XRP price pauses in the relentless pursuit of the all-time high

|

- XRP price stalls at the psychologically important $2.

- Coinshares launches XRP exchange-traded product.

- Securities and Exchange Commission (SEC) war on Ripple losing basis.

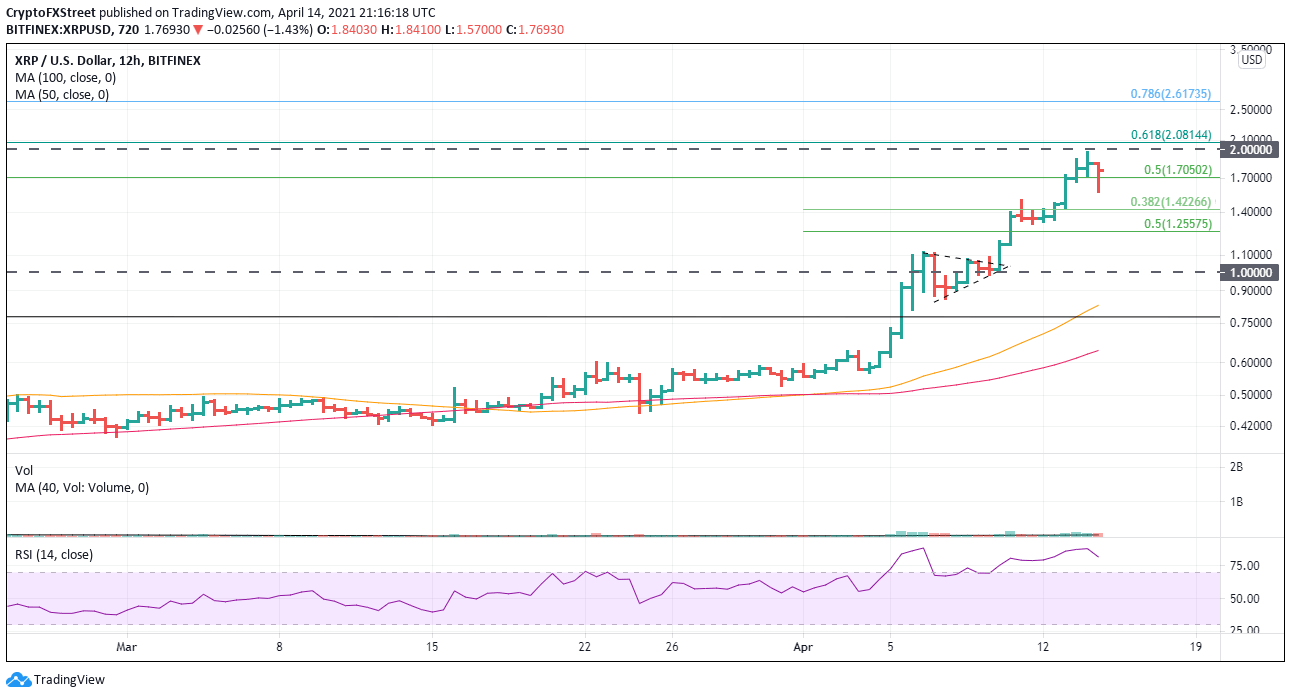

XRP has climbed over 360% over the last five weeks, from the low to its high, and is on pace to close with the second-best month since inception with a current gain of 200%, and it is up over 700% from the lowest price level this year. With all the euphoria that has followed the price action and the underlying deterioration in the SEC case against Ripple, it is easy to overlook the charts. Still, they are arguing for at least a short-term consolidation.

XRP price supported by multiple large transfers of the coin

Coinshares, a digital investment firm, announced yesterday that it would launch an exchange-traded product (ETP) following the performance of XRP. The new product will be listed on the government-regulated SIX Swiss Exchange and will be physically backed as each unit will be worth 40 tokens at the beginning. The ETP will carry a total expense ratio of 1.50%, and the base currency will be the USD.

It is a bullish statement by Coinshares considering the lingering legal battle with the SEC. This once again shows that Ripple resonates with companies and investors outside of the United States. Townsend Lansing, head of ETPs at CoinShares, concurs when he remarked, “once we determine that a professional-caliber product is feasible, and it appears that demand exits to make a liquid market for trading the product, we bring the product to fruition.”

At today’s high, Ripple’s daily chart is showing that the Relative Strength Index (RSI) did not confirm price, creating a mild bearish momentum divergence. On a weekly basis, the RSI is near the reading registered at the November 2020 highs.

If the weakness today evolves into a consolidation or even a correction, it should garner heavy support at the 38.2% retracement of the rally beginning on April 1 at $1.42. Weakness below that level would dampen the bullish outlook and delay a successful break of $2 into May or later.

XRP/USD 12-hour chart

As noted, $2 will be an obstacle just like $1, but with the 61.8% retracement in close vicinity at $2.08, it may prove more challenging. The next upside target is the 78.6% retracement at $2.62.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.