Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC crashes, markets follow suit

|

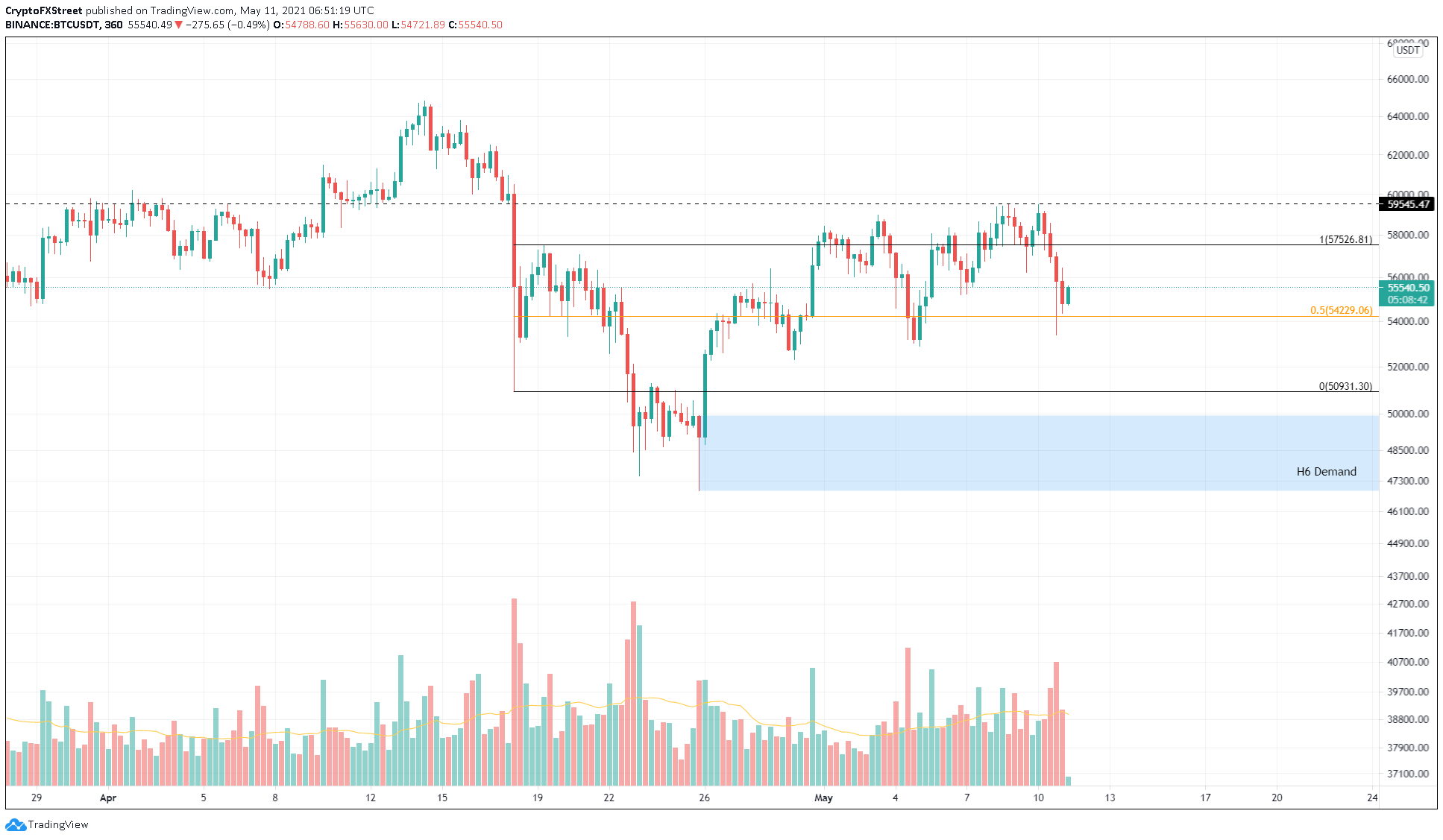

- Bitcoin price experiences a steep correction after failing to slice through the $59,545 resistance.

- Ethereum price respected the MRI’s sell signal and retraced 10% from its all-time high.

- XRP price slid below the 50 SMA at $1.426 and eyes a retest of the 200 SMA at $1.16.

The cryptocurrency market experienced a crash as the flagship cryptocurrency tumbled. Although some altcoins are recovering, Bitcoin price is still scrambling to find a support level and might trigger another sell-off soon.

In such a scenario, Ethereum and Ripple might promptly follow.

Bitcoin price remains indecisive

The 6-hour chart shows Bitcoin price has been experiencing trouble moving above $59,545. A rejection at this resistance wall has led to a 10% drop. The current recovery shows the absence of a stable support barrier, leading to a fake run-up, followed by a drop to $50,931.

Bitcoin price found multiple bid orders lined up here during the April 18 crash, which led to a quick upswing. Therefore, it is likely that the pioneer cryptocurrency will tag this level before it reverses.

Under extremely bearish conditions, it could test the demand zone that extends from $46,930 to $49,949.

Although undecided, a bounce from either of the areas mentioned above will lead to a 17% rally to $59,545.

BTC/USDT 6-hour chart

On the flip side, a breakdown of $49,949 will invalidate this bullish outlook and trigger a 4% downswing to $44,850.

Ethereum price eyes a minor downtrend

Ethereum price dropped 12% and is already on the road to recovery after gaining 2% since. However, similar to BTC, ETH might retest the 78.6% Fibonacci retracement level at $3,724 again.

Since BTC is not done dropping yet, investors can expect the altcoin pioneer to follow the flagship cryptocurrency and retest the 61.8% Fibonacci retracement level at $3,565. Interestingly, this point coincides with the 50 six-hour Simple Moving Average (SMA). Hence, an upswing that results from a test of this area will most likely push Ethereum price to retest its recent high at $4,208.

ETH/USDT 6-hour chart

Regardless of the bullish outlook, Ethereum price has seen a massive surge and might be overbought. Therefore, a breakdown of the support at $3,565 will invalidate the short-term bullish outlook and trigger an 8% correction to $3,077.

XRP price starts recovery, but threat of downturn remains

XRP price is currently bouncing off the lower trend line of a demand zone that extends from $1.372 to $1.477.

Although Ripple sliced through this support barrier during the crash, buyers seem to have quickly scooped up the remittance token at a discount. Now, XRP price could surge 15% to test the resistance wall at $1.65, which has successfully put an end to Ripple’s rallies twice over the past week.

Therefore, investors need to exercise caution around this supply level.

A breach of this barrier will open up XRP price to a 7% run-up to the immediate ceiling at $1.769.

While this bullish narrative seems plausible, market participants need to keep a close eye on Bitcoin. As explained above, if BTC takes a nosedive, XRP price will most likely head to the demand zone that extends from $0.941 to $1.156.

After taking a brief stroll in this area, an upswing might attract more sidelined buyers and propel XRP to the levels mentioned above.

XRP/USDT 6-hour chart

However, if Ripple produces a decisive close below $0.941, it would eradicate any hopes of an upswing. If this bearish scenario were to evolve, XRP price could slide 6% to $0.886.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.