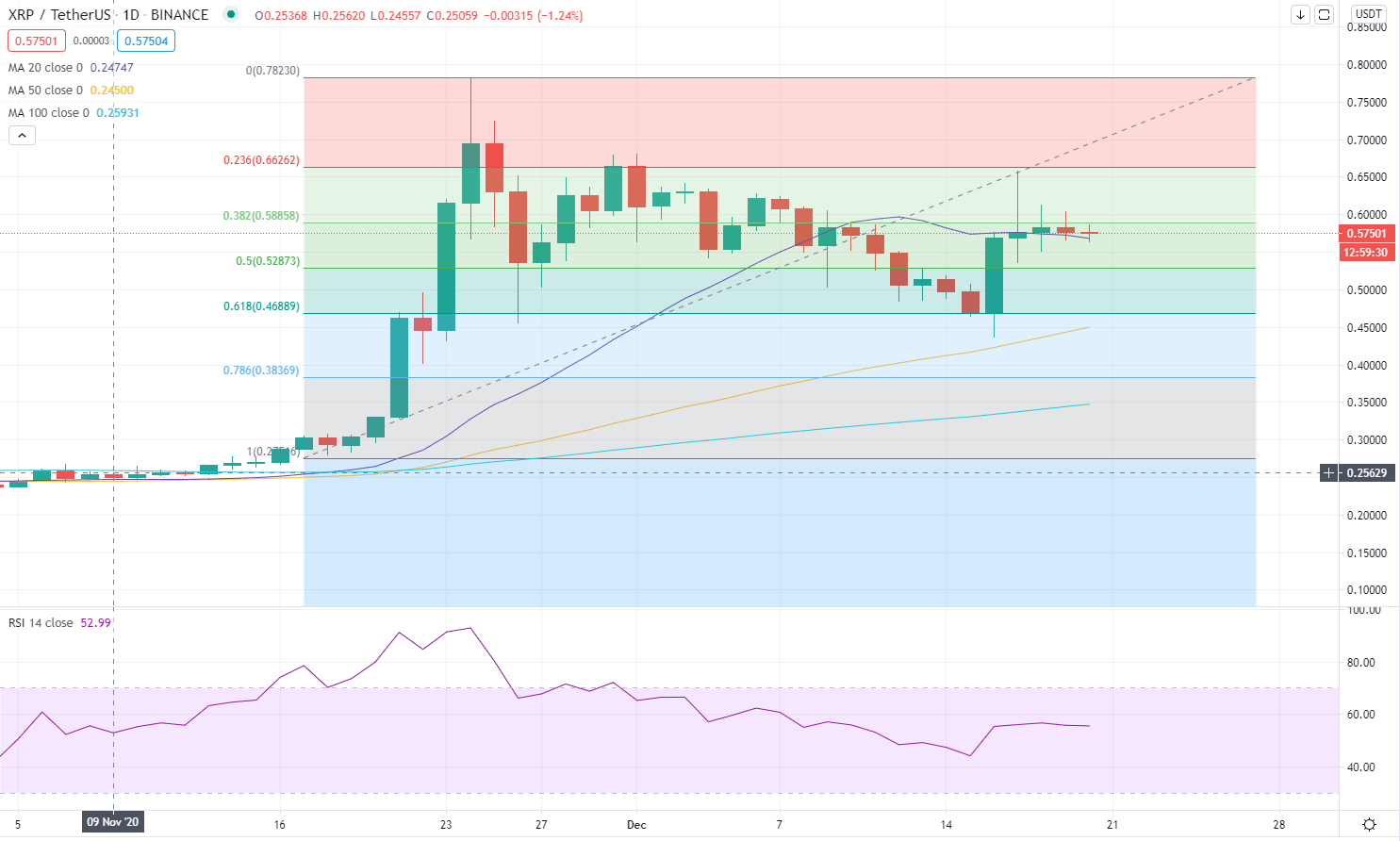

Ripple Price Prediction: XRP to target $0.66 with a daily close above $0.59

|

- Ripple is consolidation weekly gains, trades above $0.57.

- RSI indicator on the daily chart continues to float above 50.

- $0.66 aligns as the next target if XRP manages to close above $0.59.

After closing the first two days of the week in the negative territory, Ripple rose sharply and touched its highest level in three weeks at $0.6585 on Thursday. However, XRP struggled to preserve its bullish momentum and went into a consolidation phase over the weekend. As of writing, Ripple was virtually unchanged on the day at $0.5760 and was gaining more than 12% on the week.

XRP closes in on key Fibo resistance

The Fibonacci 23.6% retracement of the bull run that saw Ripple price jump from $0.28 to $0.78 in a week in mid-November is currently located at $0.59. Although XRP rose above that level on Friday and Saturday, it failed to make a daily close there. If Ripple manages to flip that resistance into support, it could target the Next Fibonacci retracement, 23.6%, at $0.66.

In the meantime, the Relative Strength Index (RSI) indicator on the daily chart continues to float above 50, suggesting that XRP has more room on the upside before becoming technically overbought. Furthermore, the price remains on track to close above the 20-day SMA for the third straight day on Sunday6, confirming the near-term bullish outlook.

On the downside, supports are located at $0.5650 (20-day SMA), $0.53 (Fibonacci 50%) and $0.47 (Fibonacci 61.8%).

Despite the subdued trading action in the last three days, Ripple's near-term technical outlook remains bullish with a target of $0.66. Only a drop below $0.53 could cause the bearish pressure to buildup.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.