Uniswap Price Prediction: UNI is breaking out as bulls target $4

|

- UNI is ready for a short-term bullish breakout from an ascending triangle.

- Uniswap's token sits on top of a strong support area.

UNI, the token of Uniswap – the largest DeFi project by the total value locked – is ready to break free from an ascending triangle pattern on a short-term time frame. At the time of writing, UNI/USD is changing hands at $3.73. The coin has recovered from the December 1 low of $3.38; however, it is still down 5.6% on a day-to-day basis.

Uniswap bulls test the triangle for strength

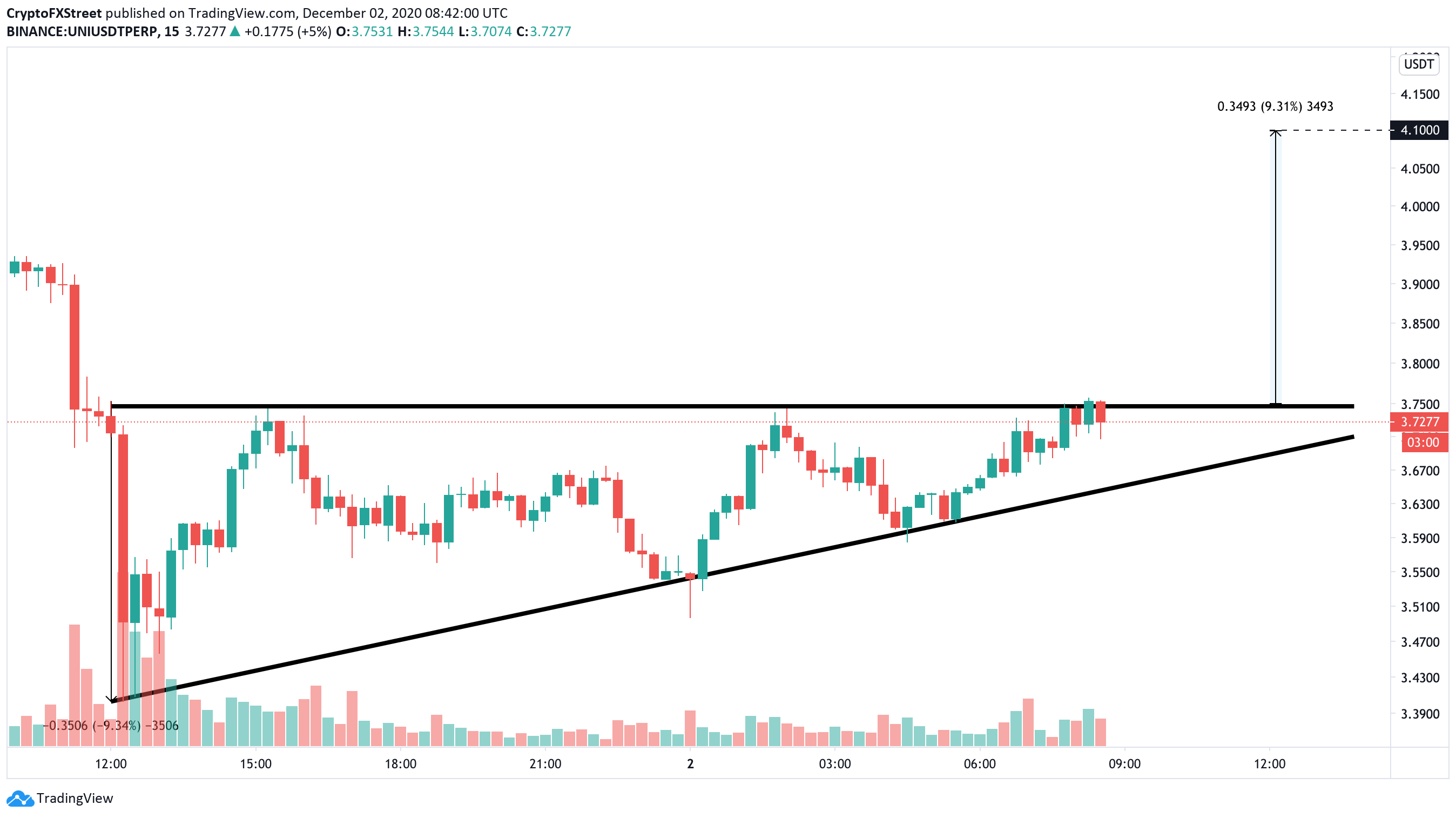

The Uniswap's recovery attempts seen over the past few hours led to the formation of an ascending triangle on its 15-min chart. The swing-highs created a horizontal resistance barrier at $3.75, while the support comes in the form of a rising trendline created along with the swing-lows.

UNI/USD 15-min chart

If the upside pressure continues building up around the current levels, UNI may break above the upper line of the ascending triangle pattern and extend the upside momentum towards the next crucial area of interest to approach the psychological barrier of $4. This target is determined by measuring the distance between the widest point of the triangle and adding it to the breakout point and represent a 9% increase.

UNI's In/Out of the Money Around Price (IOMAP)

In/Out of the Money Around Price (IOMAP) model reveals that over 4,000 addresses bought over 32 billion UNI around on approach to $3.92, making this area a hard nut to crack for the bulls. Once it is out of the way, the upside is likely to gain traction with the next focus on $4.1 as defined by the technical model, followed by $4.2

On the downside, UNI sits on top of strong support created by the IOMAP cohort of 2,600 addresses with over 56 million tokens purchased on approach to $3.5

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.