XLM Price Prediction: Stellar retreats toward bottom of consolidation channel

|

- XLM continues to fluctuate in four-week-old horizontal range.

- Additional losses are likely with a daily close below $0.36.

- Near-term technical outlook remains neutral with bearish bias.

Stellar started the week in a calm manner but came under modest pressure ahead of the weekend and touched its lowest level in a month at $0.3412. Nevertheless, XLM staged a technical correction and seems to have settled below $0.40.

Stellar remains indecisive

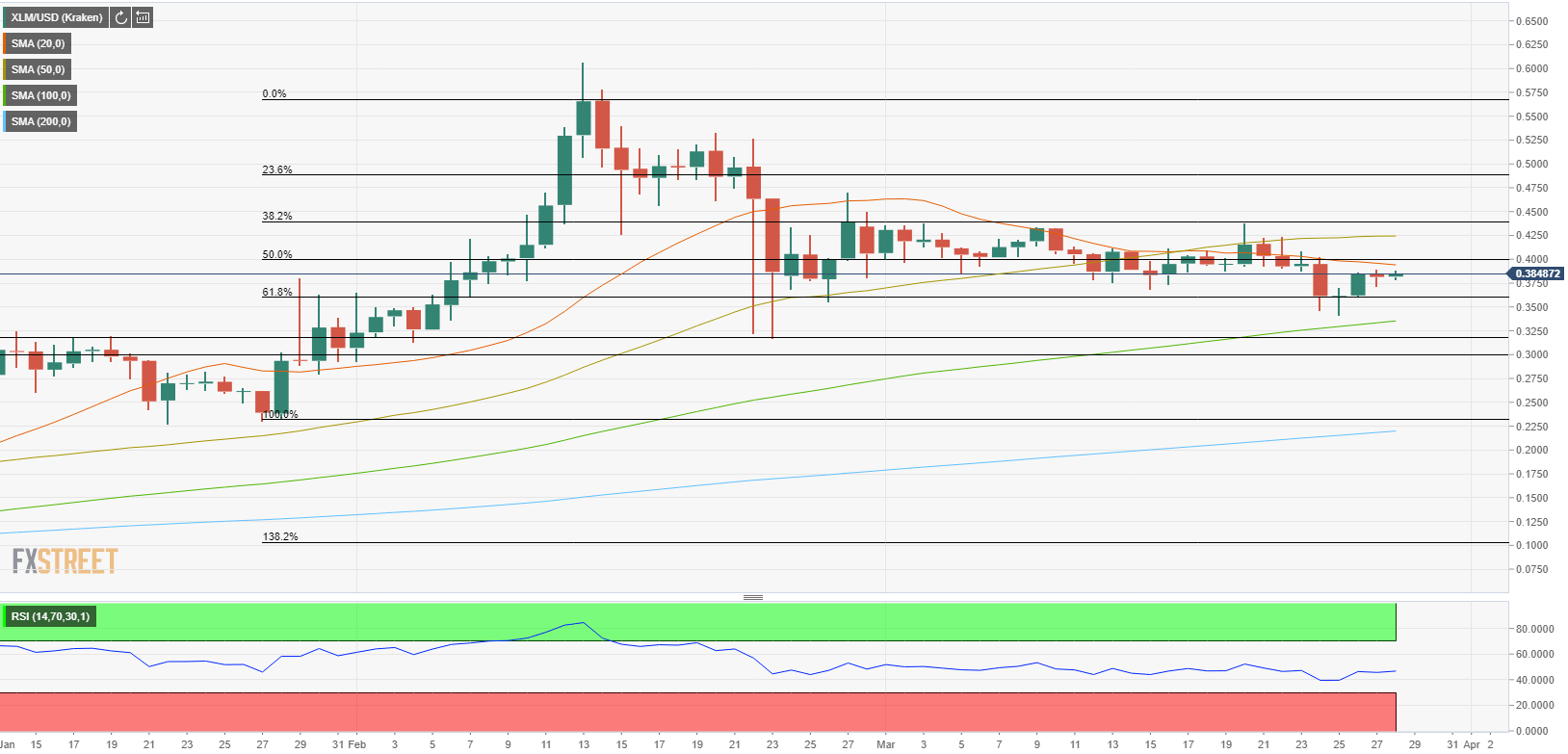

Despite the drop witnessed earlier in the week, Stellar continues to fluctuate in a four-week-old range and is having a difficult time making a decisive move in either direction. However, the price stays within a touching distance of the lower limit of this channel at $0.3600, which is reinforced by the Fibonacci 61.8% retracement of the Jan. 28 - Feb. 13 rally.

The 100-day SMA aligns as critical support at $0.3400 and a daily close below that level could trigger a technical selloff as it would be the first time since November and drag the price toward $0.3000 (psychological level).

On the other hand, several strong hurdles are located a little above the price, suggesting that a bullish shift in the technical outlook could be hard to come by. Initial resistance is seen at $0.4000 (20-day SMA, Fibonacci 50% retracement), ahead of $0.4250 (50-day SMA) and $0.4400 (Fibonacci 38.2% retracement).

Stellar one-day chart

Following this week's price action, Stellar preserves its neutral outlook with a modest bearish bias. A daily close below $0.3600 could attract more sellers, while a break above $0.4400 is required for XLM to continue to push higher.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.