Ripple’s XRP calm after hell broke loose: Recovery limited at $0.31

|

- The US SEC postpones a Bitcoin ETF proposal for the second time causing panic in the market.

- XRP has joined Bitcoin and Ethereum to explore monthly lows.

- XRP/USD sits comfortably above $0.30 as calm sets in.

Hell broke loose again in the cryptocurrency market. The situation continues to worry investors but digital currencies continued to explore not only monthly lows but also year lows. XRP, an asset that has been praised for its ability retain most of its value amid the falling prices, suffered at the hand of the bears as the price broke the support at $0.32 and the main support at $0.3. Ripple’s XRP has traded intraday lows of $0.292 (also December low) before bouncing back up to reclaim the broke support at $0.3.

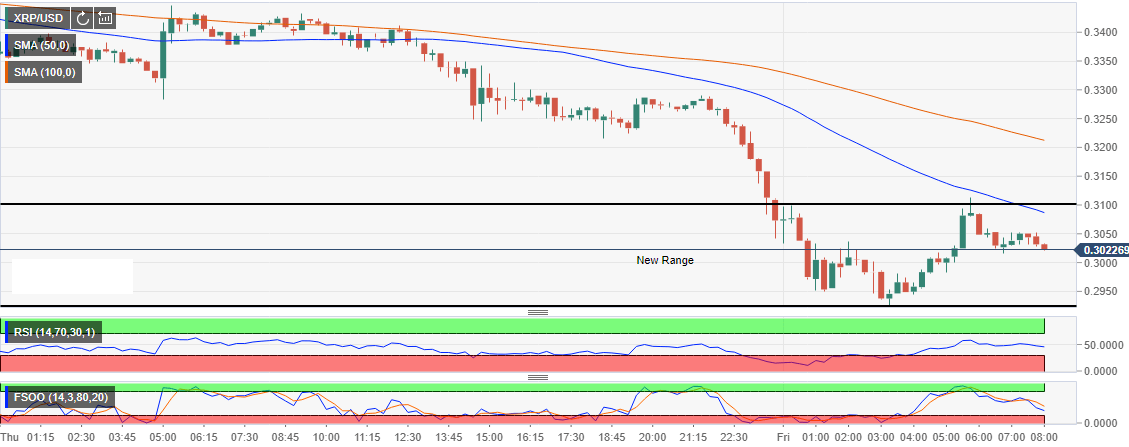

At the moment, XRP/USD is trading at $0.305 after getting stuck in a new range with an upper limit of $0.31. The 15-minutes 50 simple moving average is also standing in the way of upside movement at $0.309. If XRP escapes the range resistance it will run into another hurdle at the 100 simple moving average.

A look at the chart, we see that there is calm after the storm. XRP is stable above $0.30, however, buyers lack the momentum to push for further reversal towards $0.35. Indicators in the chart are in a range with no signals for upward or downward motion. For instance, the RSI is holding tight to the 50 percent mark while the fast stochastic is heading south to show that the sellers are still here and XRP is still at risk of dropping below $0.3 again on Friday.

In other news, the U.S Securities and Exchange Commission (SEC) has postponed the ruling on a Bitcoin exchange-traded fund (ETF) by VanEck and blockchain startup SolidX until 2019. This is the second time The SEC is delaying this proposal BTC ETF and according to the guidelines, it cannot be postponed again. This means that come 2019, the regulator will either have to approve or reject. Meanwhile, investors seem to be too afraid to commit in a bear market that no one knows when it hit its bottom.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.