Shiba Inu Price Prediction: SHIB at risk of 40% drop

|

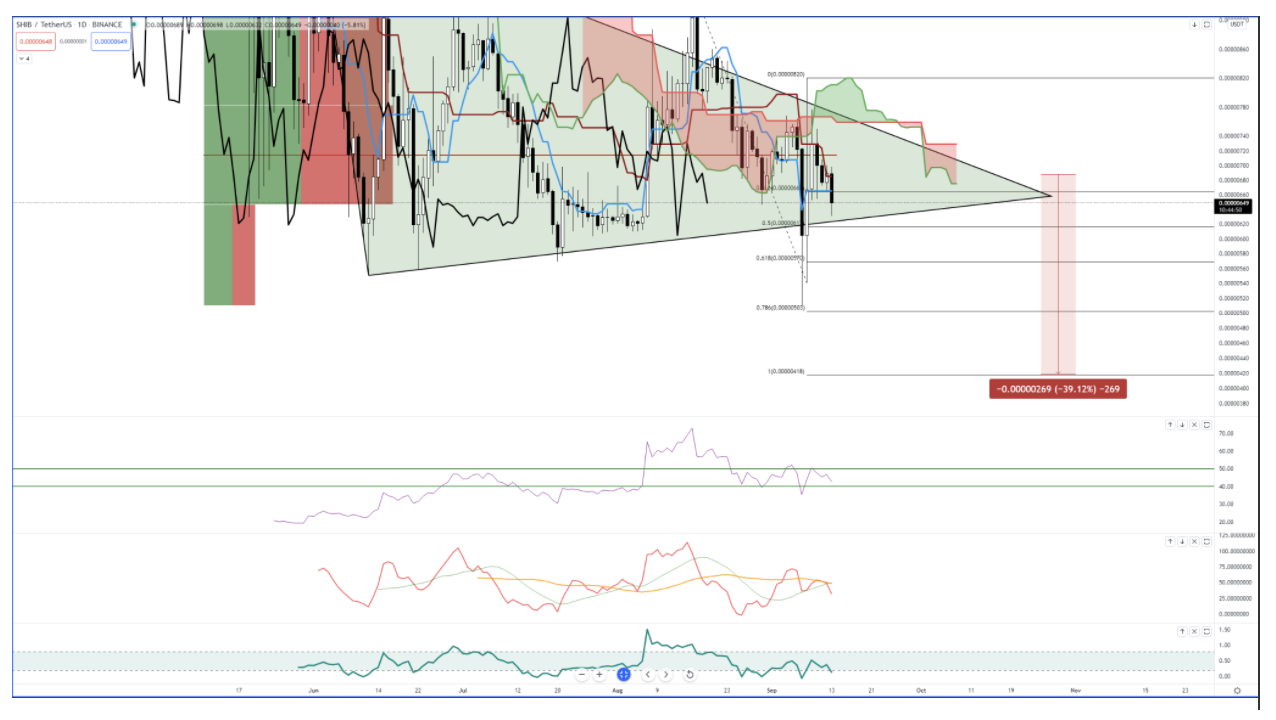

- Shiba Inu price in ideal bearish trading conditions in the Ichimoku system.

- SHIB is trading below its 2021 VPOC (Volume Point-Of-Control).

- Oscillators support further downside momentum.

Shiba Inu price action is extremely bearish and under threat from a substantial push to new all-time lows. SHIB ended the prior trading week with a 8.5% loss and is currently down 5.4% to start this week. A move from $0.00000689 to $0.00000418 is the next primary swing south.

Shiba Inu price is highly bearish, with little support below $0.00000646

Shiba Inu price action is likely to take another dive south. Shiba Inu made new lows last week, tagging the $0.00000503 price level before rallying higher with the rest of the cryptocurrency market. It is trading inside a larger triangle/pennant pattern, which is positioned within that pattern to experience its breakout. Unfortunately, the breakout is likely to the downside.

Within the Ichimoku system, Shiba Inu is currently displaying one of the most bearish trade setups in the Ichimoku system: the Ideal Bearish Breakout. SHIB has all conditions for that Ichimoku pattern to be true:

-

Price below the Cloud, Tenkan-Sen and Kijun-Sen.

-

Tenkan-Sen below Kijun-Sen.

-

Future Senkou Span A below Future Senkou Span B.

-

Chikou Span below the candlesticks and the Cloud.

SHIB/USDT Daily Chart

An accelerated move lower will likely occur when there is a daily close below the September 8 close of $0.00000667. The targeted zone where SHIB will find some support is the 100% Fibonacci Expansion at $0.00000418.

Bears will want to be wary of a powerful bear trap, however. If bulls can return the Chikou Span to a position above the candlesticks and above the Cloud, conditions will be perfect for a rally. Conversely, a close above $0.00000850 will invalidate any near-term bearish continuation for SHIB.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.