Ripple price analysis: XRP/USD downside will remain risky if $0.28 is unconquered

|

- The bear pressure continues to turn support levels in impenetrable fortresses.

- XRP/USD changing hands at $0.2520 following a 1.57% loss on the day.

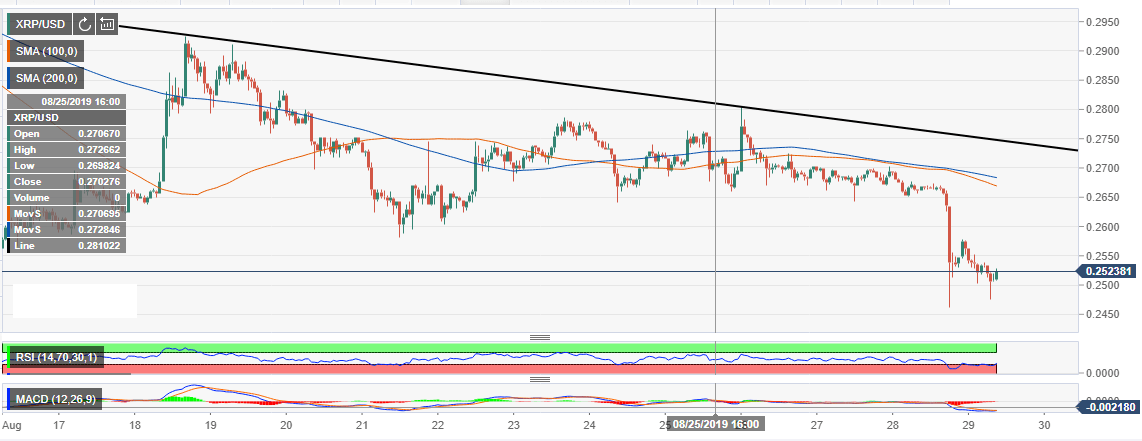

Ripple’s performance has not been impressive in the past couple of months. The bear pressure continues to turn support levels in impenetrable fortresses. The recent dive to levels close to $0.24 almost paralyzed the bulls. While shallow recovery movements put smiles on investors’ faces, the celebration was short-lived with the former support at $0.28 barricading movements towards $0.30.

To make matters worse, the largely unprotected downside has allowed another bull battering with XRP exploring levels marginally above $0.2450. A staged recovery from the intraday low lost steam short of $0.26. XRP/USD changing hands at $0.2520 following a 1.57% loss on the day.

Unless the Relative Strength Index surfaces above the oversold and the Moving Average Convergence Divergence reduces the negative divergence, XRP is doomed to slide even lower that the major support at $0.24. It is vital for XRP to ascend the levels and clear the resistance at $0.28 to be able to come out of the bear range.

XRP/USD 1-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.