Top 3 Price Prediction Bitcoin, Ethereum and Ripple: BTC/USD fights to close the week above $7,000

|

- Bitcoin price retreats from highs close to $7,300 but the bulls contain the price above $7,000.

- Ethereum is among the best weekly performance with gains targeting $200.

The weekend has been eventful where Bitcoin initially corrected towards $7,500 after containing gains above $7,000. As reported on Saturday most of the digital assets were in the green especially for the top three coins; Bitcoin, Ethereum and Ripple. Ethereum advanced towards $200 but its momentum fizzled out under $190. On the other hand, Ripple attempted a break above $0.20, although very minor progress has been made beyond $0.20.

Bitcoin confluence resistance and support

Bitcoin price is fighting tooth and nail to close the week above $7,000 as it heads closer to its block reward. The volatility in the market has been increasing over the last few days especially after Bitcoin corrected upwards from the support around $6,400. At the time of writing, Bitcoin price is trading $7,169 after shedding 1.43% of its value on the day.

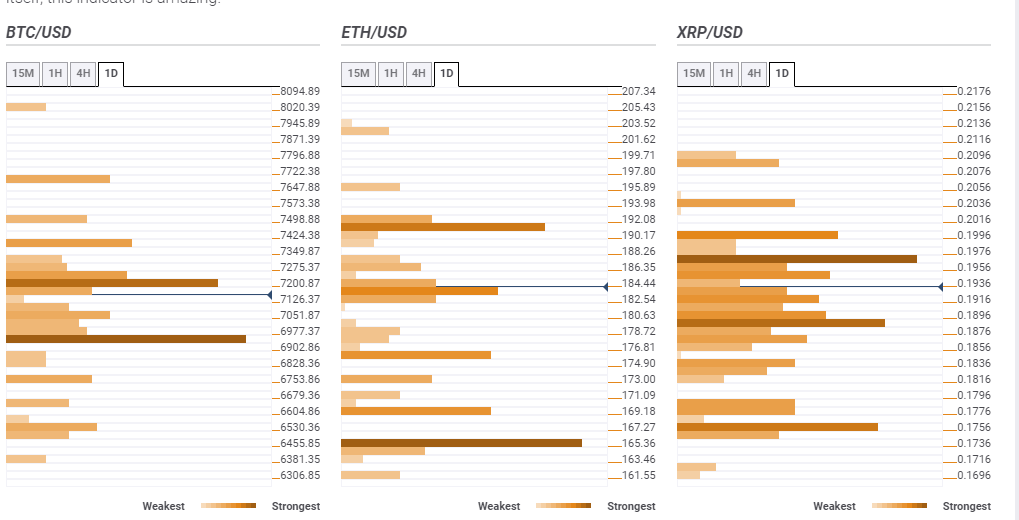

As far as confluence levels go, Bitcoin is facing initial resistance at $7,200 as shown by the previous high 15-minutes, the Fibonacci 61.8% one-month, the previous high 1-hour, the SMA ten 15-minis and the previous low 4-hour. All further upside correction will come face to face with more resistance at $7,424 as highlighted by the pivot point one-week resistance one, the pivot point one-day resistance and the Bollinger4-hour upper.

It is also apparent that the buyers’desire is to see Bitcoin close the week above $7,000. However, in case of a reversal, $6,977 will function as the initial support. This level is home to the pivot point one-day support two, the Bollinger Band 38.2% one-week and the SMA 200 1-hour.

Ethereum support and resistance levels

Ethereum is trading at $182 at the time of writing after losing 2.79% of its value on the day. The journey to $200 lost momentum under $190 with $188 as the intraday high. Meanwhile, the confluence detector place the first key resistance at $192. A region that holds the previous high one-day, the Fibonacci 61.8% one-month and the Bollinger Band 1-hour upper curve. On the downside, $176 happens to be the first support and where the previous week high and the pivot point one-day support one meet. In the event, bears extended their action under $170, $165 zone will come in handy.

Ripple support and confluence levels

The third-largest cryptoccurrency has also turned bearish after failing to break the resistance at $0.20. Beside the prevailing trend is strongly bullish amid high volatility. This means that XRP/USD could close the week trading under $0.19. The confluence detector places the initial resistance at $0.1976. This seller congestion zone is home to the 61.8% Fibo one-month, the previous week high and the previous high 4-hour. On the downside, support starts at $0.1876; the Fibo 38.2% one-week, SMA 200 1-hour, SMA 50 4-hour and the SMA.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.