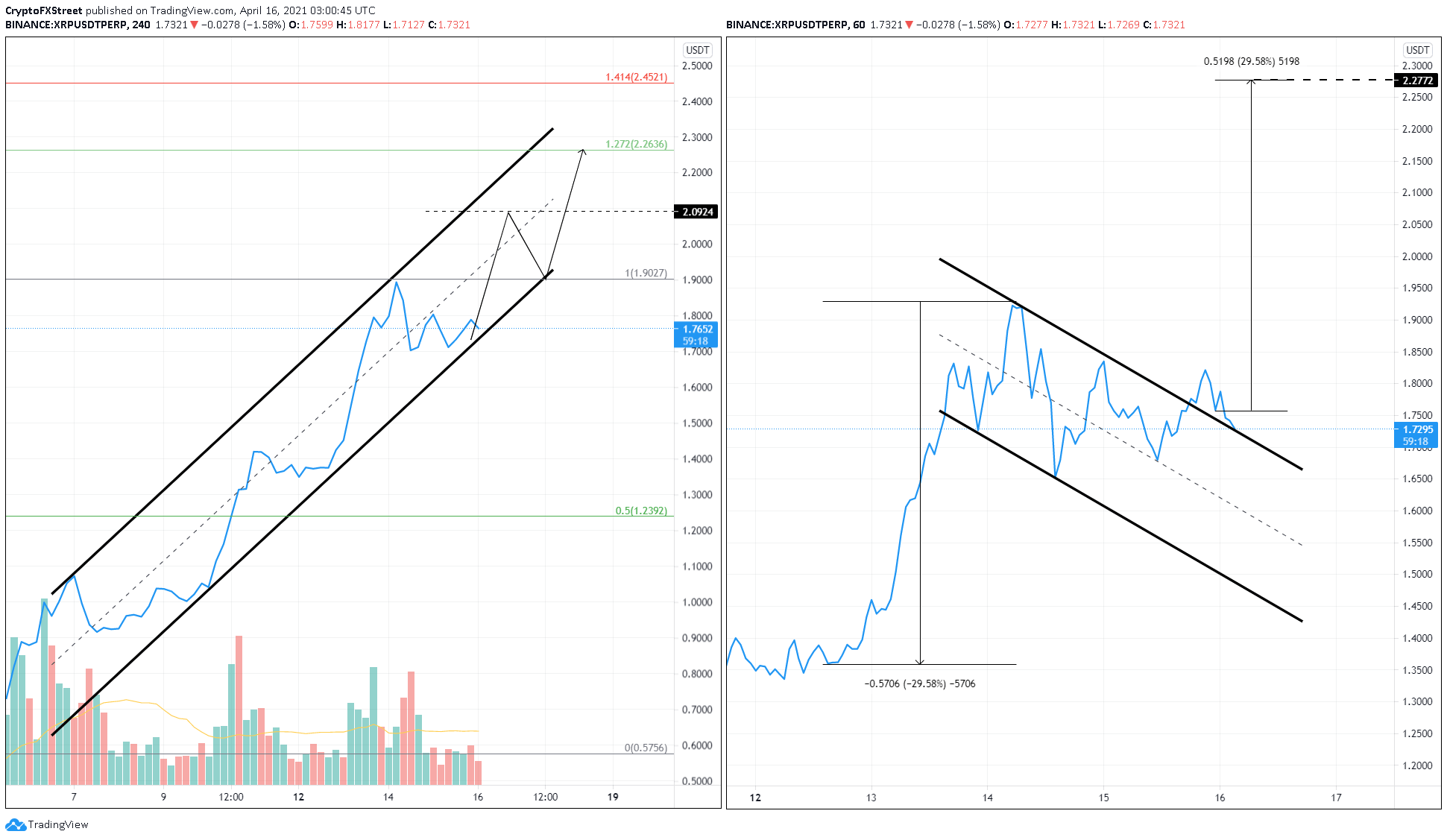

On the 4-hour chart, XRP price reveals that its hyperbolic upswing was contained within an ascending parallel channel. This technical formation is a result of higher highs and higher lows connected using trend lines.

The recent surge to $1.96 has seen a 10% retracement toward the channel’s lower trend line. Now, a bounce from this level seems likely. Therefore, a potential spike in buying pressure could push XRP price up by 20%, the immediate supply barrier at $2.09.

A swift yet decisive close above this level could set the stage for another 8.2% surge to the 127.2% Fibonacci extension level.

Interestingly, the 1-hour chart shows that the 42% upswing from $1.35 to $1.92 followed by a consolidation has formed a bull flag pattern. This setup contains an initial burst in XRP price, known as the flagpole, followed by a downward sloping channel, referred to as the flag.

Ripple recently broke out of the flag’s upper trend line, triggering a 30% upswing to $2.27. This target is obtained by adding the flagpole’s height to the breakout point at $1.75.

Interestingly, the setup’s target forecasted on the 1-hour time frame coincides with the projection on the 4-hour chart to the 127.2% Fibonacci extension level.

XRP/USDT 4-hour, 1-hour charts

Adding credence to the bullish thesis is the 71% drop in Ripple’s funding rate, as seen in the chart below. This reduction from 0.38% to 0.11% indicates a fall in long positions compared to the rally's start on April 10.

Often, such a reset in funding rate provides traders an opportunity to reopen their longs.

Moreover, Twitter's weighted sentiment on Ripple has seen a collapse from 5.04 to 1.92, suggesting that the remittance token’s hype has subsided. Therefore, this slump sets up the stage for a spike in XRP price from a counter-sentiment perspective.

XRP Twitter weighted sentiment, BitMEX funding rate chart

While everything seems to be looking for XRP price, a breakdown of the ascending parallel channel’s lower trend line at $1.70 could put the bullish narrative at risk.

A decisive 4-hour candlestick close below $1.67 will signal the start of a new downtrend. In such a scenario, the Ripple price might drop 12% to $1.45.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.