Solana price rally attracts former BitMEX CEO Arthur Hayes to SOL, here’s why

|

- Former BitMEX CEO Arthur Hayes admitted to buying Solana for the token’s recent price performance.

- Solana price yielded 88% gains over the past month, rallying alongside Bitcoin in October.

- SOL price rally resisted the bearish catalysts like FTX and Alameda’s Solana sale over the past few weeks.

Solana price climbed 88% over the past month. Bitcoin’s October rally fueled a bullish outlook among market participants, driving gains in altcoins like SOL.

While crypto influencers and retail traders have critiqued Solana for its association with bankrupt FTX exchange’s Samuel Bankman-Fried, former BitMEX CEO Arthur Hayes jumped in on the SOL wagon for the asset’s performance.

SOL price performance attracts crypto traders to Solana

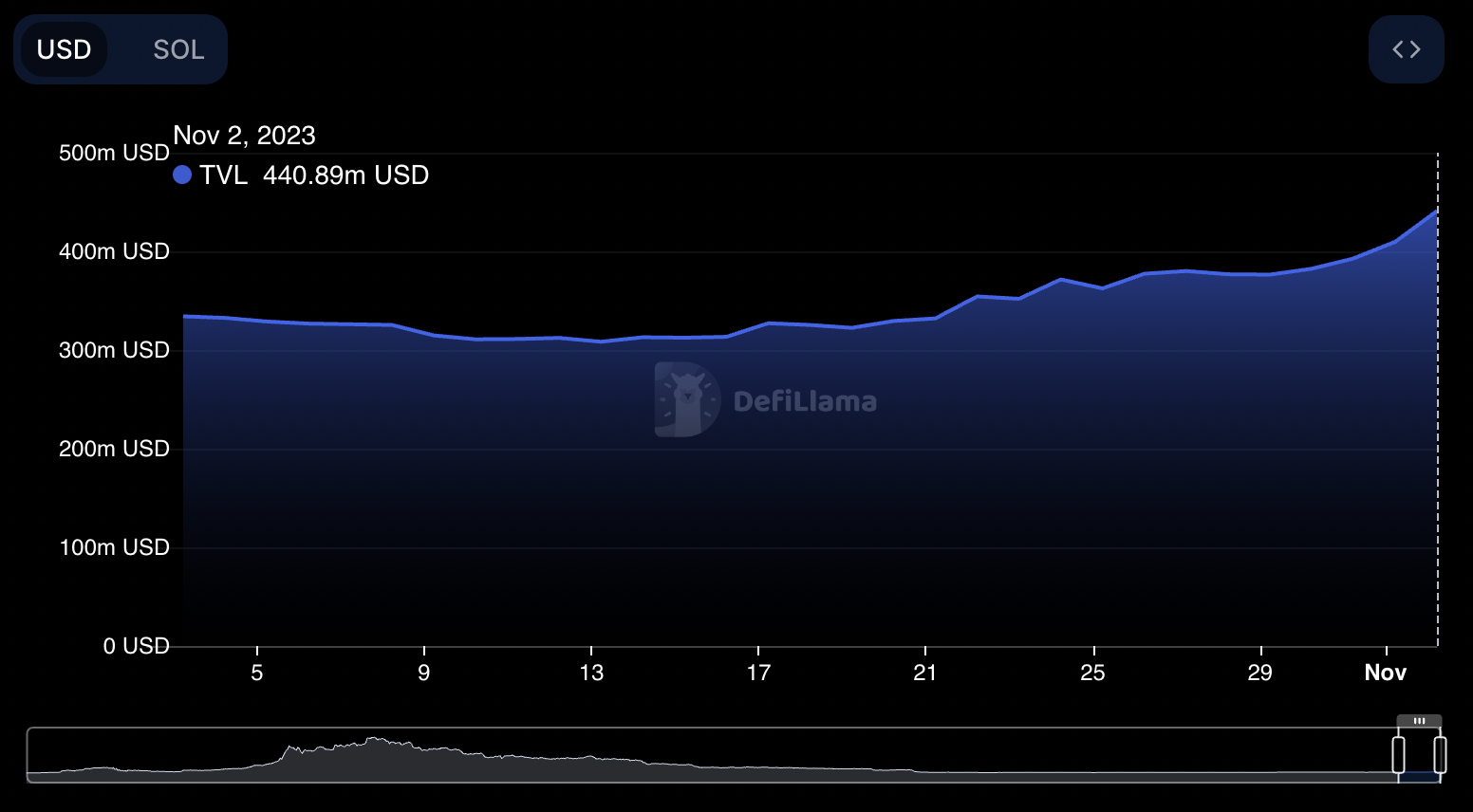

Solana price climbed 88% in the past month and 35% in the past seven days, on Binance. The Ethereum competitor has garnered the attention of retail traders, with its massive price action. Solana’s Total Value Locked (TVL) climbed nearly 32% between October 2 and November 2.

Total Value Locked in Solana as seen on DeFiLlama

The activity on Solana has increased, there is a 25% increase in daily active addresses and transactions, based on data from Santiment. The volume of daily trades climbed to highs previously seen in November 2022, when the bankrupt FTX exchange collapsed.

Former BitMEX CEO Arthur Hayes attributed Solana’s price action to his SOL purchase. The crypto community looks up to Hayes for identifying the most profitable positions in altcoins. Hayes’ move is therefore likely to influence his followers on X.

Fam I have something embarrassing I must admit.

— Arthur Hayes (@CryptoHayes) November 2, 2023

I just bot $SOL, I know its a Sam-coin piece of dogshit L1 that at this point is just a meme. But it is going up, and I'm a degen.

Let's Fucking Go!

Fam I have something embarrassing I must admit.

— Arthur Hayes (@CryptoHayes) November 2, 2023

I just bot $SOL, I know its a Sam-coin piece of dogshit L1 that at this point is just a meme. But it is going up, and I'm a degen.

Let's Fucking Go!

In its ongoing uptrend, SOL price resisted mass sell-off from FTX and Alameda and the ongoing litigation against Samuel Bankman-Fried. SOL price climbed to $43.64, at the time of writing.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.