SUI price at risk of decline with upcoming $15.88 million token unlock

|

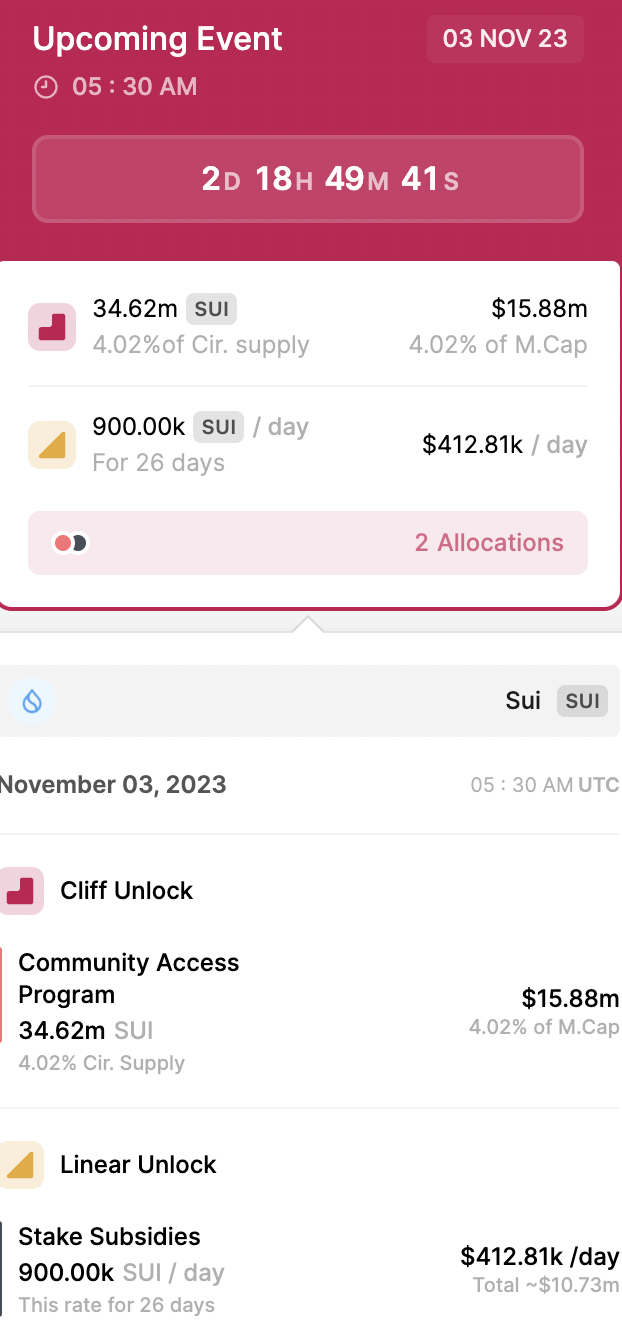

- SUI has a 34.62 million token unlock event lined up for November 3.

- With 4% of SUI token supply unlocked this week, the asset is likely to battle intense selling pressure.

- Though SUI fundamentals reveal bullish outlook, the Layer 1 blockchain token is at a risk of price decline.

SUI, a Layer 1 blockchain token, is gearing up for a $15.88 million token unlock event. Token unlock events are typically considered bearish for the asset as they increase selling pressure on the asset. SUI price is likely to decline with 4% of its supply entering circulation this week.

Also read: SEC to consider up to ten Bitcoin ETF applications as markets price in approvals

SUI token unlock scheduled for November 3

Based on data from the tracker token.unlocks.app, smart contract token SUI has an unlock lined up for November 3. 34.62 million tokens worth $15.88 million will be unlocked. Of the unlocked tokens, 34.62 million or 4% of the circulating supply will be assigned to the community access program.

Another 900,000 tokens are assigned to a linear unlock, for 26 days.

SUI token unlock

As the volume of SUI tokens in circulation increases, it contributes to rising selling pressure on the asset. SUI price climbed 7.92% over the past week, breaking out of its multi-month downtrend. The unlock event is set to trigger a trend reversal in the short term.

SUI fundamentals signal bullish strength

While the upcoming token unlock is likely a bearish catalyst for SUI, fundamentals hint at a long-term bullish outlook. In a recent tweet, SUI shared statistics like average daily volume and Total Value Locked (TVL).

The TVL of SUI has climbed consistently over the past month. SUI’s TVL hit $70.29 million, marking a milestone for the Layer 1 blockchain token. Higher TVL is indicative of rising popularity of the asset among market participants.

Average daily volume and TVL continue to soar on Sui, with TVL now at $70M!

— Sui (@SuiNetwork) October 28, 2023

The strong upward trend in TVL reflects a growing trust in the network.

Combined with the increased liquidity and depth of volume, it affirms that the Sui DeFi ecosystem is healthy and robust.❤️ pic.twitter.com/gq2BqJSjLy

Average daily volume and TVL continue to soar on Sui, with TVL now at $70M!

— Sui (@SuiNetwork) October 28, 2023

The strong upward trend in TVL reflects a growing trust in the network.

Combined with the increased liquidity and depth of volume, it affirms that the Sui DeFi ecosystem is healthy and robust.❤️ pic.twitter.com/gq2BqJSjLy

The second fundamental catalyst is SUI’s announcement of Atomic Wallet integration. Over 5 million Atomic Wallet users now have access to SUI token and its ecosystem, signaling growth in the Layer 1 blockchain protocol.

Here's a reason to celebrate this Monday: @AtomicWallet is now integrated with Sui. https://t.co/RsTvCl1Kxu

— Sui (@SuiNetwork) October 30, 2023

Here's a reason to celebrate this Monday: @AtomicWallet is now integrated with Sui. https://t.co/RsTvCl1Kxu

— Sui (@SuiNetwork) October 30, 2023

Despite bullish fundamentals, the technical outlook on SUI price is bearish.

Technical analysis: SUI holders brace for likely decline

SUI price is $0.4538 on Binance. After yielding nearly 8% gains over the past week, SUI is likely headed towards a pullback. As seen in the SUI/USDT one-day price chart below, SUI price is above its two long-term Exponential Moving Averages (EMAs), 10-day at $0.4422 and 50-day at $0.4487.

The Fair Value Gap (FVG) between $0.5531 and $0.5727 acts as a resistance for SUI price. In the event that SUI price crosses the resistance and the gap is filled, the token is likely to resume its downward trend.

The 10-day and 50-day EMAs at $0.4422 and $0.4487 are likely to act as a support.

SUI/USDT one-day price chart on Binance

The Fibonacci Retracement of the decline from SUI’s all-time high at $1.994 in May, to $0.4171 in mid-September marks support for the Layer 1 blockchain token in the event of a correction. If SUI price breaks down support at the 10-day and 50-day EMAs, the asset could hit the $0.4171 level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.