SEC green flags Grayscale and ProShares Spot Ethereum ETF, what’s next for Ethereum ecosystem tokens

|

- Grayscale Ethereum Mini Trust and ProShares Ethereum ETF received SEC approval, joining eight others awaiting the regulator's final nod.

- SEC approval came through a Form 19b-4 filing, sentiment among Ether traders is positive.

- The final approval for Spot Ethereum ETFs could benefit Ethereum-related tokens, Layer 2 scaling tokens, and staking assets.

- Ethereum Layer 2 tokens note a dip in their prices, Ether extends gains by 1% on Thursday and sustains above $3,400.

Crypto traders are awaiting a key catalyst, the Spot Ethereum Exchange Traded Fund (ETF) approval by the Securities & Exchange Commission (SEC). The regulator approved two applicants for Spot Ethereum ETF products, as Grayscale Ethereum Mini Trust and ProShares Ethereum ETF received SEC nod through a Form 19b-4 filing.

The two join eight other competitors awaiting SEC’s final nod, which is considered a key market mover for Ethereum and related tokens.

Bitcoin ETF approval pushed related tokens and BRC-20 assets higher, alongside gains in the largest crypto asset. Analysts expect a similar impact of Spot Ethereum ETF approval on Ethereum-related and ecosystem tokens.

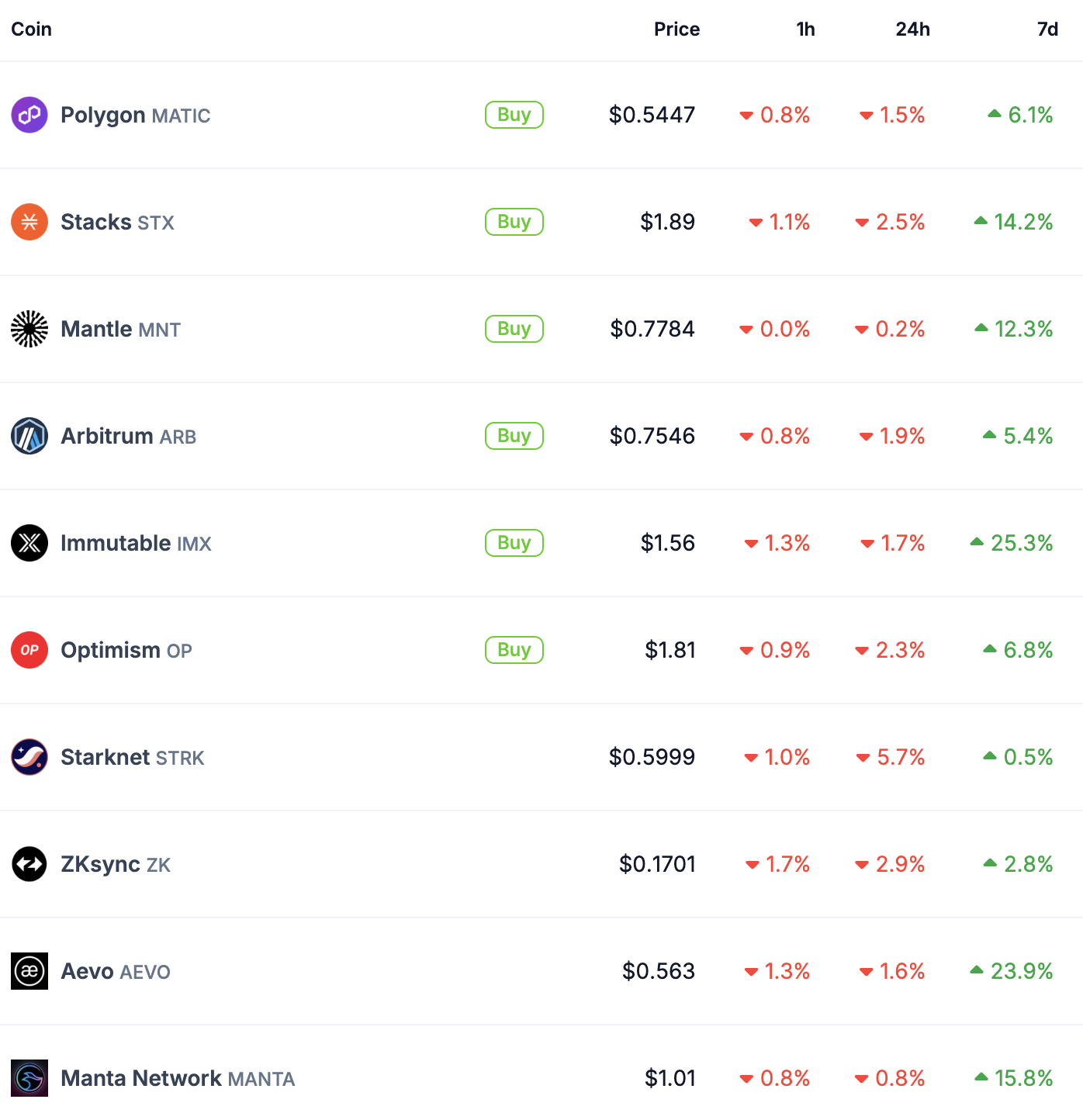

Layer 2 tokens Polygon (MATIC), Mantle (MNT), and Arbitrum (ARB), among others, suffered a loss of value early on Thursday.

Layer 2 tokens, staking tokens note correction ahead of anticipated SEC approval

Ethereum ETF approval is highly anticipated among Ether traders and the crypto market community. Ahead of the approval, the sentiment among traders has turned positive, as seen on cryptoeq.io.

At the time of writing, early on Thursday, Ethereum ecosystem tokens, Layer 2 scaling tokens, and related crypto assets face a correction in their prices, as Coingecko data shows.

Ethereum Layer 2 tokens and price in the last 24 hours

The correction in Layer 2 tokens offers an opportunity to sidelined buyers to “buy the dip.” Spot Ethereum ETF approval is anticipated on Thursday, July 18, according to Bloomberg Senior ETF analyst Eric Balchunas.

We don't have a new over/under launch date yet because we haven't heard what the SEC's game plan is. Hope to hear soon. But if you forced me gun to head style to give my best guess for date I'd go with July 18th.

— Eric Balchunas (@EricBalchunas) July 8, 2024

We don't have a new over/under launch date yet because we haven't heard what the SEC's game plan is. Hope to hear soon. But if you forced me gun to head style to give my best guess for date I'd go with July 18th.

— Eric Balchunas (@EricBalchunas) July 8, 2024

Matt Hougan, CIO at Bitwise, believes that if approved, Spot Ethereum ETFs could be listed on

Nasdaq, NYSE, and CBOE. The investment product could attract up to $15 billion in inflows in the first 18 months of launch, leading traders to the key question: Will the Spot Ethereum ETF outperform the Spot Bitcoin ETF?

Higher demand and capital inflow to the Spot Ethereum ETF could catalyze gains in Ether, and fuel demand for the altcoin and related tokens, like meme coins in the Ethereum ecosystem.

Dogecoin, Shiba Inu, PEPE, Dogwifhat, and Floki to gain from Spot ETH ETF approval

Ethereum-based meme coins could rally after Spot Ethereum ETF approval. Just as BRC-20 assets attracted traders and volume, post Spot Bitcoin ETF approval, Ethereum ETF approval could result in capital rotation to meme coins.

Early on Thursday, ahead of the ETF approval, meme coins Dogecoin (DOGE) and Shiba Inu (SHIB) wiped out between 3% and 9% of their value in the last 24 hours, per CoinGecko data. PEPE and Dogwifhat (WIF) extended gains by 2% and 7%, respectively, in the same timeframe. Meanwhile, FLOKI erased 2% of its value in the last 24 hours.

Meme coins offer sidelined buyers the opportunity to buy the assets ahead of the anticipated Spot ETH ETF approval.

Staking tokens could benefit from Spot Ether ETF approval

SEC Commissioner Hester Peirce said in a recent interview that there is a possibility that the agency allows features like staking for Ethereum ETF issuers. This makes staking protocols and their assets lucrative, with the likelihood of capital inflow and higher demand for their service.

Lido Dao (LDO) and Eigenlayer could benefit from a reconsideration, among other projects.

Ethereum eyes nearly 20% gains post ETF approval

Ethereum is rallying. At the time of writing, the altcoin trades at $3,457.70 early Thursday. The second largest cryptocurrency by market capitalization is likely to extend gains by 10% and climb to $3,819.16, the 78.6% Fibonacci retracement of the decline between the March 12 top of $4,093.92 and the July 5 low of $2,810.

If bullish momentum persists, Ether will likely extend gains further, nearly 18%, to the March 12 peak at $4,093.92.

The Moving Average Convergence Divergence (MACD) momentum indicator flashes green histogram bars above the neutral line. This supports a bullish thesis for Ether, and shows positive underlying momentum in the altcoin’s uptrend.

Ether faces resistance at the Fair Value Gap between $3,709.50 and $3,760, as seen in the ETH/USDT daily chart below.

ETH/USDT daily chart

On the other hand, Ethereum could find support at the July 16 low of $3,346 and the psychologically important $3,000 level in case of a correction in the altcoin’s price.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.