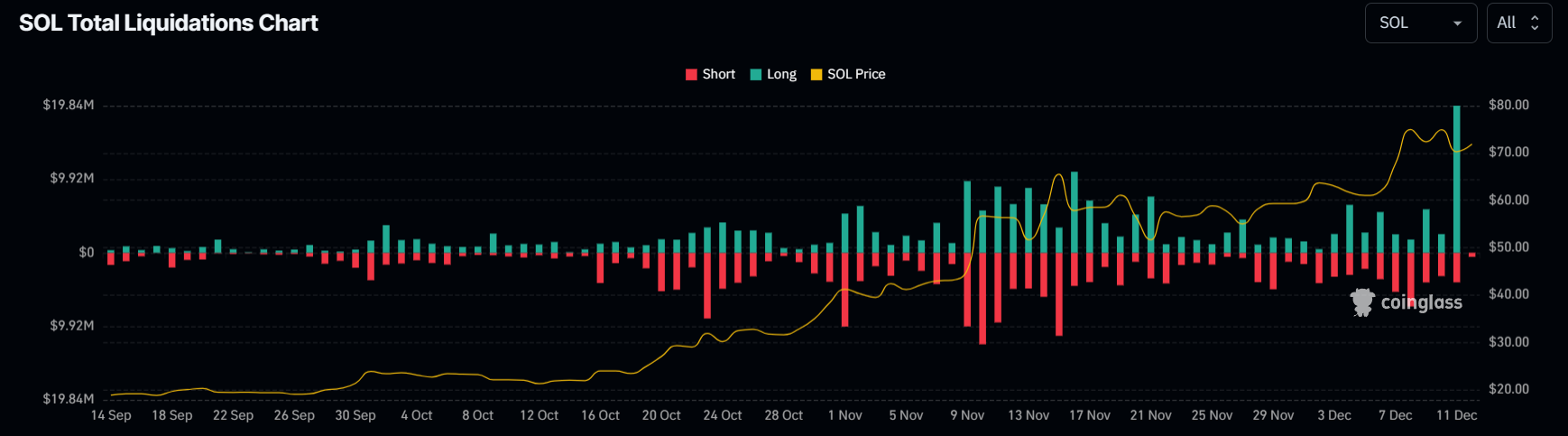

SOL traders lose nearly $20 million in long liquidations as Solana price crashes by almost 13%

|

- Solana price fell to $65 during the intra-day trading lows before recovering to $71 at the time of writing.

- SOL witnessed the liquidation of $20 million worth of long contracts, marking the highest single-day liquidation of Q3.

- The altcoin is exhibiting the potential of a quick recovery, which could wipe the losses, given SOL’s demand.

Solana price did not escape the bearish impact of Bitcoin whales selling as the altcoin noted a crash on Monday. Unprecedented, the sudden drop in price took a toll on the traders who were pining for further increases after SOL became one of the best-performing assets of 2023.

Solana traders in peril

Traders looking to make money on Solana price rise experienced significant losses on Monday after nearly $20 million worth of long contracts liquidated. The almost 13% crash of the altcoin to $65 led to the biggest liquidation observed in the last three months.

Solana long liquidations

This crash was the biggest blow to SOL traders as the cryptocurrency emerged as one of the best-performing assets of 2023. Up until Monday, the consistent increase in price led to Solana rising by almost 600% since the beginning of the year. This was one of the biggest driving factors for the bulls, who were expecting the digital asset to tag $80 before the end of the year.

While there is no certainty of the same happening, there is a chance that Solana price could resume rallying again given the quick recovery noted on the charts.

Solana price might recover its losses soon

Solana price at the time of writing could be seen hovering at $71 on the 4-hour chart, recovering from $68 in the last few trading sessions. The altcoin is presently testing $71 as a resistance, and flipping it into support would provide it with the necessary boost to continue recovering the losses witnessed in the past 24 hours.

Both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators are exhibiting bullish signals in the short-term timeframe. RSI is already above the neutral line marked at 50.0.

This is likely going to imbue confidence in SOL investors that Solana price might not be too far away from climbing back to testing $78 as a resistance level. Breaching the same would mark fresh year-to-date highs for the altcoin.

SOL/USD 1-day chart

On the other hand, failing to reclaim $71 might lead to Solana price falling to test the support line at $66. Falling through this line would invalidate the bullish thesis, leaving SOL vulnerable to a decline to $61.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.