XRP Price Prediction: Ripple bulls face extinction as profit-booking intensifies

|

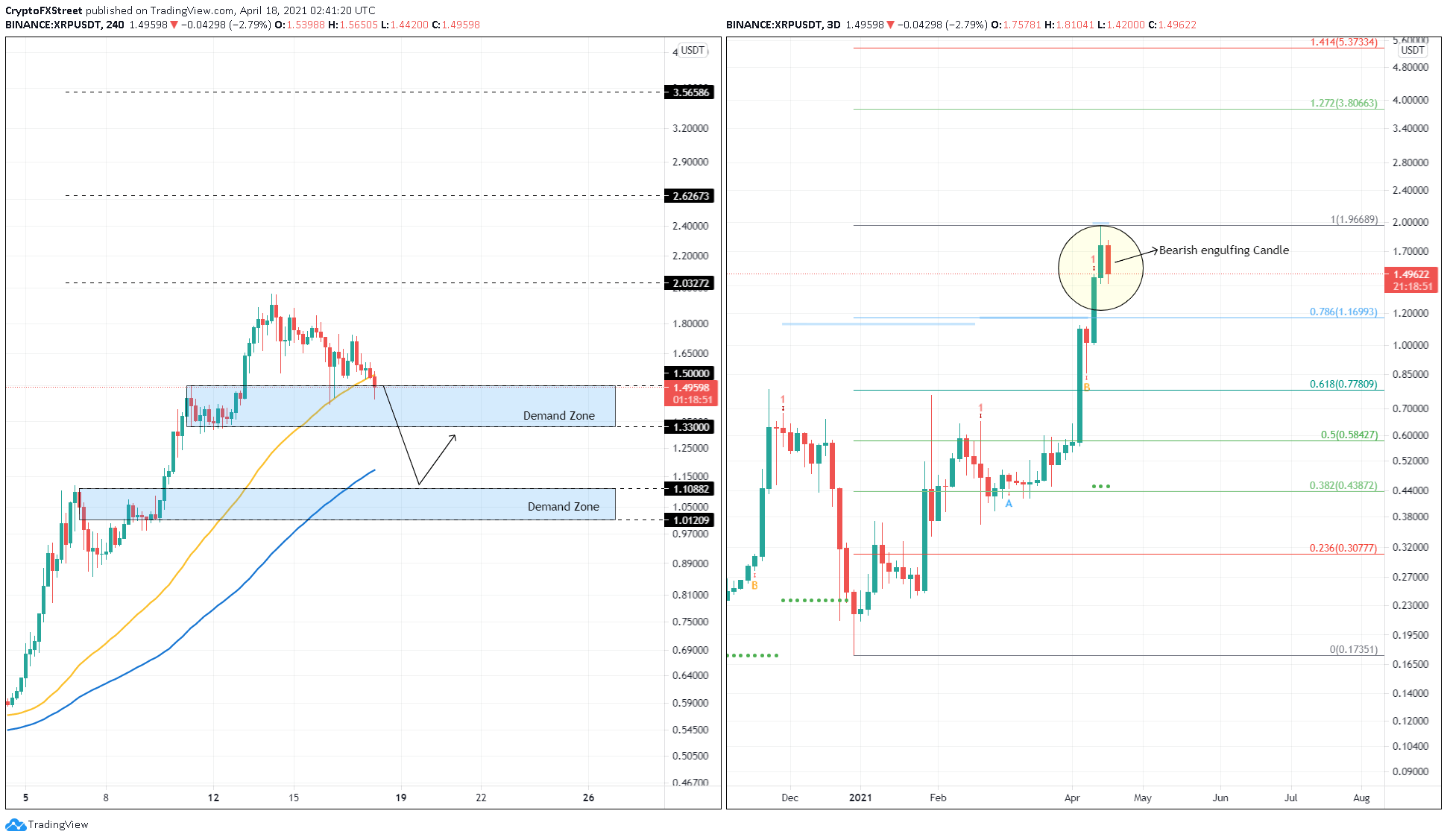

- XRP price is moving toward the immediate demand zone ranging from $1.33 to $1.50.

- This decline since April 14 suggests a weakening bullish momentum that could drive Ripple toward the next support area.

- A bounce from either of the zones seems plausible, but if sellers shatter $1.01, investors could expect an extended downtrend.

XRP price is slowly pulling back after setting up new yearly highs. As Ripple tries to establish a base, an accumulation could lead to the next leg up, but distribution, on the other hand, could evolve the correction into a crash.

XRP price prepares for the next volatile move

XRP price saw an explosive run-up from $0.63 to $1.96, which may have triggered market participants to book profits, leading to a slow downtrend. As seen on the 4-hour chart, Ripple is currently trading above the first demand zone that ranges from $1.33 to $1.50 but below the 50 four-hour Simple Moving Average (SMA).

A bounce from this level to retest the recently erected local top at $1.96 is possible but unlikely. On the 3-day chart, XRP price shows a bearish formation where the current red candlestick is engulfing more than 75% of the previous green candlestick’s body, suggesting lower prices to come.

This setup adds to the profit-booking thesis.

Hence, if the sell-off intensifies, XRP holders can expect a solid retracement to the lower demand area that stretches from $1.01 to $1.10.

All in all, XRP price looks bearish in the short-term and could test the 100 four-hour SMA at $1.16, which interestingly coincides with the 78.6% Fibonacci retracement level on the daily chart.

XRP/USDT 4-hour/3-day chart

On the other hand, if the buyers rescue XRP price from the first support barrier and produce a decisive close above $2.03, it would invalidate the bearish outlook. If this were to happen, a 30% upswing to $2.62 seems likely.

If the buyers persist, then bulls can target a new all-time high at $3.56.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.