Ripple Price Prediction: XRP’s rise to $1 hinges on one crucial upside barrier

|

- XRP/USD remains primed for a big technical breakout.

- The No. 3 coin battles descending trendline resistance on the 12H chart.

- Acceptance above the key Fib 61.8% hurdle is critical to take on the $1 mark.

Ripple (XRP/USD) sellers have returned this Sunday, as the recent recovery from sub-$0.50 levels appears to lose steam.

XRP/USD: Technical setup favors the bulls

However, from a technical perspective, it looks like the bulls have taken a breather before the bullish reversal picks up pace.

XRP/USD: 12-hour chart

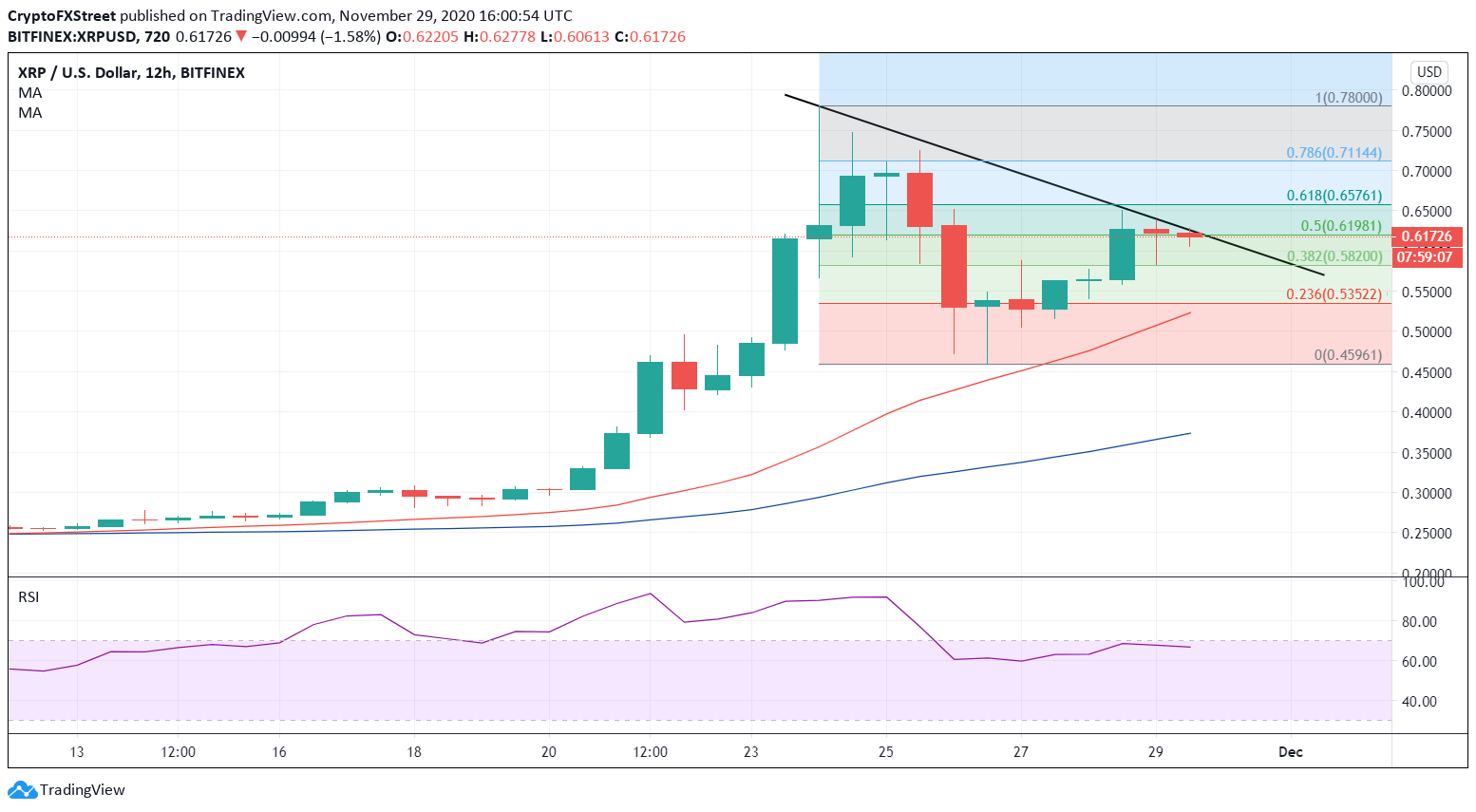

Looking at the 12-hour chart, Ripple continues to face strong offers at the one-week-old descending trendline resistance, now at $0.6262.

Closing on the candle above that level could trigger a fresh breakout, with the bullish Relative Strength Index (RSI) favoring the move higher. Although the follow-through buying interest could weaken at $0.6576, which is the critical resistance of the 61.8% Fibonacci Retracement of the pullback from the highest level since May 2018 reached at $0.7842 last Tuesday.

Acceptance above the latter is critical to reviving XRP/USD’s journey towards the $1 mark. Alternatively, the bullish 21-simple moving average (SMA) at $0.5226 is the level to beat for the bears. The next relevant downside target awaits at the 50-SMA of $0.3762.

All in all, the upside appears more compelling in the week ahead.

XRP/USD: Additional levels to consider

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.