Singapore sees its first institutional DeFi trade with JP Morgan, SBI and DBS Bank via Polygon

|

- The banks interchanged government securities, bonds and currencies.

- The trades were conducted on Polygon, enabling DeFi-enabled financial transactions between banks.

- Institutional net flows have been consistently disappointing due to the volatile market.

Banks and governments around the world are considering blockchain technology as the next step in technological advancements. Singapore incorporated this technology with Decentralized Finance (DeFi) into testing cross-country institutional digital asset trading.

Singapore welcomes institutional DeFi

In an announcement on Wednesday, the Monetary Authority of Singapore (MAS) shared the completion of the first industry pilot of its Project Guardian. The project has been initiated to explore the potential DeFi applications in institutional markets.

In the pilot, DBS Bank, JP Morgan and SBI Digital Assets Holdings participated. These financial institutions conducted transactions consisting of foreign exchanges (forex) as well as government bonds. Liquidity pools comprising tokenized Singapore Government Securities Bonds, Japanese Government Bonds, Japanese Yen (JPY) and Singapore Dollar (SGD) were used for the same.

Through this pilot, MAS demonstrated the potential of cross-country exchange of tokenized assets that can be traded, cleared and settled instantaneously among direct participants. The announcement further stated,

“This frees up costs involved in executing trades through clearing and settlement intermediaries, and the management of bilateral counterparty trading relationships as required in today’s over-the-counter (OTC) markets.

For performing the pilot, AAVE on Polygon was used. This is because the institutions intended to execute the trades on Ethereum but with cheaper gas fees. However, future operations of the project could observe the use of other blockchains as per MAS.

Institutions and crypto elsewhere

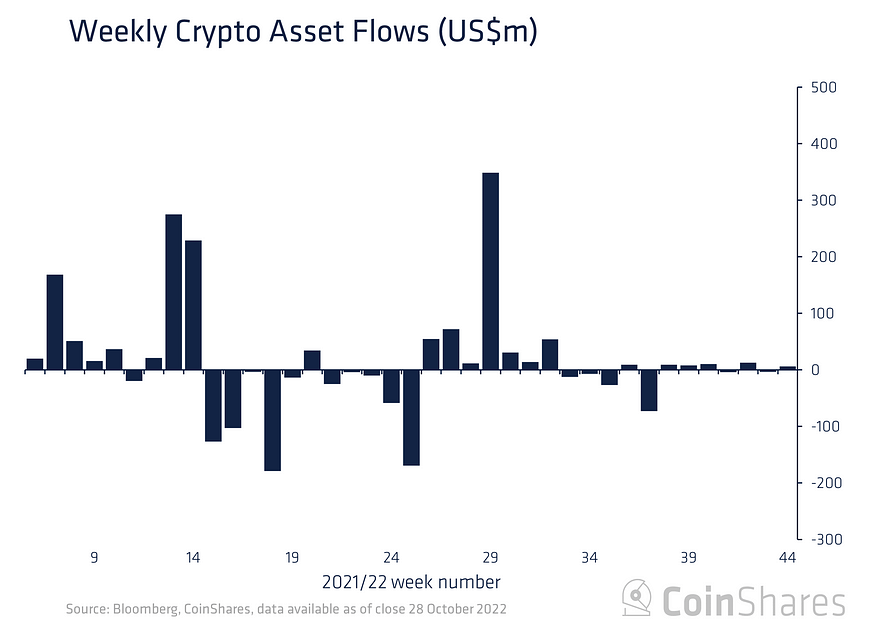

While Singapore is expanding its institutional operations, such existing investors within the U.S. have been holding back. According to the CoinShares data, the weekly transactions as of October 28 only registered inflows worth $6.1 million from the hands of institutions.

Institutional flows as of October 28

Except for Bitcoin’s $13.4 million inflow and XRP’s $500K inflow, every other asset noted outflows. As the crypto market continues to maintain a broader bearish sentiment, these investors will also continue making nominal movements.

Asset-specific net flows

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.