XRP struggles to overcome $0.50 resistance, SEC vs. Ripple could enter final pretrial conference

|

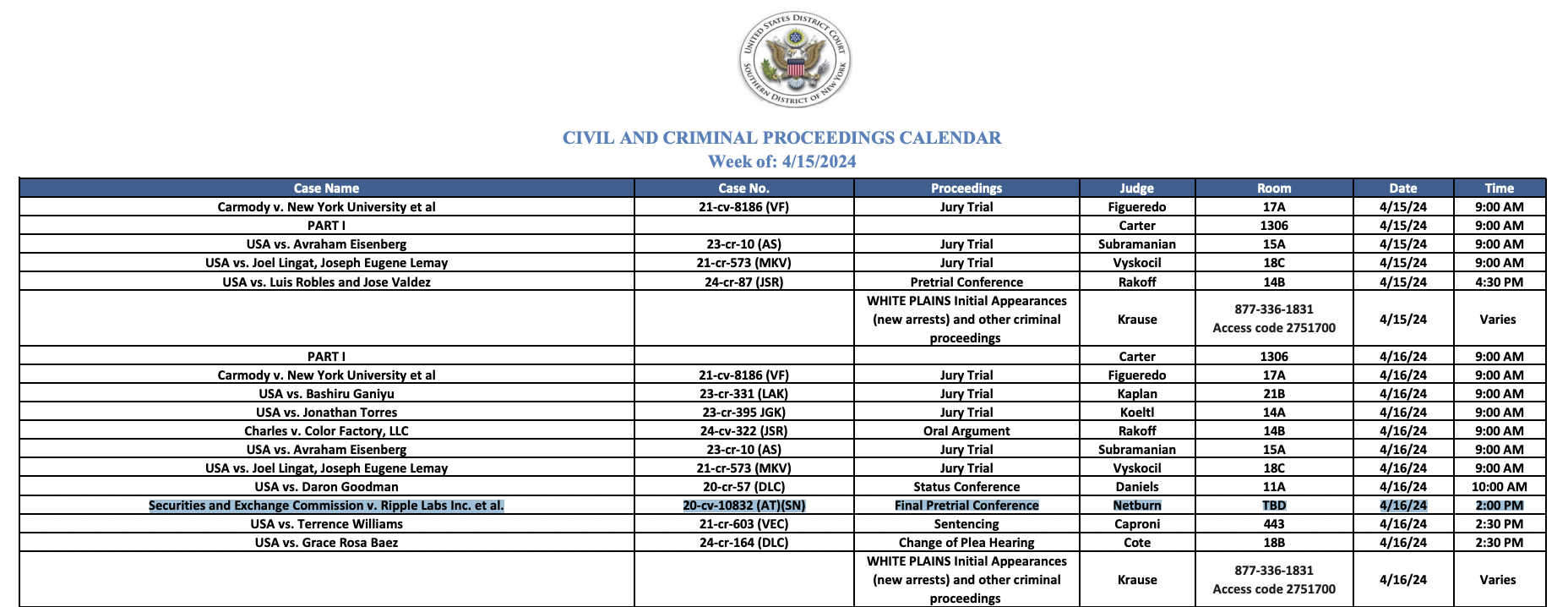

- SEC vs. Ripple lawsuit is likely to enter its final pretrial conference on Tuesday under Judge Sarah Netburn.

- XRP holders and proponents anticipate settlement talks between the two parties to avoid the trial phase.

- XRP price is struggling to overcome resistance at $0.50, falling to $0.48 on Tuesday.

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court. This conference will allow both parties to explore settlement options before the official trial phase begins. The legal calendar shows the date and time, so the conference is planned and may proceed as scheduled.

Daily digest market movers: final pretrial conference could influence XRP price

- SEC vs. Ripple lawsuit proceedings have acted as a catalyst for XRP price since 2020. The latest development is the final pretrial conference, mentioned in the legal calendar of a New York court, which is expected to begin on Tuesday at 18:00 GMT (14:00 local time).

- While some XRP holders expect a settlement between the two parties, such an agreement is unlikely if the US regulator decides to appeal the XRP programmatic sales ruling of Judge Analisa Torres.

Civil and criminal proceedings calendar

- On July 13, Judge Analisa Torres ruled that XRP is a non-security in its secondary market sales on exchanges. This programmatic sales ruling, which was widely considered a victory for Ripple, is likely to be appealed by the SEC.

- Ashley Prosper, XRP proponent and crypto influencer, shared his insights on why a settlement between the two parties is likely in a recent tweet on X.

#XRP #XRPCommunity

— Ashley PROSPER (@AshleyPROSPER1) April 12, 2024

Is the Ripple case over? Let me count the ways...

➡️2nd Circuit says no SEC disgorgement where no financial loss was suffered.

➡️SEC submits terrible remedies and judgment brief, failing to identify a single investor who suffered financial loss at the hands of… https://t.co/uP5MpCgsUk

#XRP #XRPCommunity

— Ashley PROSPER (@AshleyPROSPER1) April 12, 2024

Is the Ripple case over? Let me count the ways...

➡️2nd Circuit says no SEC disgorgement where no financial loss was suffered.

➡️SEC submits terrible remedies and judgment brief, failing to identify a single investor who suffered financial loss at the hands of… https://t.co/uP5MpCgsUk

- It is important to note that the final pretrial conference may or may not lead to a settlement in the lawsuit.

Technical analysis: XRP struggles to recoup from drop below $0.50

XRP flipped $0.50 support to resistance on Saturday after holding up above this level for nearly six months. If the downside persists, XRP could sweep liquidity below $0.4717, the 23.6% Fibonacci retracement level of the altcoin’s drop from the April 9 top at $0.6431 to the April 13 bottom at $0.4717.

The Moving Average Convergence Divergence (MACD) indicator on the daily chart supports a thesis of further correction since the red histogram bars persist.

XRP price could find support at the April 13 low of $0.4188 and the weekly support level at $0.4117 if the downside persists.

XRP/USDT 1-day chart

A daily candlestick close above $0.50, a resistance level that is significant to XRP, could invalidate the bearish thesis. XRP price could surge to $0.5310, the 50% Fibonacci retracement level of the aforementioned decline from April 9 to April 13.

Further up, the altcoin faces resistance at the psychologically important $0.60 level in its path to the April 9 local top at $0.6431.

Cryptocurrency prices FAQs

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.