Ripple Price Prediction: XRP/USD prepares for a lift-off to $0.20 – Confluence Detector

|

- Ripple price consolidates above $0.16 in readiness to take off and tackle resistance at $0.20.

- The bumps at the 100 SMA in the 4-hour range and at $0.1750 lag XRP/USD breakout.

Ripple price has been in consolidation above $0.16 for the two days in a row. The price commenced the trading on Thursday with bears in control. However, as the volatility returns to the crypto market, the European session could see some formidable action from the bulls.

At the time of writing, XRP is trading at $0.1620 while struggling to clear the resistance at the 100 SMA on the 4-hour chart. On the flipside, $0.1600 is offering immediate support marginally above the 50 SMA. Also in a position to curb declines is the ascending channel.

Looking at the 4-hour chart, the RSI puts emphasis on sideways action, which is likely to take center stage in the coming sessions. XRP/USD needs a boost above the 100 SMA and the seller congestion at $0.1750 to pave the way for more action above the coveted $0.2000.

Ripple price confluence resistance and support levels

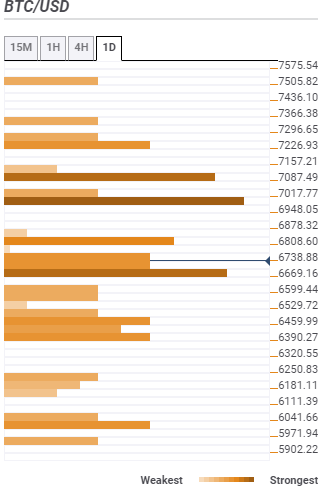

Resistance one: $6,808 – Home to the previous high 1-hour, the Fibo 61.8% one-day and the previous high 4-hour.

Resistance two: $7,017 – Where the previous week high and the pivot point one-day resistance one converge.

Resistance three: $7,087 – Highlighted by the pivot point one-month support two and the Bollinger Band 4-hour upper curve.

Support: $6,669 one – Hosts the SMA five 4-hour the SMA 10 4-hour, the Fibo 38.2% one-day and the BB 1-hour middle curve.

Support two: $6,390 - $6,459 – The pivot pint one-day support one, the BB 4-hour middle curve, the SMA 100 1-hour and the 23.6% Fibo one-week.

Support three: $6,041 – Highlighted by the SMA 10 one-day and the Fibo 38.2% one week.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.