Whales buy $1.4 billion worth of Chainlink amidst market-wide sell-off

|-637336005550289133_Small.jpg)

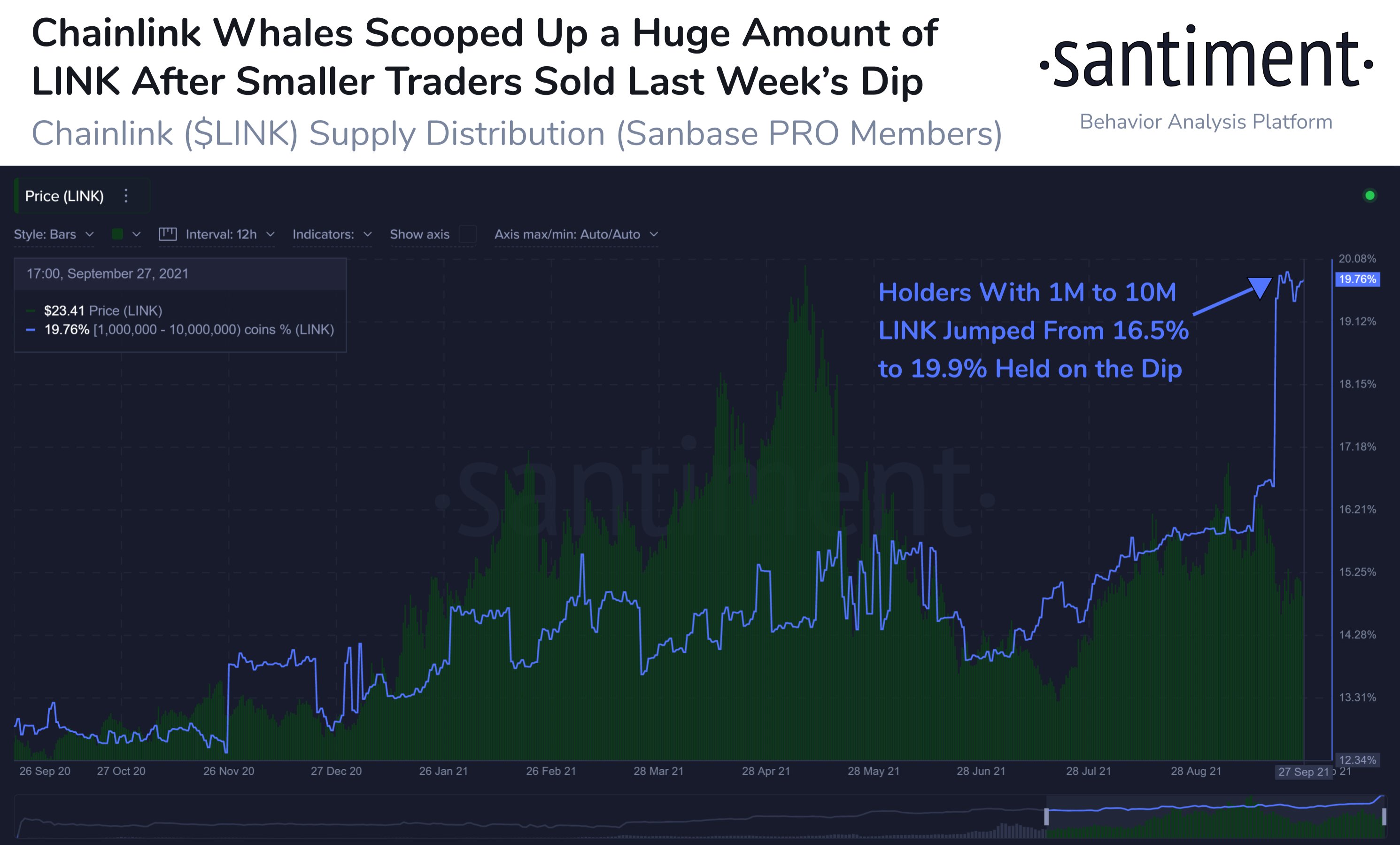

- Wallet addresses holding 1 million to 10 million LINK accumulated nearly 62 million tokens during the dip in price.

- In August 2021, large wallet investors accumulated LINK; however, the supply was redistributed soon after.

- Chainlink's recent partnership with Avalanche and Cardano is expected to boost the utility of LINK tokens.

A sell-off has historically followed the accumulation of the altcoin by large wallet investors. LINK whales are known to hold tokens for short periods. Another cycle of accumulation has kicked in with the purchase of $1.4 billion worth of Chainlink by whales.

Chainlink whales bought the dip, added 62 million LINK to their holdings

Large wallet investors have accumulated 62 million LINK tokens during the recent price drop. The accumulated tokens are equivalent to 3.4% of the total LINK supply. "Weak hands" – wallet addresses known to sell rather than hold cryptocurrencies – sold their LINK holdings.

The market-wide sell-off event was accompanied by whale accumulation. Addresses holding between 1 million and 10 million LINK added 62 million tokens to their holdings.

Chainlink (LINK) supply distribution

Previously in August 2021, Chainlink whales had accumulated LINK tokens; however, these investors shed their holdings soon after.

Crypto behavior analytics platform Santiment has observed the unwillingness of large investors to hold LINK; therefore, the altcoin's supply gets redistributed among small wallet investors.

Shedding their LINK holdings is a natural response to the altcoin's volatility. Since the first week of September, there has been a consistent drop in LINK price.

Analysts expected Chainlink's recent partnerships with Avalanche and Cardano to trigger a rally in the altcoin's price. However, despite the announcement of the partnership on September 25, LINK has failed to recover.

A pseudonymous cryptocurrency analyst at an investment firm with the Twitter handle @EffortCapital expects Chainlink to rally. The analyst believes that the Oracle network is the next stop of capital rotation after layer-1 solutions.

I can see Oracles being the next rotation after L1s are done pumping$LINK is the only answer.

— D (@EffortCapital) September 24, 2021

I can see Oracles being the next rotation after L1s are done pumping$LINK is the only answer.

— D (@EffortCapital) September 24, 2021

Michäel van de Poppe, CEO and co-founder of Eight Global, considers LINK significantly undervalued. The analyst's opinion resonates with @EffortCapital's expectation of a bull run in LINK.

#Chainlink is a very undervalued #crypto.

— Michaël van de Poppe (@CryptoMichNL) September 25, 2021

#Chainlink is a very undervalued #crypto.

— Michaël van de Poppe (@CryptoMichNL) September 25, 2021

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.