XRP begins short squeeze as bear trap to return Ripple to $1

|

- XRP price action develops an effective bear trap.

- Short sellers and weak hands will experience some significant pain as XRP rallies.

- Extremely bullish Point and Figure pattern present a 6:1 reward/risk setup.

XRP price has experienced some major selling over the past six trading days. Sellers have promptly sold off Ripple upon hitting the $1 level, pushing XRP lower by as much as 20%. However, the bearish price action has developed into a powerful buying opportunity.

XRP price to rally more than 30% to the $1 value area

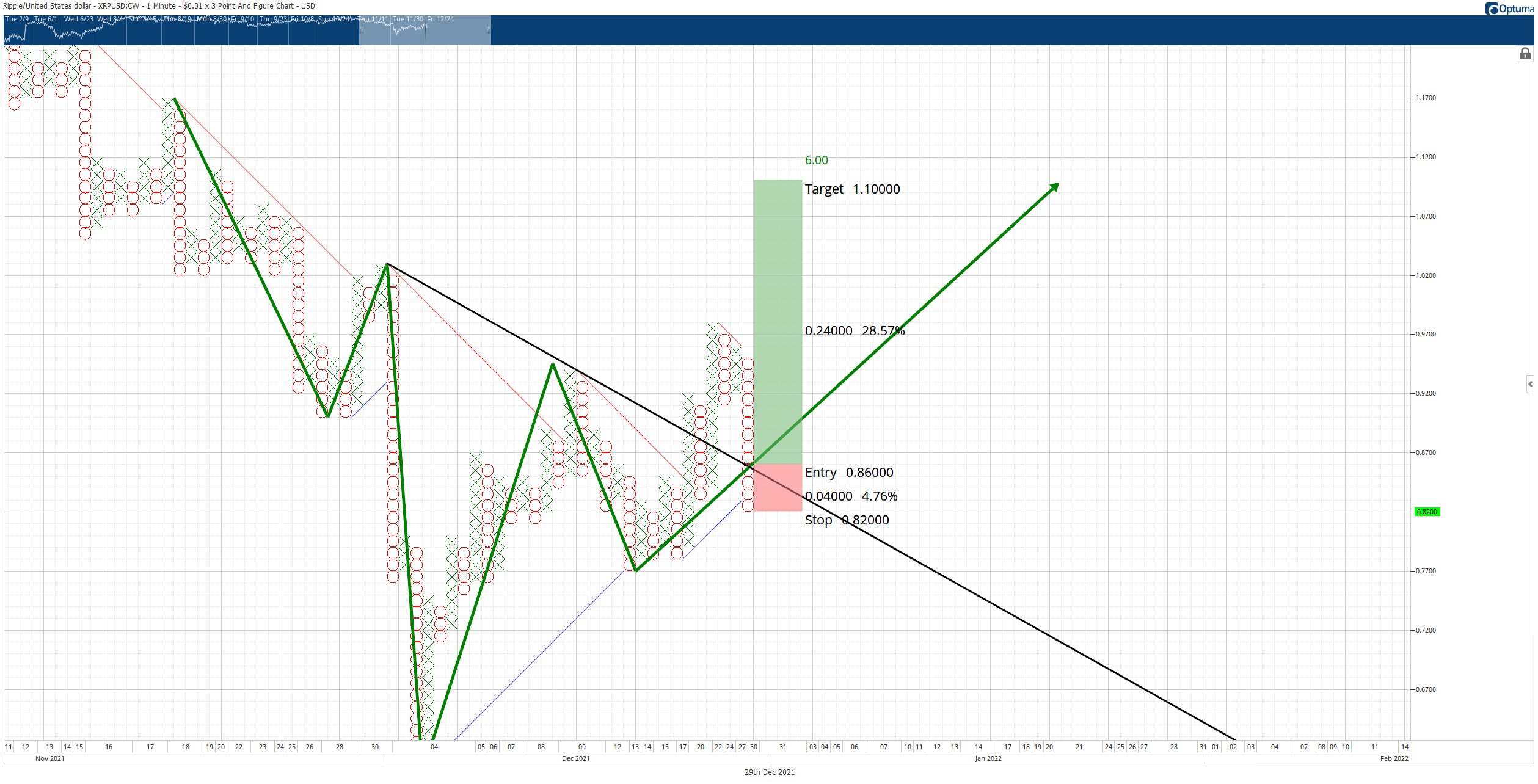

XRP price is currently testing the neckline breakout from a previous head-and-shoulders pattern on the $0.01/3-box reversal Point and Figure chart. The Point and Figure pattern that has developed is a Spike Pattern. The Spike Pattern is an aggressive reversal strategy with an entry immediately on the 3-box reversal of the current O-column.

The theoretical trade setup for XRP price is a buy stop order at $0.86, a 4-box stop loss at $0.82, and a profit target at $1.10. This trade setup represents a 6:1 reward for the risk. In addition, a two to three-box trailing stop would help protect any implied profit post entry.

The buy stop order is at $0.86 at the time of publication, but the current O-column could move lower. If that occurs, then the entry and the stop loss also move lower. For example, if XRP price moves three more Os lower to $0.79, the buy stop order would shift to $0.82 and the stop loss to $0.79. The profit target remains the same.

XRP/USDT $0.01/3-box Reversal Point and Figure Chart

There is no invalidation setup for the theoretical long trade setup. By their very nature, Spike Patterns have no known low or high until a reversal occurs. Diligent traders should anticipate resistance or momentum slowing when XRP price retraces roughly 50% of the O-column.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.