Top 3 Price Prediction Bitcoin, Ethereum, XRP: Crypto markets test new higher lows before moving higher

|

- Bitcoin price tests prior congestion zone as support.

- Ethereum price continues to push below $3,000, threatening to hit 2022 lows.

- XRP nose dives over 10% before bouncing off of its final Ichimoku support level.

Bitcoin price fell below the Ichimoku Cloud over the weekend and extended its losses to sub $40,000 for the first time since early February. Likewise, Ethereum price dropped below key Ichimoku support levels over the weekend before hitting a critical support zone to close out Monday’s session. Finally, XRP bears attempt to wrest control from bulls and move below the $0.70 value area.

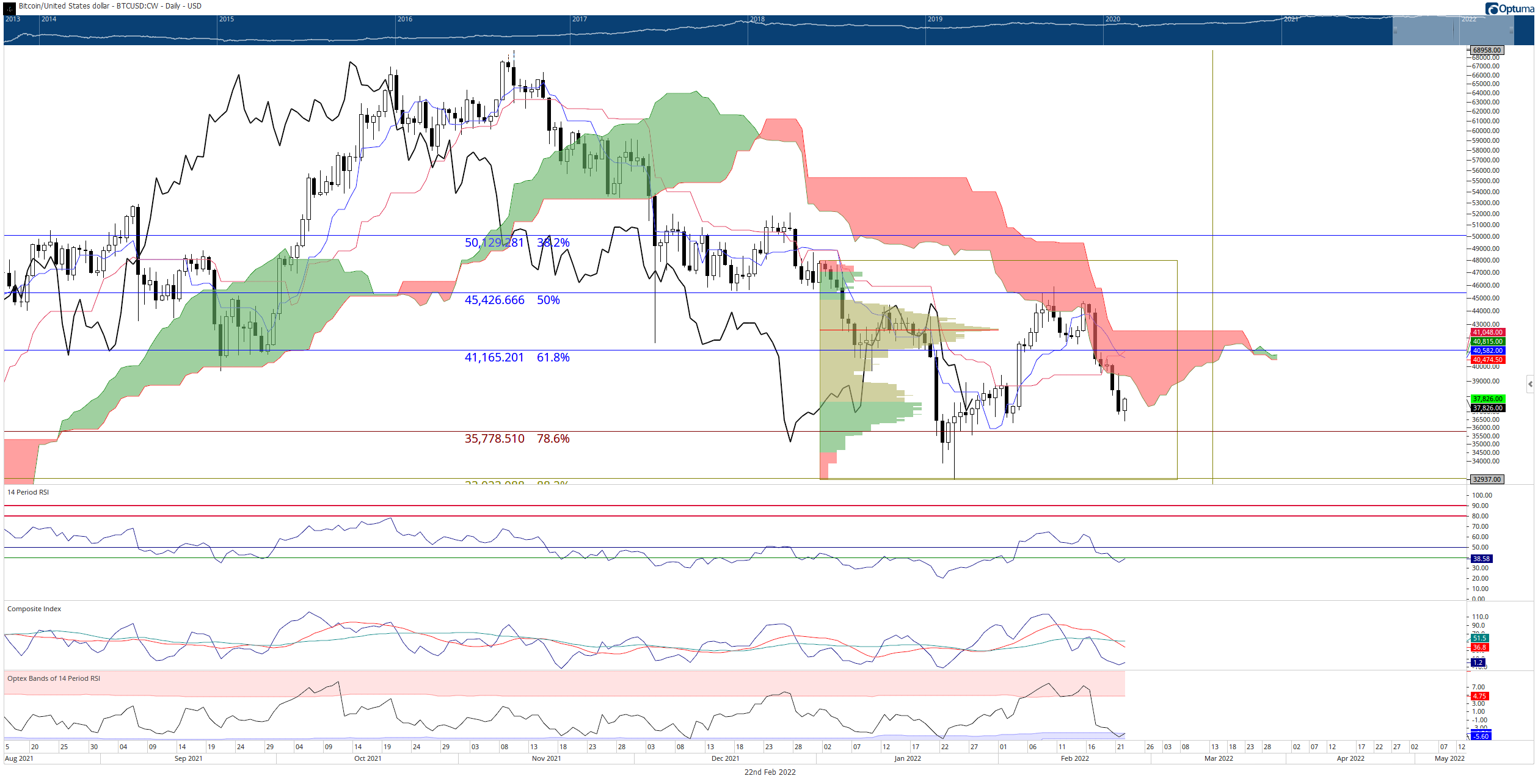

Bitcoin price finds a bottom, return to $40,000 likely

Bitcoin price has suffered some significant bearish pressure along. Risk-on markets across the globe continue to feel pressure due to Russia’s invasion of Ukraine.

Since last Tuesday (February 15, 2022), Bitcoin has dropped from a swing high of $44,760 to a swing low of $36,400 – nearly a 20% drop in a week. Whether the news or standard technical analysis behavior is to blame, BTC nonetheless returned to test a former resistance level as support – so far, it has held.

Bulls are likely to take over and push Bitcoin price back inside the Ichimoku Cloud to test the 61.8% Fibonacci retracement at $41,160 as resistance. Ultimately, bulls will need to return Bitcoin above the Ichimoku Cloud (Senkou Span B) to return BTC to a full-on bull market. A daily close above $42,685 would position Bitcoin into an Ideal Bullish Ichimoku Breakout, leading to moves beyond $50,000 and into the $60,000 value areas.

BTC/USD Daily Ichimoku Kinko Hyo Chart

However, downside risks are significant. If bears push Bitcoin price to a close below $36,500, then new 2022 lows and even a retest of the 2021 lows at $28,500 is almost a certainty.

Ethereum price hits strong Fibonacci support near $2,500

Ethereum price has suffered the same selling pressure experienced by Bitcoin and the broader cryptocurrency market. Like Bitcoin, Ethereum has lost more than 20% since last Tuesday – but there is evidence of support and a new bottom developing.

The most important thing for bulls to accomplish is to stave off any further bearish momentum. This can be done by pushing Ethereum price to a close above the bottom of the Ichimoku Cloud (Senkou Span A). However, that may be a complicated task to pull off.

A close at or above $2.925 would return Ethereum price inside the Ichimoku Cloud, but to do so, buyers need to break four resistance levels all between $2,800 and $2.900: the Kijun-Sen, the Tenkan-Sen, Senkou Span A, and the 50% Fibonacci retracement at $2,900.

From there, the goal is to close above the 2022 Volume Point Of Control and the top of the Ichimoku Cloud (Senkou Span B) at or above $3,150. In that scenario, Ethereum price would complete an Ideal Bullish Ichimoku Breakout and trigger the entry necessary to retest $4,000.

ETH/USD Daily Ichimoku Kinko Hyo Chart

Bears have an easier road to put Ethereum price into some significant sell-off territory. A close below the bodies of the candlesticks, at or below $2,400, could trigger a sell-off that could push ETH down to $1,800.

XRP price selling pressure continues, but bulls defend

XRP price experienced some intense selling pressure on Monday. The 11% drop was the greatest suffered by a major cryptocurrency, yet XRP maintained some support structure where Ethereum and Bitcoin did not.

Monday’s price action saw XRP dive below three crucial Ichimoku support levels: the Tenkan-Sen, Kijun-Sen, and top of the Ichimoku Cloud (Senkou Span B). The most significant of these drops was the move below the strongest level of the Ichimoku system, Senkou Span B. Bulls kept XRP price above Senkou Span A despite the strong selling pressure.

With XRP price inside the Ichimoku Cloud, indecision is now the name of the game. While it may look like bears have an easier road to taking control due to the proximity of XRP to the bottom of the Cloud, their road is much more difficult. Until the Chikou Span closes below the bodies of the candlesticks, XRP remains within some significant support. Bears would have to push XRP price below the $0.70 and $0.60 zones to gain control.

XRP/USDT Daily Ichimoku Kinko Hyo Chart

On the other hand, Bulls need only return XRP price to a close at or above $0.79 to initiate a new bull run.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.