Ripple Price Analysis: XRP/USD bounces off key supports to renew bullish bets

|

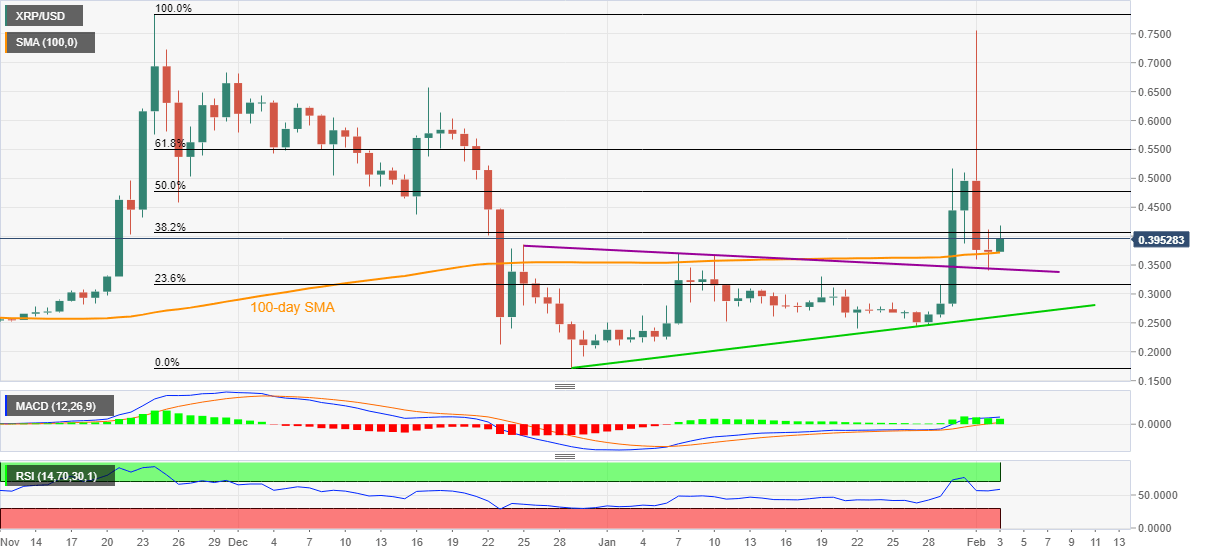

- XRP/USD keeps corrective pullback from 100-day SMA, previous resistance.

- Bullish MACD, sustained recovery direct buyers toward the key Fibonacci retracement levels.

- Sellers have yearly support line as an extra barrier to cross for entry.

XRP/USD picks up the bids around 0.3965 during early Thursday. The cryptocurrency pair marked a reversal from 100-day SMA and a six-week-old support line, previous resistance, the previous day.

The recovery moves also gain support from bullish MACD and strong RSI conditions to suggest further upside.

In doing so, 50% and 61.8% Fibonacci retracement levels of November-December 2020 downside, respectively around 0.4780 and 0.5500, gain the market’s attention.

Also acting as an upside barrier is the weekend’s high around 0.5170 and December 17, 2020 peak surrounding 0.6580.

Meanwhile, a downside break of 100-day SMA, at 0.3715 now, will have to drop below the previous resistance line, currently around 0.3430, to revisit the sub-0.3000 area.

However, an upward sloping trend line from December 29 near 0.2600 will be a tough nut to break for the XRP/USD bears, which also holds the key to the 0.2000 threshold and December low of 0.1719.

XRP/USD daily chart

Trend: Bullish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.