Ripple Price Prediction: XRP looks poised for a breakout to $0.30

|

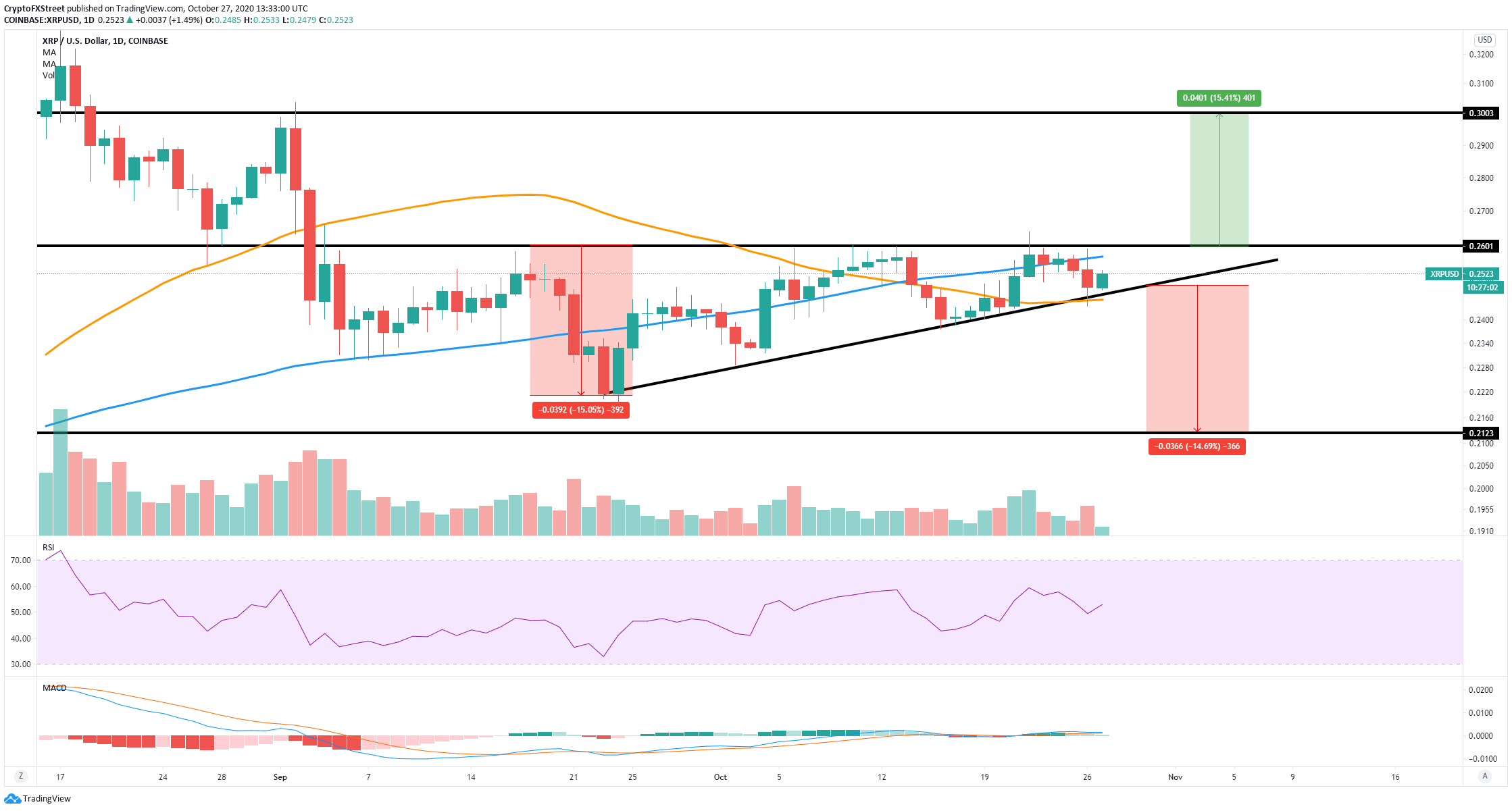

- XRP has been trading inside an ascending triangle pattern on the daily chart for several weeks.

- Bulls have defended the lower trendline of the pattern and are targeting a breakout above $0.26.

XRP is currently trading at $0.252 after successfully defending a critical support level at $0.247. In the past two weeks, the digital asset has been rejected from the upper boundary of the daily ascending triangle around ten times.

XRP needs to break the $0.26 resistance level to reach $0.30

Bulls have defended the support level at $0.247, which coincides with the 50-SMA. The daily MACD remains bullish and will gain some momentum after the rebound in the past 24 hours. The critical resistance level is still located at $0.26.

XRP/USD daily chart

The resistance at $0.26 also coincides with the 100-SMA. A daily candlestick close above this point can drive the price of XRP up to $0.30. However, bulls need to ensure that XRP will not experience another fakeout as the one seen on October 22.

Can bears hold this short-term resistance level?

On the 4-hour chart, the rebound seems to have been stopped by the 50-SMA at $0.252, acting as a strong resistance level. Additionally, the MACD turned bearish on October 23 and has remained that way ever since.

XRP/USD 4-hour chart

Rejection from the 50-SMA at $0.252 can push XRP down to the ascending triangle's hypotenuse at $0.247. Moving past this critical support level can lead to a steep correction towards $0.213.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.