Solana loses $100 million in TVL over 24 hours after Lido bids farewell

|

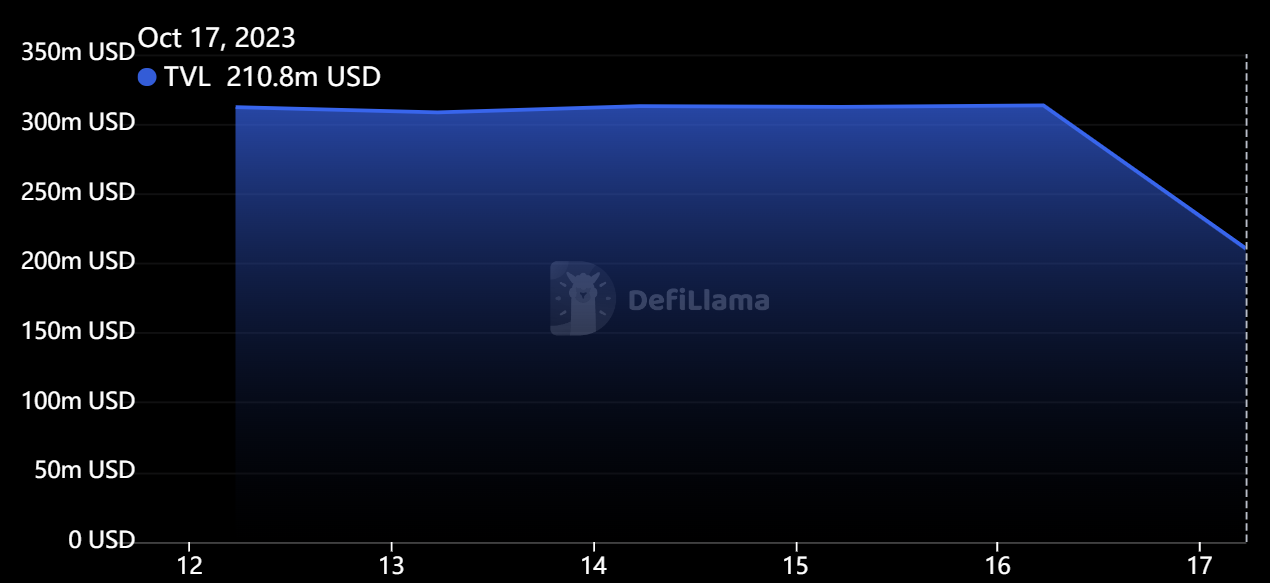

- Solana's Total Value Locked (TVL) experienced a drop of $100 million in a single day on Tuesday.

- Lido Finance, a liquid staking provider, announced its intention to discontinue on Solana.

- Solana's TVL decreased from $313 million to $210 million despite positive price action.

Solana's Total Value Locked (TVL) took a substantial hit on Tuesday, plummeting by $100 million in just one day. The steep decline follows liquidity staking platform Lido Finance's announcement that it will discontinue its services on the Solana blockchain.

Also Read: LDO sees lowest cumulative volume in ten months as Lido DAO price struggles to breach key barrier

Solana bids adieu to Lido

Lido Finance, a liquid-staking provider, made an announcement on Monday that confirmed their intent to discontinue services on the Solana network over the coming months.

Lido is the third largest among Solana protocols and has a presence on five chains, including Ethereum.

The decentralized application (dApp) noted that the decision was reached following discussions within the Decentralized Autonomous Organization (DAO) forum and a community vote. The statement said, "The sunsetting of the Lido on Solana protocol was approved by Lido token holders and the process will begin shortly."

The decision stemmed from a P2P Validator proposal that outlined Lido's challenges and future prospects on Solana.

The DAO discussed if they can continue Lido on Solana with the treasury's backing or discontinue it.

Following the discussion, users of Lido's staking services on Solana (stSOL holders) will reportedly receive network rewards throughout the discontinuation. stSOL holders can also unstake with Lido having shut down new stakes on Monday. It will begin node off-boarding on November 17 with the front-end support ceasing on February 4, 2024.

Solana TVL loses $100 million

Data from defiLlama reveals that Solana, which boasted a TVL of $313 million on October 16, saw that figure drop to $210 million on October 17.

The interesting bit is that Lido witnessed a positive TVL change in one day. The liquidity-staking dApp dominates around $56.4 million of Solana's entire TVL, but it has seen a positive 7% addition in the last 24 hours.

Solana's TVL decline coincided with Lido Finance's decision to sever ties with the platform. This comes despite Solana experiencing a positive price movement over the last 24 hours.

As of the time of writing, Solana (SOL) is trading close to $24, fluctuating within the $22 to $24 daily range. CoinGecko reports a 24-hour trading volume of $900 million, signifying a 9% price increase in the past day and a similar increase over the past week. With a circulating supply of 420 million SOL, Solana boasts a market cap of $9.9 billion.

The substantial loss of TVL on Solana has to be monitored as there are no other apparent factors to account for at the moment. This is especially true as Solana recorded a TVL increase over the last week despite a sluggish altcoin market. Its strong price action is a positive for the chain in the short term.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.