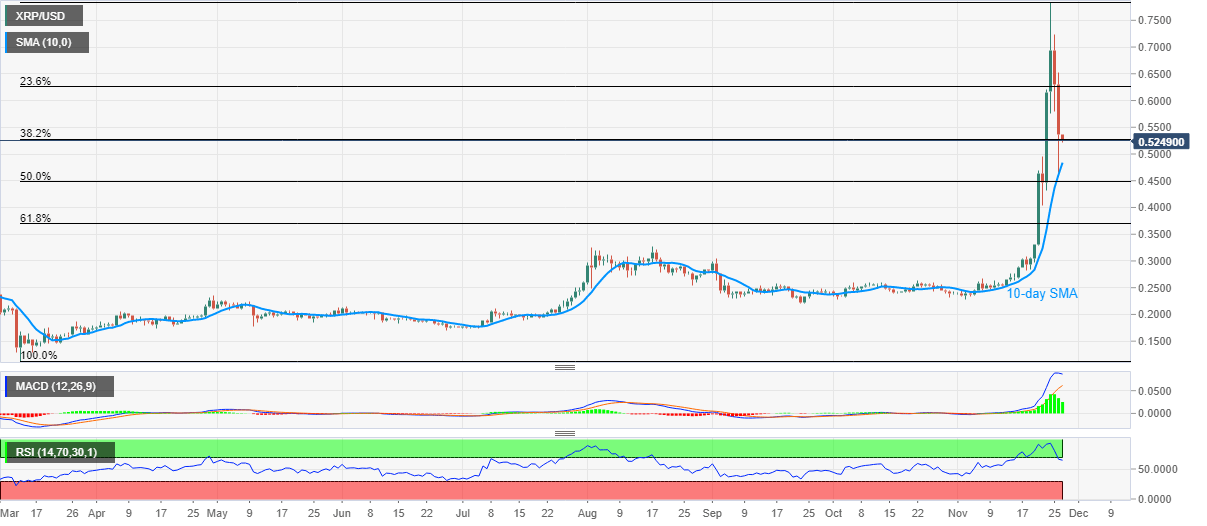

Ripple Price Analysis: XRP/USD fails to extend bounce off 10-day SMA

|

- Ripple stays depressed near the weekly low, eases below 0.5500 off-late.

- RSI’s pullback from overbought conditions keeps sellers hopeful.

- Key Fibonacci retracements hold the gate for further downside.

Ripple fades bounce off 0.4581 while declining to 0.5240, down over 2% during early Friday. The crypto major slumped the previous day, before bouncing off-late SMA.

However, failures to extend the corrective recovery join the RSI conditions that ease from the overbought region to keep the sellers hopeful.

Hence, XRP/USD sellers are currently eyeing a revisit to the 10-day SMA level of 0.4840 ahead of declining to 50% Fibonacci retracement of March-November upside, near 0.4485.

Also acting as a downside filter is the 61.8% Fibonacci retracement level of 0.3693 and August month’s top near 0.3280.

Meanwhile, an upside clearance of 0.5500 can trigger fresh recovery moves targeting the early-week lows below 0.5800. Though, any further rise will have multiple hurdles to cross beyond the 0.6000 threshold ahead of reaching the latest top close to 0.7845.

XRP/USD daily chart

Trend: Bearish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.