Top 3 price predictions for Bitcoin, Ethereum & Ripple: dangerous game being played with key technical levels

|

- Yesterday's critical levels held thanks to the rise of buyers during the American session

- Some buying interest is out there despite the subdued technical outlook

The main Cryptocurrencies are holding above critical levels in the analyzed assets despite the tension still being high, as key price areas that were lost this week have not been recovered. Uneasiness is all around.

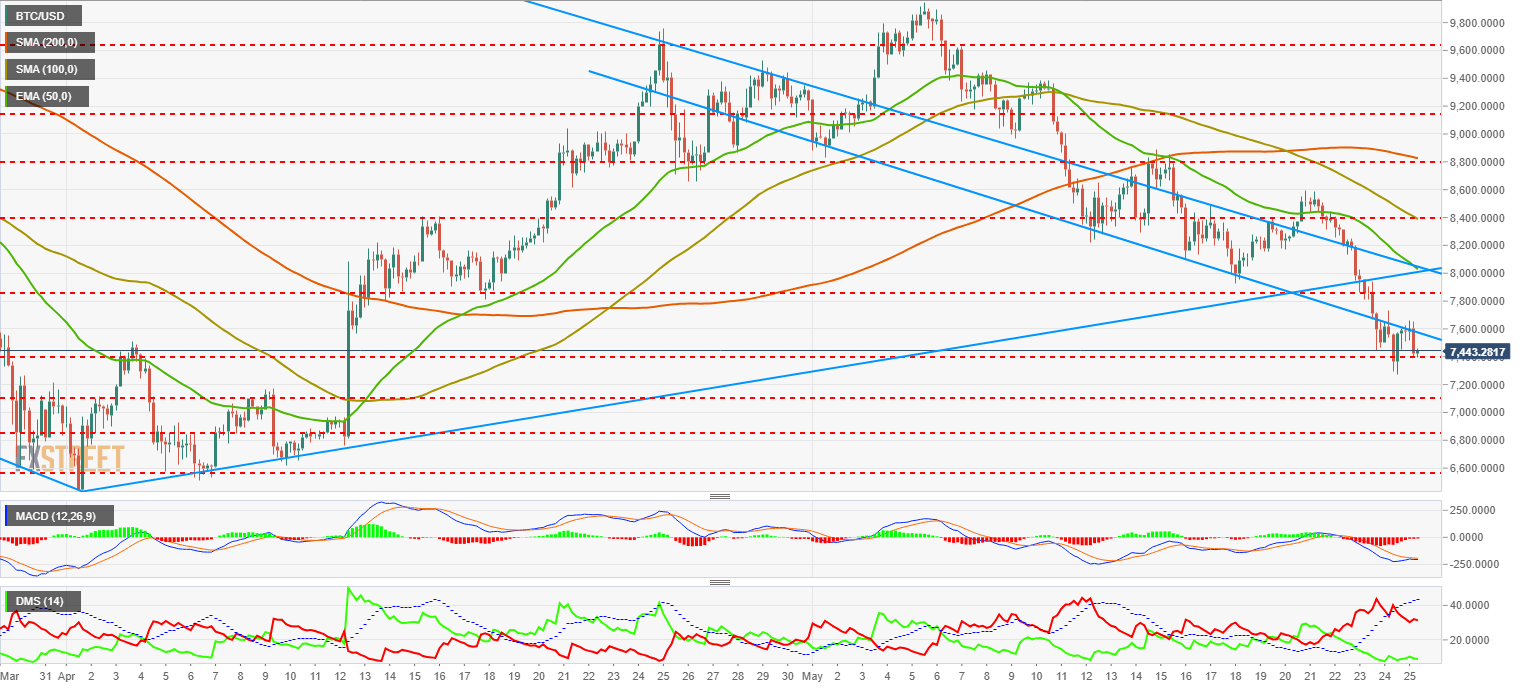

BTC/USD 4H chart

Bitcoin left its session low at the $7275.5 mark after a bullish run that gave validation to the base of the bearish channel that is currently acting as a price resistance. BTC/USD recovered in the action the $7400 support and such level is where it is trading at the time of writing this article. This is a good position for a bullish attempt although, as we will see in the indicator analysis, this bullish move doesn't have the steam that we might expect.

On the upside, the resistance levels pointed yesterday are staying in play, with slight variations. As we have been seeing in the latest articles, there are multiple resistances that Bitcoin needs to beat if it wants to come back to January levels: $7540, $7850, $7985, $8040, $8400, $8600 and finally at the 200-SMA, the $8800 mark.

On the other side, the first meaningful support is at yesterday's lows ($7825), followed to the downside by a key price resistance at $7110. If that last level is lost, the $6850 awaits.

MACD in the Bitcoin 4-hour chart is showing the formation of a "MACD failure" pattern, being developed in the first hours of the European session. The pattern demands the price falls that we are witnessing besides an increase of volatility, so it is quite probable that we might see some bearish aggressiveness in the next hours.

Directional Movement Index in the same chart is showing how sellers keep losing strength while buyers are increasing, although slightly, as price keep falling. ADX is losing inclination and supports the possibility of a change of direction in the mid-term.

ETH/USD 4H chart

Ethereum is strengthening against Bitcoin in the early European trading, following a typical bullish technical move after a trend breakout. On the mid-term, we expect the Bitcoin to continue outperforming Ethereum.

ETH/USD has traded to the upside like its Crypto siblings, but it has not retraced during the first hours of today's trading. Ethereum is still just below the trendline that held it during its bullish run, and a new bullish leg would take Ethereum back immediately to a much more positive territory for more bullish attempts.

On the upside, there are less technical barriers for Ethereum than for Bitcoin to break. ETH/USD needs to break and close above the $608 to then face some resistances in the $620, $652, $693 levels, with a super-tough resistance at the $700 mark, where a price congestion and the 200-SMA collide.

On the downside, yesterday's support was able to hold the bears and it is still key for the outlook of Ethereum. There remains a slight support at the $520 mark, with a last key price level below this year's lows at $485.

MACD in the Ethereum 4-hour chart is crossed to the upside, although this has not been accompanied by more rises. The most probable pattern after the cross will be a confirmation on the lower side that should happen at the same time that the BTC/USD indicator cross.

Directional Movement Index in the same chart is showing buyers rising considerably, while sellers are retreating. ADX is finally losing the bullish inclination, pointing to a loss of steam in the bearish run.

XRP/USD 4H chart

XRP/USD is facing a different technical situation than the two Crypto giants just analyzed. Ripple has just escaped from the extremely strong bearish trends and seems to consolidate the change of direction in an expansive triangle area. If the Crypto bulls keep their foot on the pedal in the upcoming sessions, XRP/USD should definitely go back to a bullish technical setup.

On the upside, XRP/USD is facing multiple resistances, first at $0.631, then at $0.638 and $0.655.

MACD in the Ripple 4-hour chart is crossed to the upside and is showing the path that ETH/USD will most likely take. A confirmation of the cross to the upside is needed for more rises.

Directional Movement Index in the same chart shows also that buyers reacted strongly yesterday but lost some interest after finding the resistance level. Sellers retreat during the bullish leg to then go back to action once $0.635 was reached.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.