Solana price has investors crunching 50% gains in prospect

|

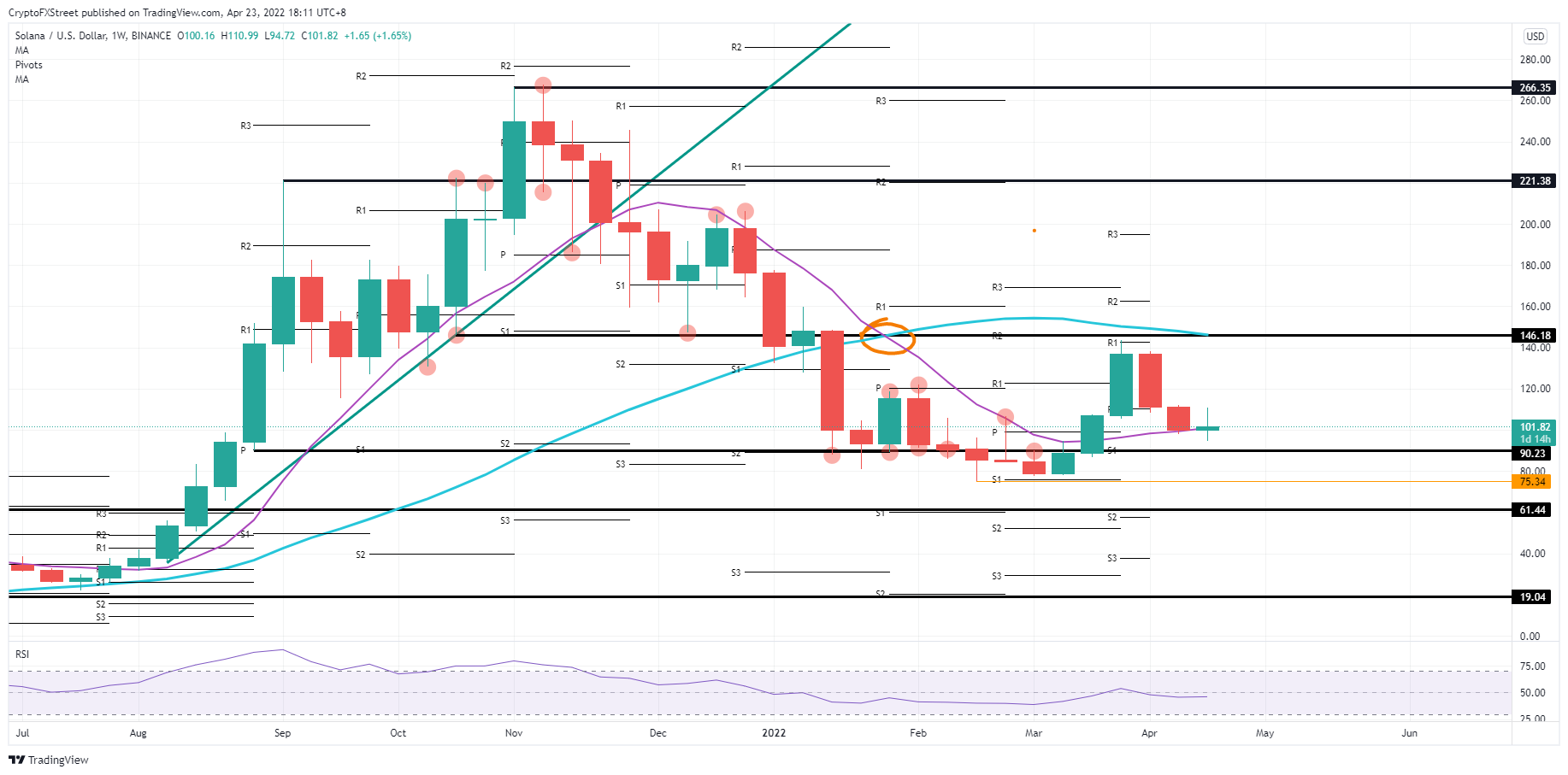

- Solana price sees bulls defending $90 with a technical handle as an anchor point.

- SOL price could be set for a rally of enormous magnitude, holding 50% gains.

- Expect to see tail risks diminishing over the weekend, offering a window of opportunity for SOL price to cover a large portion of ground to the upside.

Solana (SOL) price has been on the back foot for two consecutive weeks. Although the earning season is rocking the boat quite a fair bit, SOL looks set to eke out gains for this week, where a weekly close above the 55-day Simple Moving Average would be ideal. If investors can sit on their hands, SOL price could get pumped in a rally towards $146, holding 50% gains.

SOL price set to cut like a knife through butter towards $150

Solana price saw its rally in March, being almost wholly paired back in the first weeks of April. Bulls are planning, however, not to let it come that far. Eagerly defending $90.23, the 55-day SMA at $100 is being used as an anchor point where buyers and sellers are in a distribution phase, where bulls then get to sit on their hands and see price action ramp up higher with bears desperate to sell and looking for the highest price where finally some bulls are willing to sell.

SOL price thus is in a scenario that favours the bulls in this technical play. Even jumping in now for that trade still makes sense; with a stop below $0.90, a trader only has to give up roughly $10, and when SOL price rallies towards $150, your trading book will have made 50$ return in a 1-to-5 risk-reward ratio which is very lucrative. If the rally has much more legs beyond $150, it is doubtful that the death cross and the 200-day SMA at $146 will put a drag on the rally for the short term.

SOL/USD weekly chart

Solana bulls could get entrenched on that $90.23, with bears further shorting massively the price action. That could result in a long squeeze with bulls being stopped out, sell-side volume exploding and creating a nose dive move towards $75.34 or even $61.44, depending on the volume. Luckily the Relative Strenght Index is already below 40. Thus, not much room is offered for another downturn, as by then, the RSI will be trading in ‘oversold.’

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.