Ripple Price Prediction: XRP prepares to pullback to $0.27 before an ultimate breakout

|

- After days in the positive region, Xrp prepares to drop by 19% before a bounce back.

- The Fibonacci retracement tool confirms the sell signal on a daily chart.

It would seem that the price of XRP is showing signs of a potential retracement before bouncing off to the upside in the short term. Indicators show that incoming bearish momentum could see it go as low as $0.27 before it takes off.

XRP at the brink of retracement before next leg up

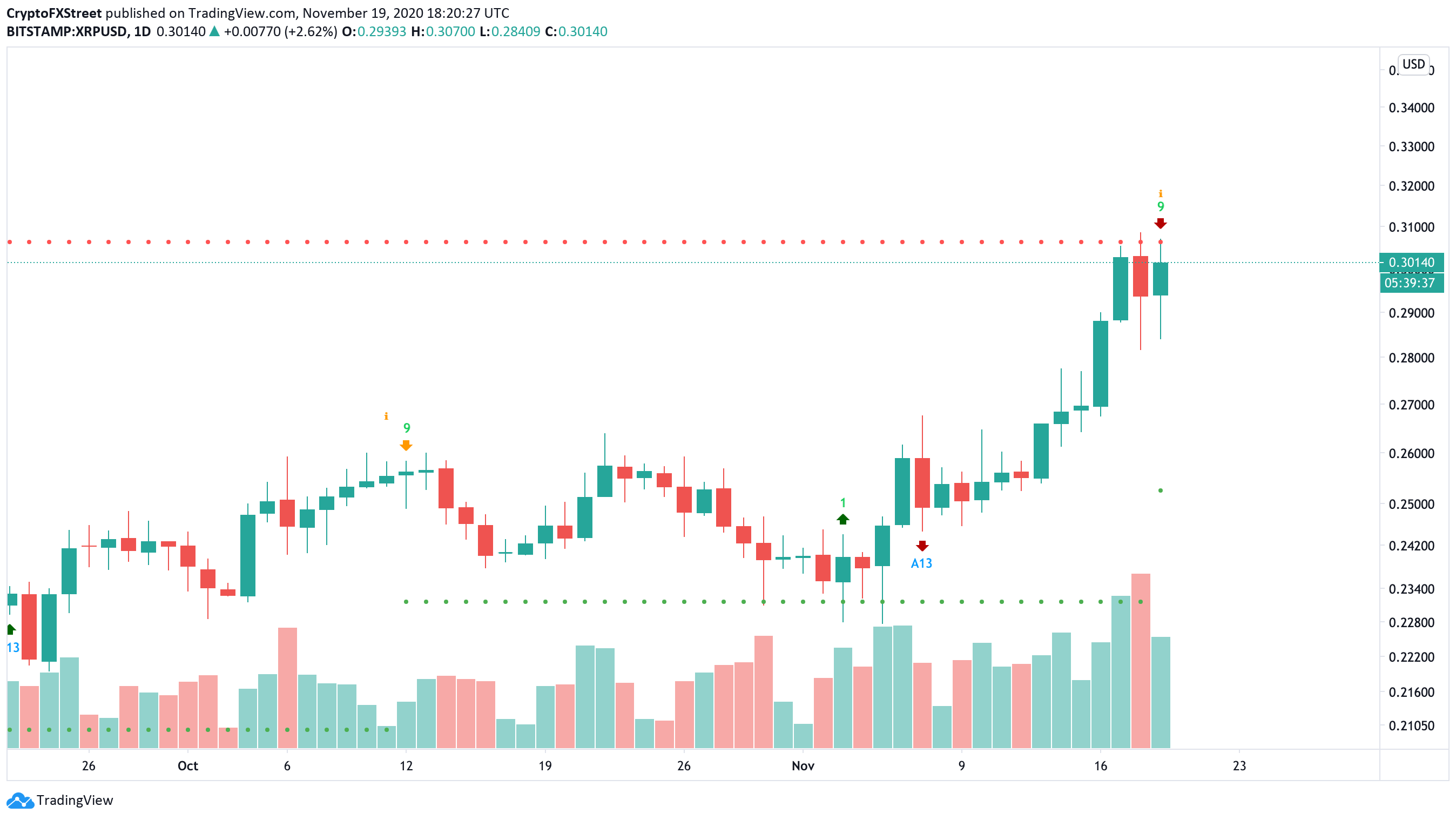

On the daily chart, a reversal in the price of XRP seems to be brewing as the TD sequential indicator presents a sell signal. The bearish formation developed in the form of a green nine candlestick, suggesting that the cross-border remittances tokens is poised to retrace for one to four daily candlesticks.

XRP/USD Daily chart

Another indicator further reinforces this bearish outlook. A movement to the downside is expected as we see XRP falling to the 61.8% or 50% on the Fibonacci retracement levels before advancing further. Meaning prices could drop to $0.27 or $0.26.

XRP/USD Daily chart

On the other hand, if the price sustains the rally above $0.31, the bearish stance will be invalidated. A spike in the buying pressure behind XRP around the current price levels could see it rise to the 127.2% or 141.4% Fibonacci retracement levels. These resistance barriers sit at $0.33 and $0.35, respectively.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.