Ripple Price Prediction: Is XRP/USD at danger of falling towards $0.10 again?

|

- XRP has progressively lost strength compared to other top coins.

- XRP/USD is struggling to stay above $0.18 after another bear break.

It’s quite apparent that XRP has been weaker than Bitcoin or Ethereum. XRP, like most of the other altcoins, is following Bitcoin, however, with every crash, XRP crashes harder and with every bounce, recovers less. The XRP/BTC pair has been in a huge downtrend basically since January 2018.

Not many positive indicators in favor of XRP

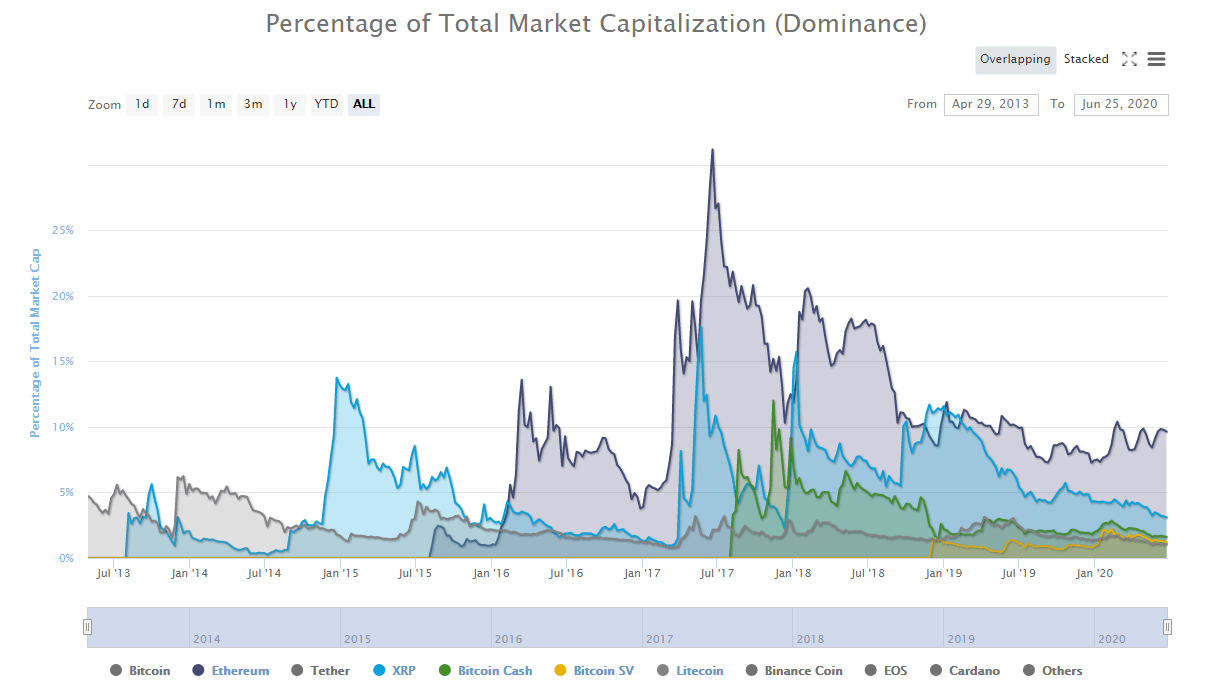

The decline in dominance is significant. The chart clearly shows that XRP’s dominance (blue) has been going down since 2019. Ethereum, for instance, only lost a little of its dominance. Similarly, BCH is practically at the same level as it was at the start of 2019, BSV’s dominance has actually increased a little. Of course, this metric alone doesn’t necessarily indicate that XRP will go to $0 but it does show a clear weak trend.

Looking at the weekly chart of XRP, the downtrend is also quite notable, far weaker than most of the other coins. XRP is down 95% since its peak in January 2018. Ethereum is also down around 83% since its peak, which might seem like a similar situation but it’s not. For Ethereum to be down 95%, the price would need to be at $67 approximately.

Even on the monthly chart, XRP is showing no signs of recovery, bears have been forming lower lows since January 2018. There is no reason to think XRP will not break the low of March at $0.11 in the coming months.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.