TRON Market Update: Network’s utility increases, TRX prepares for a massive price movement

|

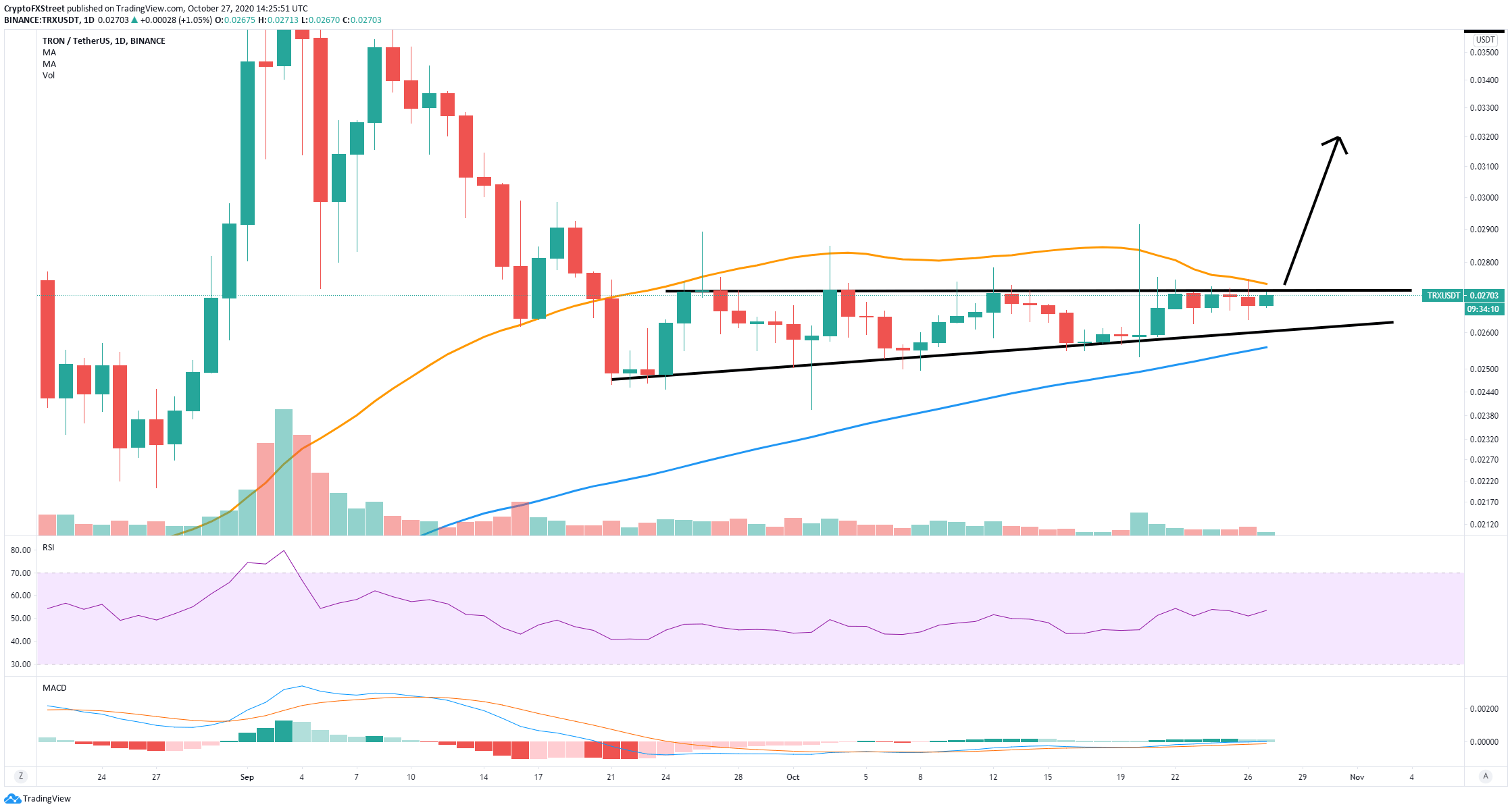

- TRX is currently trading at $0.0271 inside an ascending triangle pattern.

- The latest TRON weekly report is out with positive news for TRX holders.

TRON's weekly report has been released, giving some information about the finalization of the TRC-20 shielded contract on the mainnet and a security test for the smart contract on TVM instructions to stake and unstake.

Major cryptocurrency exchanges like HBTC and MXC have enabled deposits and withdrawals of the TRON-based BTC token (TRC-20 BTC). Justin Sun, the founder of the cryptocurrency platform TRON and current CEO of BitTorrent, also recently announced the acquisition of blockchain streaming platform DLive.

Several indicators show TRX is ready for a significant price move

Although the TRON foundation has released several positive announcements over the past few weeks, TRX has continued trading sideways inside an ascending triangle pattern formed on the daily chart.

TRX/USDT daily chart

The upper trendline at $0.0272, which coincides with the 50-SMA, is acting as a robust resistance level that bulls need to break. The MACD has remained bullish since October 9 and seems to be gaining some momentum again.

Additionally, the Bollinger Bands are incredibly tight at the moment, with the upper band also acting as resistance. A breakout above the pattern's upper boundary can drive the price of TRX up to $0.032.

Rejection from $0.0272 can be a strong bearish sign

At the same time, another rejection from the critical resistance level at $0.0272 can be a strong sell signal. On the 12-hour chart, the 100-SMA coincides with the upper boundary of the ascending triangle pattern.

TRX/USDT 12-hour chart

The MACD seems to be on the verge of turning bearish as the price approaches the resistance level. The bearish price target would be $0.026 and as low as $0.021, which is the 100-SMA on the daily chart.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.